Investors with a lot of money to spend have taken a bullish stance on Axon Enterprise (NASDAQ:AXON).

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with AXON, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga's options scanner spotted 52 uncommon options trades for Axon Enterprise.

This isn't normal.

The overall sentiment of these big-money traders is split between 57% bullish and 25%, bearish.

Out of all of the special options we uncovered, 5 are puts, for a total amount of $166,925, and 47 are calls, for a total amount of $5,212,533.

Predicted Price Range

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $105.0 and $800.0 for Axon Enterprise, spanning the last three months.

Volume & Open Interest Development

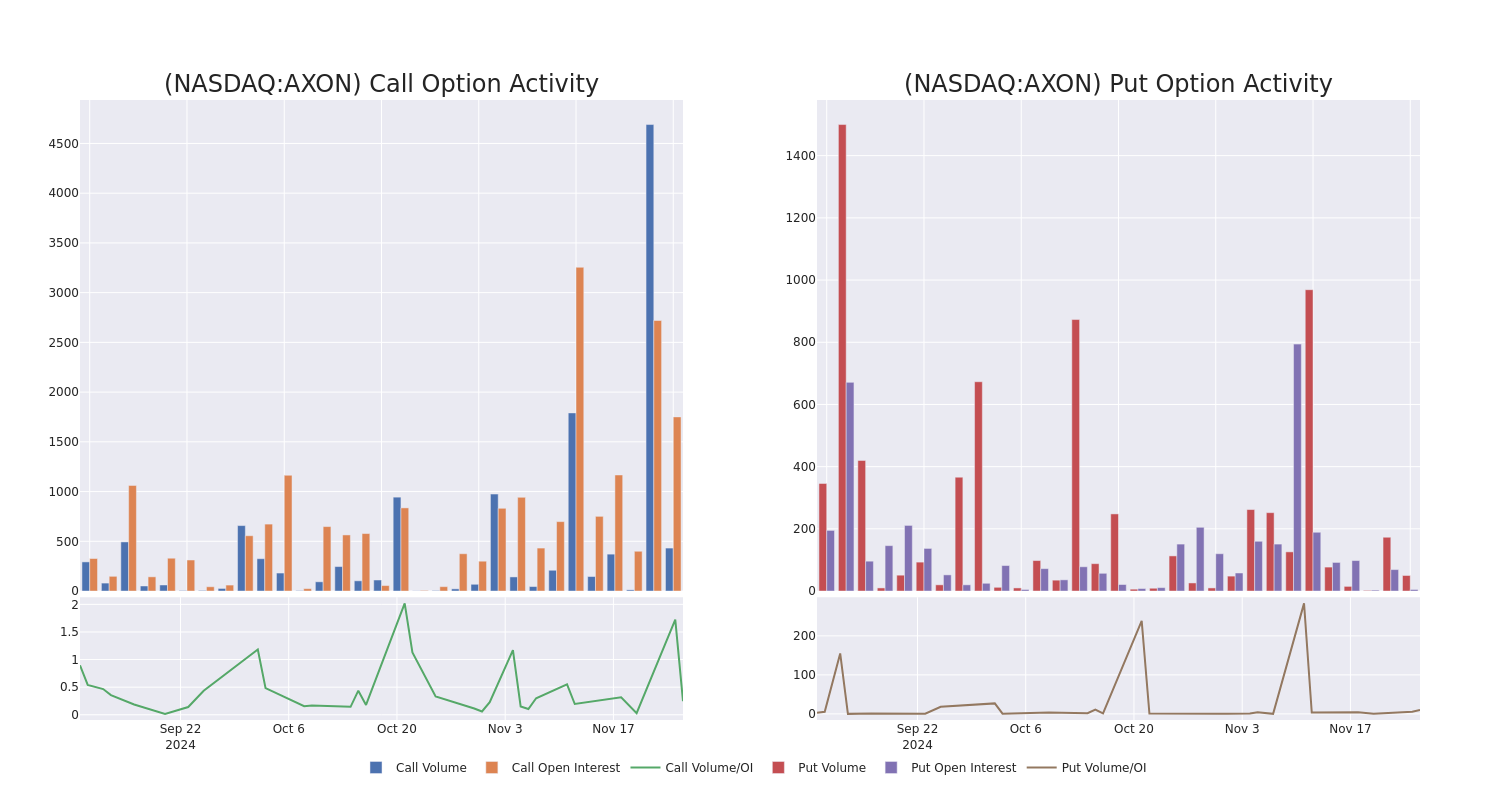

In today's trading context, the average open interest for options of Axon Enterprise stands at 96.23, with a total volume reaching 9,645.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Axon Enterprise, situated within the strike price corridor from $105.0 to $800.0, throughout the last 30 days.

Axon Enterprise Call and Put Volume: 30-Day Overview

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AXON | CALL | SWEEP | BULLISH | 01/17/25 | $27.3 | $26.2 | $27.29 | $670.00 | $544.7K | 41 | 835 |

| AXON | CALL | SWEEP | BEARISH | 01/17/25 | $27.5 | $23.7 | $25.49 | $670.00 | $509.9K | 41 | 505 |

| AXON | CALL | TRADE | BULLISH | 01/17/25 | $25.6 | $23.7 | $25.6 | $670.00 | $460.8K | 41 | 305 |

| AXON | CALL | TRADE | NEUTRAL | 01/17/25 | $30.7 | $26.8 | $28.9 | $670.00 | $289.0K | 41 | 1.2K |

| AXON | CALL | TRADE | NEUTRAL | 01/17/25 | $28.4 | $26.3 | $27.5 | $670.00 | $275.0K | 41 | 935 |

About Axon Enterprise

Axon Enterprise Inc develops, manufactures, and sells conducted energy devices and cloud-based digital evidence management software designed for use by law enforcement, corrections, military forces, private security personnel, and private individuals for personal defense. The company operates in two segments: Taser and software & sensors. Taser develops and sells CEDs used for protecting users and virtual reality training. Software and sensors manufacture fully integrated hardware and cloud-based software solutions such as body cameras, automated license plate reading, and digital evidence management systems. Axon delivers its products worldwide and derives the majority of its revenue from the software & sensors segment and geographically from the United States.

Having examined the options trading patterns of Axon Enterprise, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Current Position of Axon Enterprise

- Trading volume stands at 823,728, with AXON's price up by 5.87%, positioned at $673.72.

- RSI indicators show the stock to be may be overbought.

- Earnings announcement expected in 84 days.

Professional Analyst Ratings for Axon Enterprise

5 market experts have recently issued ratings for this stock, with a consensus target price of $582.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access. * An analyst from Baird has decided to maintain their Outperform rating on Axon Enterprise, which currently sits at a price target of $600. * Maintaining their stance, an analyst from Northland Capital Markets continues to hold a Outperform rating for Axon Enterprise, targeting a price of $550. * An analyst from Needham has decided to maintain their Buy rating on Axon Enterprise, which currently sits at a price target of $600. * In a positive move, an analyst from Morgan Stanley has upgraded their rating to Overweight and adjusted the price target to $700. * An analyst from Baird persists with their Outperform rating on Axon Enterprise, maintaining a target price of $460.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Axon Enterprise options trades with real-time alerts from Benzinga Pro.