Despite the meltdown in the broader market over the past 24 hours, investors in Ulta Beauty (ULTA) just don’t seem to care.

The stock took a shallow dip on Friday morning, falling just over 1% despite the cosmetics retailer's better-than-expected quarterly results. At last check, the shares were up about 1.5%.

Don't Miss: GE Stock Breaks Out; $100 Could Be Its Next Target

Earnings of $6.68 a share smashed expectations by almost $1 per share, while revenue of $3.23 billion grew over 18% year over year and beat estimates by $240 million.

Even better for the longs, the retailer’s full-year earnings and revenue estimates topped analysts’ estimates.

In that respect, it’s not surprising that traders bought the opening dip. It’s a bit surprising that there was a dip in the first place.

So far, the retail space has seen a mostly negative reaction to earnings.

But Dick’s Sporting Goods (DKS) also had a strong report and its shares recently hit all-time highs as a result.

Is that next for Ulta stock?

Trading Ulta Stock on Earnings

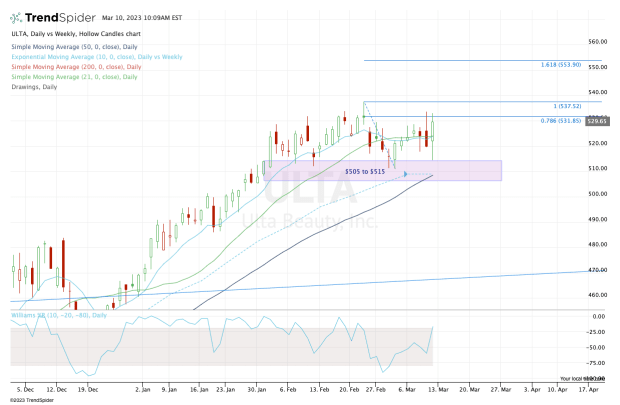

Chart courtesy of TrendSpider.com

Ulta stock dipped right into the top of our support range, between $505 to $515. Ultimately, a slightly deeper dip would have been ideal.

While that sounds counterintuitive to the bulls, pullbacks are what give investors more attractive risk/reward setups. They’re also what set up the bigger upside moves.

That said, the current rally is far from robust and that could leave a larger dip on the table. If that’s to occur, look for support from the 10-week and 50-day moving averages. Those measures come into play near the lower end of the $505 to $515 support range.

Don't Miss: Amazon Stock: Back Up to $100 or Down Toward New Lows?

Even though the technical and fundamental situation for Ulta Beauty is strong right now, the market is in a bit dicier of a situation as the technicals start to crack and as the prospect for higher interest rates takes form.

If the market can hold up, it could give Ulta the fuel it needs to break out over resistance in the low-$530s.

Should Ulta clear resistance, then the all-time high near $537.50 is on the table. Above that would open the door to a potential rally into the $550 to $555 zone.

The bottom line: Until the trend fails, Ulta stock is a name bulls want to stick with.