Deep-pocketed investors have adopted a bullish approach towards Robinhood Markets (NASDAQ:HOOD), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in HOOD usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 16 extraordinary options activities for Robinhood Markets. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 50% leaning bullish and 50% bearish. Among these notable options, 2 are puts, totaling $75,980, and 14 are calls, amounting to $777,977.

Projected Price Targets

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $10.0 and $55.0 for Robinhood Markets, spanning the last three months.

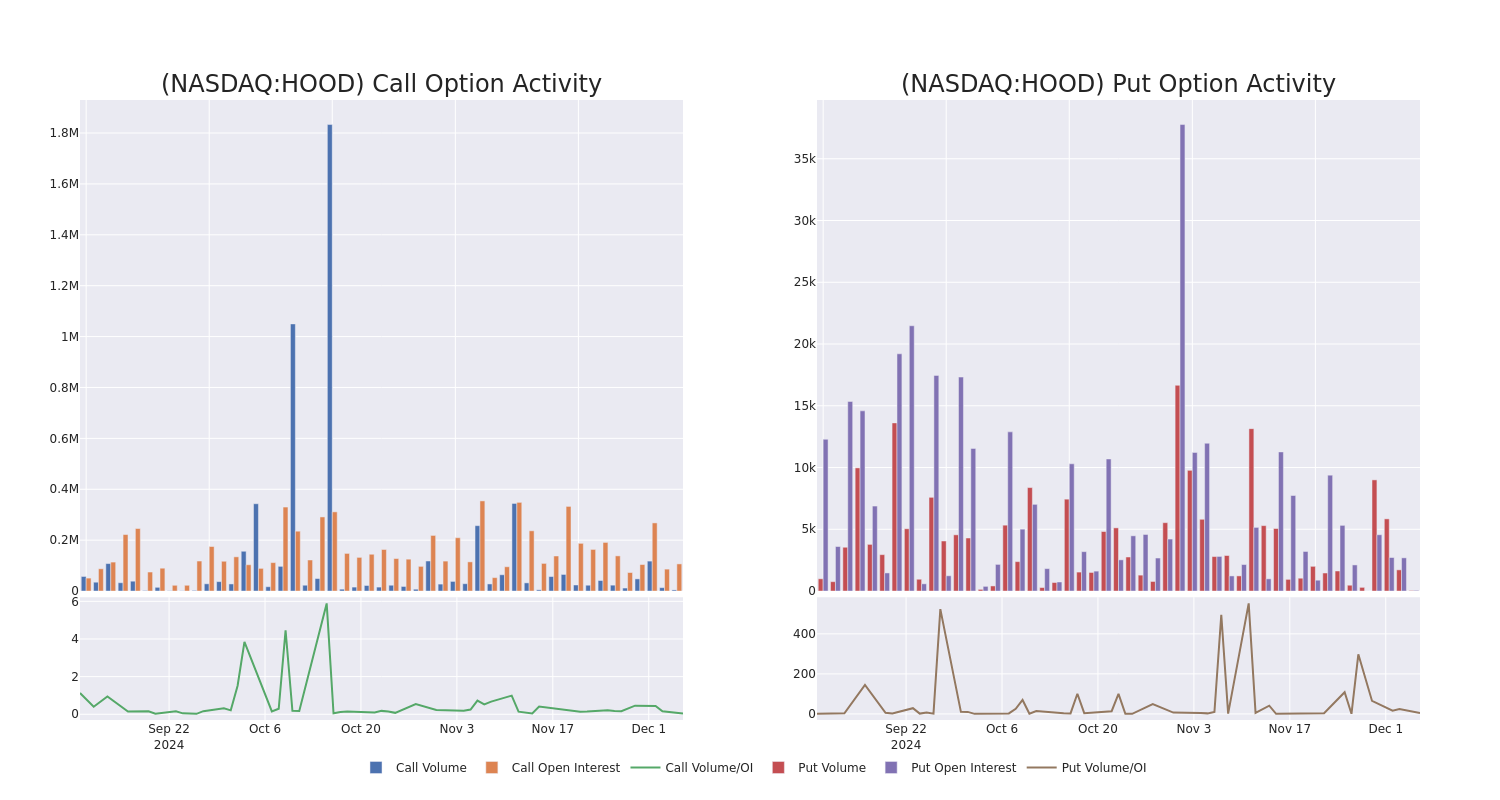

Insights into Volume & Open Interest

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Robinhood Markets's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Robinhood Markets's whale trades within a strike price range from $10.0 to $55.0 in the last 30 days.

Robinhood Markets Option Activity Analysis: Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| HOOD | CALL | SWEEP | BEARISH | 12/13/24 | $0.86 | $0.84 | $0.85 | $41.00 | $141.1K | 7.6K | 2.1K |

| HOOD | CALL | SWEEP | BULLISH | 01/16/26 | $8.35 | $8.0 | $8.35 | $50.00 | $83.5K | 8.2K | 100 |

| HOOD | CALL | TRADE | BULLISH | 01/17/25 | $3.3 | $3.25 | $3.3 | $40.00 | $82.5K | 15.4K | 650 |

| HOOD | CALL | SWEEP | BEARISH | 02/21/25 | $6.2 | $6.05 | $6.05 | $37.00 | $75.6K | 2.3K | 133 |

| HOOD | CALL | SWEEP | BEARISH | 01/17/25 | $24.65 | $24.55 | $24.55 | $15.00 | $73.6K | 15.1K | 30 |

About Robinhood Markets

Robinhood Markets Inc is creating a modern financial services platform. It designs its own products and services and delivers them through a single, app-based cloud platform supported by proprietary technology. Its vertically integrated platform has enabled the introduction of new products and services such as cryptocurrency trading, dividend reinvestment, fractional shares, recurring investments, and IPO Access. It earns transaction-based revenues from routing user orders for options, equities, and cryptocurrencies to market makers when a routed order is executed.

In light of the recent options history for Robinhood Markets, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Current Position of Robinhood Markets

- Currently trading with a volume of 5,914,464, the HOOD's price is up by 1.08%, now at $39.34.

- RSI readings suggest the stock is currently may be overbought.

- Anticipated earnings release is in 67 days.

What The Experts Say On Robinhood Markets

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $41.4.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access. * Maintaining their stance, an analyst from Deutsche Bank continues to hold a Buy rating for Robinhood Markets, targeting a price of $42. * Consistent in their evaluation, an analyst from Deutsche Bank keeps a Buy rating on Robinhood Markets with a target price of $32. * An analyst from Piper Sandler persists with their Overweight rating on Robinhood Markets, maintaining a target price of $42. * An analyst from Bernstein has decided to maintain their Outperform rating on Robinhood Markets, which currently sits at a price target of $51. * An analyst from JMP Securities has decided to maintain their Market Outperform rating on Robinhood Markets, which currently sits at a price target of $40.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Robinhood Markets options trades with real-time alerts from Benzinga Pro.