The U.S. stock market has soared recently, with the S&P 500 -Wall Street's benchmark index- climbing over 8% so far this year and almost 33% throughout the past 12 months.

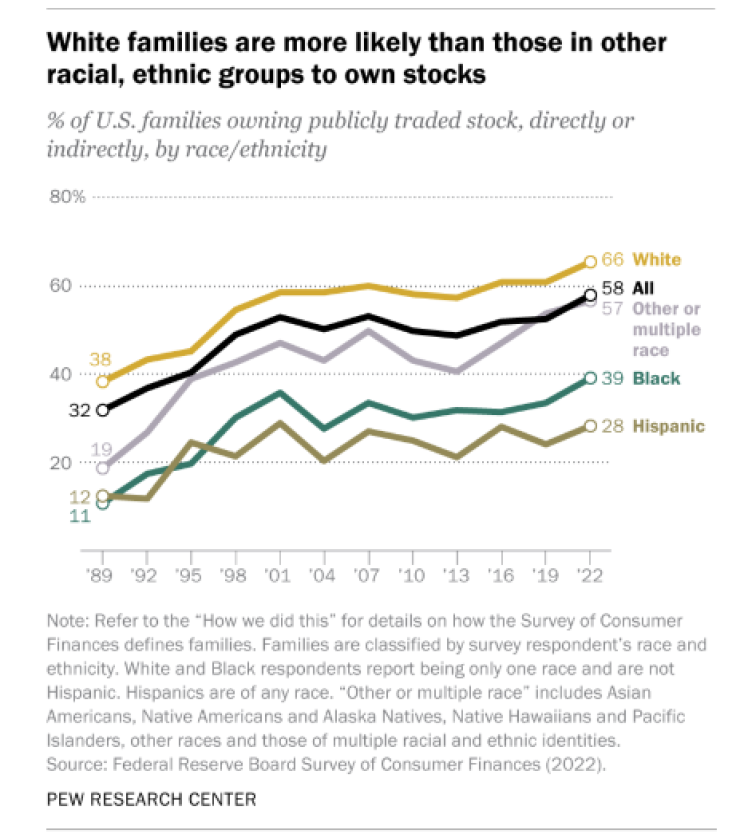

However, not all demographics have been able to seize the period, Latinos being the least likely group to do so. According to a new survey by the Pew Research Center, only 28% of Latino families owned publicly traded stocks in 2022, whether directly or indirectly.

It was the lowest figure of all demographics surveyed and less than half the country average (58%). Whites were on the other end of the spectrum, with two thirds families owning stocks (66%), while 39% of Black families were in said position.

Another passage of the survey, which cites the Federal Reserve Survey of Consumer Finances (SCF), showed that Latino families who did own stock held larger amounts than Blacks but much lower than Whites. Concretely, the median value for families was $24,500, compared to $16,500 for Blacks and $67,800 for Whites.

The average, however, was much higher: $97,400 for Latinos, $80,400 for Blacks and $568,100 among Whites. "The means are considerably higher than the medians because stock ownership is highly skewed. Most families own relatively little, but a few very wealthy families own quite a lot," the survey explained.

An analysis from the Pew Research Center last year which used a different data source, the U.S. Census Bureau's Survey of Income and Program Participation, found similar gaps in asset ownership.

"That analysis found that 47% of Asian households and 35% of White households owned bonds, stocks and mutual funds in 2021 compared with 18% of Black households and 16% of Hispanic households," according to the survey.

Looking at the historical evolution of stock ownership, the survey shows that the share of Latino families owning stocks has "fluctuated between 20% and 30% since 1995, peaking at 29% in 2001."

"Overall, 58% of U.S. families had some sort of exposure to the stock market in 2022, the highest level ever recorded by the SCF. The median value of those holdings was $52,000; the mean value was $489,500," it added.

Latinos were also the demographic who least owned stock through a retirement plan. 54% of all American families had one in 2022, but it was the case for only 28% of Latinos (62% of White families and 35% of Blacks). In terms of amounts, Latinos who did have these plans held some $120,000 in retirement accounts, compared to $118,000 for Black families and $380,000 for White ones. The mean was $334,000.

Even if most Latinos have seen the stock market's surge from afar, there's another asset class that's been soaring and in which the demographic has shown larger interest: cryptocurrencies. According to a survey conducted by Morning Consult, while 24% of cryptocurrency owners are Latino, only 16% of U.S. adults overall "identify as Hispanic".

Bitcoin topped $71,000 on Monday, reaching a new all-time high, while Ether, the second largest digital asset climbed over $4,000 amid a climate of strong enthusiasm among retailers and as it marches to a new halving, a 50% reduction in the reward for mined blocks that has historically coincided with a rally in Bitcoin's price, as well as the broader ecosystem.

This milestone is also significant given that the halving event, expected for April 2024, has not yet occurred and could be linked to the significant influx of purchases by companies issuing Bitcoin spot Exchange-Traded Funds (ETFs). This means that the currency could be poised to rally even more during the following months, if current behavior follows traditional patterns.

© 2024 Latin Times. All rights reserved. Do not reproduce without permission.