Shopify has been an underloved, underperformer for a while. The drop-shipping, “start your own business” style company was once a pandemic high-flier alongside stocks like Peloton and Zoom.

However, in 2022, companies that aren’t putting up a profit have been big targets for stock sellers as economic weakness and record-high inflation takes its toll on the market. As a result, shares of Shopify are down roughly 75% year-to-date.

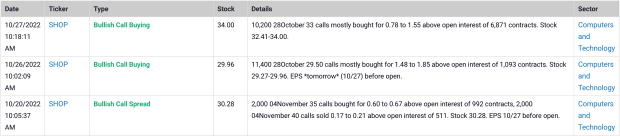

That’s why it piqued our interest when we saw a massive amount of bullish buying in weekly (SHOP) call options just one day before earnings.

Ready to start trading the technicals? Try Rebel Weekly. Ride the waves of market momentum with two actionable trade ideas designed to capture technical break outs and break downs — delivered to your inbox every week.

Shopify Unusual Options Activity: What We Saw

Market Rebellion identified the purchase of these calls at the same time as even big tech heavyweights like (GOOG) and (MSFT) were getting hammered over poor earnings.

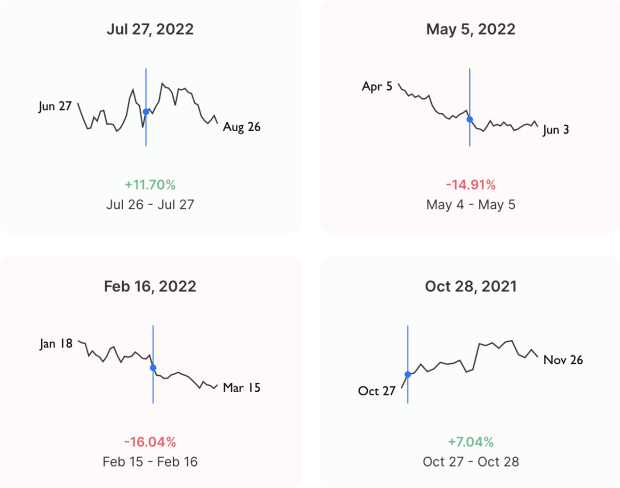

These call options required a roughly 4% move in the underlying stock within just two days. On its face, that sounds like a big ask. However, when you dig into the data, these options were actually underpriced relative to the average earnings move in Shopify over the four prior quarters.

What does this mean? With an implied move (the price of the at the money straddle) for 10/28 sitting at roughly ±8%, the implied volatility of these options were undercutting the average earnings move by more than ⅓. But this trader didn’t buy the straddle — they bought straight calls. How did it go?

Ready to start trading? Try Unusual Option Activity Essential. Learn how you can follow the "smart money" with a fresh UOA trade idea each week - including technical levels so that you know where to enter and exit!

Shopify Q3 Earnings Result

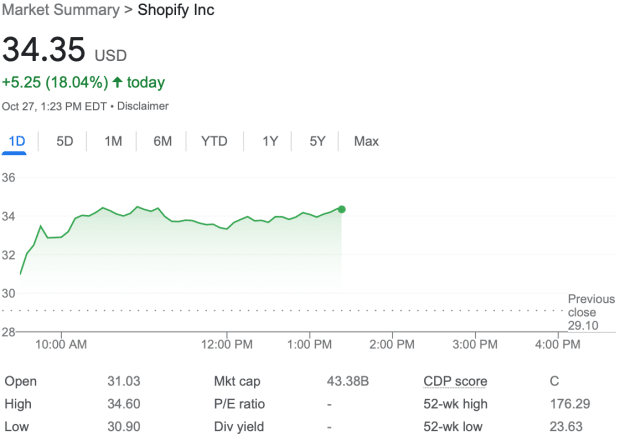

On Thursday morning, Shopify Q3 earnings dropped, and the news was out: the e-commerce stock locked in a top and bottom line beat.

- EPS: -$0.02 vs -$0.07 expected

- Revenue: $1.37B vs $1.33B expected (+22% year-over-year)

Shopify president Harley Finkelstein noted in the earnings call that roughly 10% of all U.S. e-commerce capital comes from Shopify. The president also pointed out that despite the company’s impressive top and bottom line earnings beat, the strength of the U.S. dollar weighed heavily on the results.

This was all shareholders needed to hear — Shopify shares took off like a rocket, surpassing the overall move of all four prior quarters.

Shopify Unusual Options Activity Result

The Shopify call weekly’s identified above were bought yesterday at the $29.50 strike for an average contract price of roughly $1.67. Today, just one day later, those options have traded for as much as $5.10 — more than 3X the average trade price. And some bulls clearly think there’s more upside to come.

Today, after the earnings report sent the stock soaring, Market Rebellion identified another bullish trade in Shopify options — the third one in the past 7 days.

This time, the trade was in 10,200 of the $33 strike calls expiring tomorrow, for a total trade price of roughly $1.2 million dollars.

The key takeaway: If the smart money is right, Shopify’s rally be just beginning.