6 analysts have expressed a variety of opinions on NIO (NYSE:NIO) over the past quarter, offering a diverse set of opinions from bullish to bearish.

Summarizing their recent assessments, the table below illustrates the evolving sentiments in the past 30 days and compares them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 1 | 2 | 2 | 0 | 1 |

| Last 30D | 0 | 0 | 0 | 0 | 1 |

| 1M Ago | 0 | 1 | 1 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 1 | 1 | 1 | 0 | 0 |

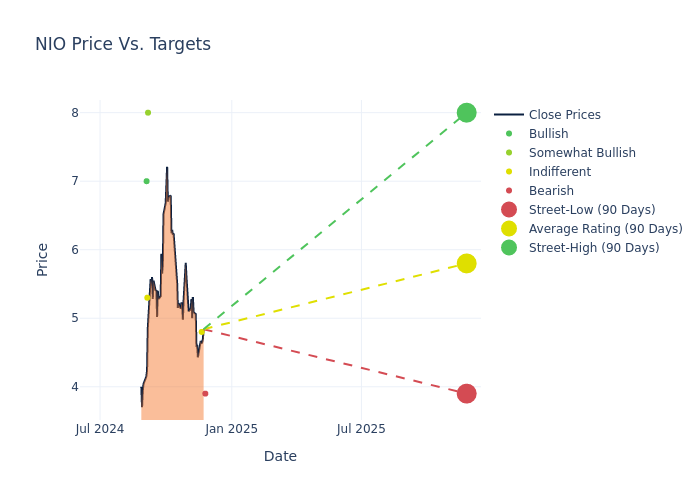

Analysts' evaluations of 12-month price targets offer additional insights, showcasing an average target of $5.93, with a high estimate of $8.00 and a low estimate of $3.90. Observing a downward trend, the current average is 1.82% lower than the prior average price target of $6.04.

Deciphering Analyst Ratings: An In-Depth Analysis

A comprehensive examination of how financial experts perceive NIO is derived from recent analyst actions. The following is a detailed summary of key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Tina Hou | Goldman Sachs | Lowers | Sell | $3.90 | $4.80 |

| Eugene Hsiao | Macquarie | Lowers | Neutral | $4.80 | $6.60 |

| Eugene Hsiao | Macquarie | Announces | Outperform | $6.60 | - |

| Nick Lai | JP Morgan | Raises | Overweight | $8.00 | $5.30 |

| Ming Hsun Lee | B of A Securities | Raises | Neutral | $5.30 | $5.00 |

| Jeff Chung | Citigroup | Lowers | Buy | $7.00 | $8.50 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to NIO. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Gaining insights, analysts provide qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of NIO compared to the broader market.

- Price Targets: Understanding forecasts, analysts offer estimates for NIO's future value. Examining the current and prior targets provides insight into analysts' changing expectations.

Considering these analyst evaluations in conjunction with other financial indicators can offer a comprehensive understanding of NIO's market position. Stay informed and make well-informed decisions with our Ratings Table.

Stay up to date on NIO analyst ratings.

Discovering NIO: A Closer Look

Nio is a leading electric vehicle maker, targeting the premium segment. Founded in November 2014, Nio designs, develops, jointly manufactures, and sells premium smart electric vehicles. The company differentiates itself through continuous technological breakthroughs and innovations such as battery swapping and autonomous driving technologies. Nio launched its first model, its ES8 seven-seater electric SUV, in December 2017, and began deliveries in June 2018. Its current model portfolio includes midsize to large sedans and SUVs. It sold over 160,000 EVs in 2023, accounting for about 2% of the China passenger new energy vehicle market.

NIO: A Financial Overview

Market Capitalization Analysis: The company's market capitalization is below the industry average, suggesting that it is relatively smaller compared to peers. This could be due to various factors, including perceived growth potential or operational scale.

Negative Revenue Trend: Examining NIO's financials over 3 months reveals challenges. As of 30 September, 2024, the company experienced a decline of approximately -2.06% in revenue growth, reflecting a decrease in top-line earnings. When compared to others in the Consumer Discretionary sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: NIO's net margin is impressive, surpassing industry averages. With a net margin of -27.53%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): NIO's ROE is below industry averages, indicating potential challenges in efficiently utilizing equity capital. With an ROE of -37.5%, the company may face hurdles in achieving optimal financial returns.

Return on Assets (ROA): NIO's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive -5.03% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: The company faces challenges in debt management with a debt-to-equity ratio higher than the industry average. With a ratio of 2.99, caution is advised due to increased financial risk.

Analyst Ratings: Simplified

Analysts are specialists within banking and financial systems that typically report for specific stocks or within defined sectors. These people research company financial statements, sit in conference calls and meetings, and speak with relevant insiders to determine what are known as analyst ratings for stocks. Typically, analysts will rate each stock once a quarter.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.