United Rentals, Inc. (NYSE:URI) is set to provide sustainable solutions, including all-electric trucks and zero-emission power systems, to Turner Construction.

Shares of this leading equipment rental company rose 5.2% in the trading session on Jul 19, 2022.

In this partnership, United Rentals will supply equipment package like the all-electric, zero-emissions Ford F-150 Lightning pickup truck, in addition to a 9.6 kilowatt Pro Power onboard generator system, to Turner.

Turner will utilize the rental equipment for construction of a data center of Meta, in Kansas City, MO, to lower the carbon footprint of the jobsite.

Both United Rentals and Turner have been proactively engaged in reducing the environmental impact of their operations. This latest agreement will eventually help United Rentals to locate other construction projects where emissions-saving solutions can be deployed to work toward net-zero jobsites.

Testing electric vehicles, such as the F-150 Lightning, on the construction site will deliver key information on how electrifying construction equipment will help reduce emissions while driving productivity.

U.S. Administration's Pro-Green Efforts & Infrastructural Push

United Rentals and other construction companies are expected to benefit from strong global trends in infrastructure modernization, energy transition, national security, and a potential super-cycle in global supply-chain investments. The company is expected to continue maintaining positive momentum in the near term, as the company's solutions are closely aligned with President Biden's policies and industry trends.

Development and deployment of technology solutions across the full spectrum of decarbonization efforts, including carbon management mitigation and compliance consulting, as well as all facets of infrastructure for providing carbon-free energy solutions, should benefit United Rentals and other construction companies, going forward.

United Rentals has been gaining from better fleet productivity on broad-based rental demand in construction and industrial verticals. The company expects a diverse mix of federal projects for road and bridge work, water control, harbors and ports, and also on the power grid, which will drive growth in 2023 as well.

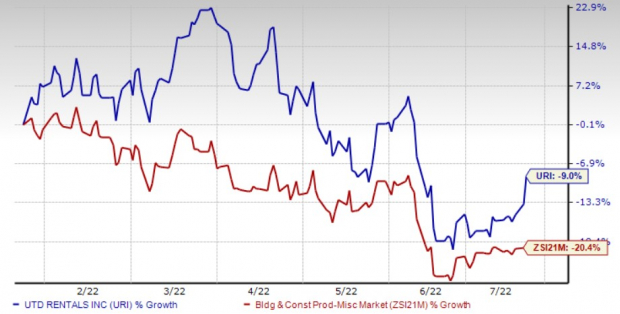

Shares of URI, a Zacks Rank #4 (Sell) company, have dropped over the past six months owing to the ongoing supply-chain challenges and higher inflation but outperformed the Zacks Building Products – Miscellaneous industry during the period.

For 2022, United Rentals expects higher demand across the end markets served, with 11.3% year-over-year growth, at the midpoint of the guided revenue range. This will be supported by a significant investment in growth capital.

The Zacks Consensus Estimate for 2022 earnings of $29.65 per share implies 34.4% year-over-year growth. The solid growth rate depicts the stock's promising future.

3 Better-Ranked Construction Stocks to Consider

KBR, Inc. (NYSE:KBR), currently carrying a Zacks Rank #1, provides scientific, technology and engineering solutions to governments and commercial customers. Its mission-critical government services, high-end and differentiated government business work, strong margin performance, proprietary technology solutions and a significant increase in backlog (particularly in Government Solution) are expected to boost 2022 earnings.

KBR's 2022 earnings are likely to rise 7.9%. The company's earnings estimates have remained stable over the past 60 days.

Primoris Services Corporation (NASDAQ:PRIM), currently carrying a Zacks Rank #2 (Buy), provides a wide range of construction, fabrication, maintenance, replacement and engineering services.

PRIM's 2022 earnings are likely to rise 19.4%. The company's earnings estimates have remained stable at $2.59 over the past 60 days.

Toll Brothers Inc. (NYSE:TOL), currently carrying a Zacks Rank #2, mostly offers luxury homes and its communities are located in prosperous suburban areas with easy access to major cities.

TOL's expected earnings growth rate for fiscal 2022 is 53.7%. The consensus mark for its fiscal 2022 earnings has moved up to $10.19 from $9.87 per share in the past 60 days.

To read this article on Zacks.com click here.

Image sourced from Shutterstock