Small-cap stocks, which generally refers to companies with a market cap between about $250 million and $2 billion, are usually seen as top prospects for high growth - but they're not necessarily a go-to for dividend hunters. However, some small-cap names offer the best of both worlds, pairing the potential for outsized growth with the reliability of dividend income.

Now, the Russell 2000 Index (RUT), a benchmark for small-cap U.S. stocks, isn't having its strongest year. The RUT has gained just over 3% YTD, while the S&P 500 Index ($SPX) has rallied 17% - and the Nasdaq-100 Index ($IUXX) boasts a standout return of 44% on the year.

However, it's worth pointing out that small-caps tend to outperform coming out of recessionary environments - and there are some other market signals suggesting the time is right to buy small-caps now, too.

With this in mind, let's take a look at one dividend-paying RUT component that's already in rally mode, with plenty more upside expected over the next year.

Introducing InterDigital

InterDigital (IDCC) is barely clinging to small-cap status after its stellar run higher in 2023, with a market cap teetering just above $2.41 billion. The company is a wireless solutions and connectivity services provider, with interests in the realms of 5G, multimedia content delivery, artificial intelligence (AI), and machine learning, too.

The list of companies licensing IDCC's wireless IP looks a little bit like a “who's who” of the Fortune 500. Licensees include Alphabet (GOOGL), Sony (SONY), Apple (AAPL), General Motors (GM), Panasonic (PCRFY), Ericsson (ERIC), and Huawei, just to hit some of the highlights.

Over the last three years, IDCC's revenue has expanded at a CAGR of 14.85%, while earnings from continuing operations registered a CAGR of 56.9% - and the latest quarterly earnings report easily beat expectations. Meanwhile, the company has consistently returned value to shareholders by paying out a dividend for over a decade.

IDCC Outperforms the Russell 2K

Shares of IDCC have performed not only the lagging Russell 2000 this year - they're also outpacing some of the high-flying, tech-focused benchmarks, as well. IDCC is up more than 94% on a YTD basis, beating the tech-heavy NDX by a staggering 50 percentage points over this time frame.

The stock's most recent leg higher was fueled by InterDigital's latest earnings report on Nov. 2. For the third quarter, IDCC reported $140.1 million in revenue, a hefty 22% bump compared to the same period last year. Adjusted EPS arrived at a stronger-than-forecast $2.13, up 81% from the year-ago period, and operating expenses fell 4% on lower IP enforcement costs. IDCC also issued upbeat guidance for the current quarter.

Looking at the profitability metrics, IDCC's adjusted EBITDA hit $83.5 million, a solid 48% increase year-over-year, with the adjusted EBITDA margin hitting 60%, up 11 percentage points.

IDCC has a consistent history of surpassing analysts' bottom-line estimates. For the current quarter, the consensus is looking for adjusted EPS of $1.22, narrowly below the midpoint of InterDigital's recently provided $1.17-$1.29 range.

The stock is priced at 10.51 times 2023 earnings, well below the sector median of 22.13, and 15.65 times 2024 earnings. Meanwhile, forward EPS growth for the company is projected at 31.5%, compared to the sector median of 7.02%.

And if you're into investments that offer steady income via dividend payments, IDCC is worth adding to your watchlist. The company just hiked its quarterly dividend payment to $0.40 per share, resulting in a forward yield of 1.71%. Plus, the modest payout ratio of about 16% suggests there's plenty of room to fuel future growth and dividend hikes, too.

What Do Analysts Expect from IDCC?

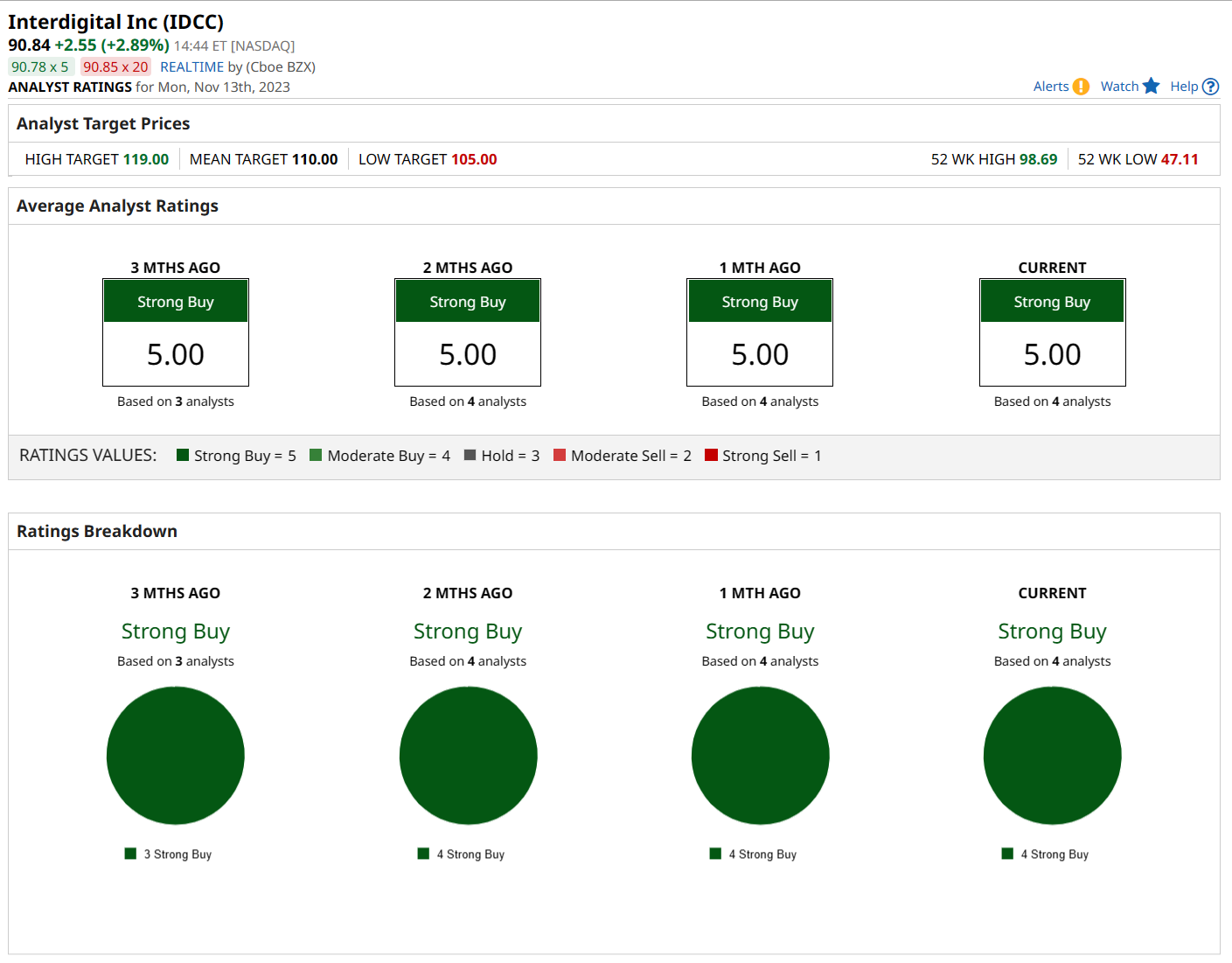

Although the shares have nearly doubled in value already this year, analysts see more upside ahead for IDCC. All four analysts tracking the stock consider it a “strong buy,” and the average 12-month price target of $110 is a premium of more than 16% to current levels.

The Street-high price target of $119 belongs to RothMKM, which expects IDCC's earnings to eventually top $7 per share. That target implies expected upside of more than 25%.