United Parcel Service (UPS) shares on Tuesday are tipping lower by about 3%. That’s after the package-delivery giant reported earnings before the open.

While the stock is off its session low — it was down about 4.7% — it’s not the reaction that the bulls were hoping for. That’s for two reasons.

First, UPS stock recently erupted to new highs in February when it reported earnings, climbing more than 14% in one session.

Second, the stock was down about 20% from the highs coming into this earnings report. The bulls were hoping that the decline was enough to remove the downside risk and, if anything, create the base for an upside pop.

It’s clear that investors are in a risk-off mood, though, with equities struggling on Tuesday.

The company beat on earnings and revenue expectations — with profit growing nearly 10% year over year. UPS also said it planned to double its share buyback to $2 billion and it affirmed its full-year outlook.

Wall Street isn’t buying the news. Where from here?

Trading UPS Stock

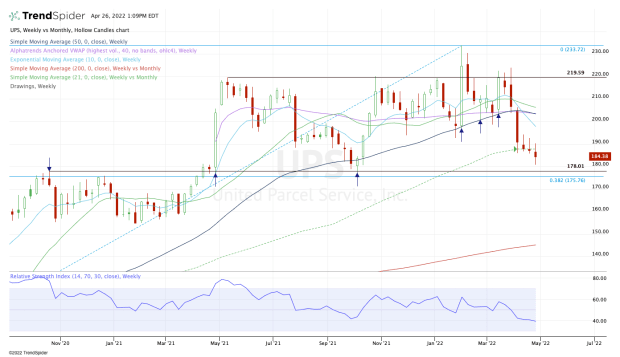

Chart courtesy of TrendSpider.com

There is a fundamental case for being long UPS stock, but I believe that comes with the caveat that the shares must hold key support. In my view, that’s $175 to $178.

That's been a critical zone over the past 16 months, marking resistance in the fourth quarter of 2020, the breakout area in the second quarter of 2021, and support later in the fourth quarter.

It’s also where the 38.2% retracement comes into play when we measure from the all-time high down to the 2020 low.

If UPS can’t hold this area, then the stock is not one that I am all that interested in from a technical perspective. Buying a dip into this zone could be a low-risk approach to UPS, but that’s assuming we test this zone, which is not a guarantee.

On the upside, keep an eye on the 21-month moving average. On a weekly basis, this measure lately has been resistance.

The stock is working on its sixth straight weekly decline. At some point, one would think the stock is becoming oversold — particularly after a decent earnings report. That said, the market is in a tough place right now.

If UPS stock can clear the 21-month moving average, look for a test of the declining 10-week moving average. Above that opens the door to the key 50-week moving average, just above $200.

.jpg?w=600)