Closing post

Time to wrap up… here are are today’s main stories:

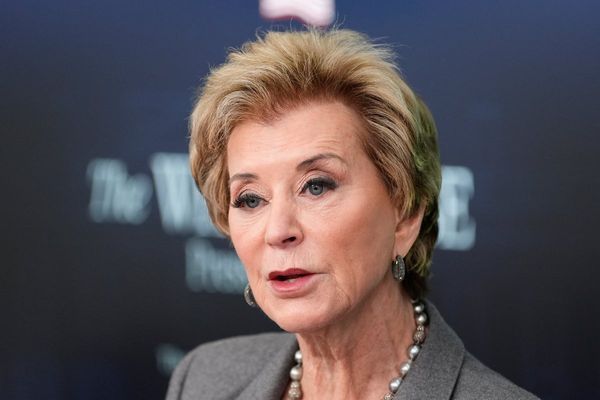

Yellen warns of worldwide panic if debt ceiling not raised

European stock markets are ending the day in the red, as fears over the US debt ceiling ripple across trading floors.

In London, the FTSE 100 index is down 31 points or 0.4% at 7746. The blue-chip index is being dragged down by Vodafone, which has now lost over 8% today after announcing 11,000 job cuts this morning.

Germany’s DAX and France’s CAC are down around 0.2%.

Investors have noted warnings from US Treasury Secretary Janet Yellen today that a default on government debt would likely leave millions of Americans without income payments, potentially triggering a recession that could destroy many American jobs and businesses.

Yellen told a gathering of community bankers that the unprecedented economic and financial crisis would be exacerbated by possible disruptions to the federal government’s operations, including air traffic control, law enforcement, border security and national defense, and telecommunications systems.

The accompanying financial crisis could multiply the severity of the downturn, she said in remarks prepared for delivery, adding,

“It is very conceivable that we’d see a number of financial markets break - with worldwide panic triggering margin calls, runs and fire sales.”

Yellen also warned:

“Our economy would suddenly find itself in an unprecedented economic and financial storm….

And the resulting income shock could lead to a recession that destroys many American jobs and businesses.

Updated

Reuters are reporting that French prosecutors have issued an arrest warrant for the central bank governor of Lebanon, Riad Salameh.

This dramatic move comes after Salameh failed to attend a hearing in Paris today, they say.

AFP report that Salameh was due to be questioned on corruption charges, adding:

A European judicial team from France, Germany and Luxembourg is conducting a corruption probe into an array of financial crimes, including illicit enrichment and alleged laundering of $330m, implicating the Lebanese governor, Riad Salameh.

Salameh, 72, who has held his post for almost 30 years, has repeatedly denied all allegations against him. He has insisted that his wealth comes from his previous job as an investment banker at Merrill Lynch, inherited properties, and investments.

The three European governments in March 2022 froze over $130m in assets linked to the probe. During a visit to Lebanon in March, the European delegation questioned Salameh about the Lebanese central bank’s assets and investments outside the country, a Paris apartment — which the governor owns— and his brother Raja Salameh’s brokerage firm Forry Associates Ltd.

According to a senior Lebanese judicial official, Riad Salameh never received his summons from Paris despite several attempts to deliver it.

The official said a Lebanese judge sent the notice to Salameh several times over the past two weeks, but it was returned each time because the governor was not present at the central bank to receive the notice.

More here.

🇫🇷🇱🇧@AFP reports that an international arrest warrant has been issued against Lebanon Central Bank’s Governor Riad Salame, a fugitive form justice🥂🍾👏

— Karim Emile Bitar (@karimbitar) May 16, 2023

Biens mal acquis libanais : une juge française émet un mandat d'arrêt international contre Riad Salamehttps://t.co/cRAoLz1vb5

Federal Reserve policymaker Loretta Mester has dampened hopes that US interest rates could soon be held.

Mester, president of the Federal Reserve Bank of Cleveland, told a conference in Dublin today that she does not think the US central bank is at a point yet where it can hold interest rates steady for a period of time, given how stubborn inflation is.

Mester said:

“The approach I’m taking is that I would like the policy rate to get to a point where, when I’m thinking about what would the next policy change be, I want it to be equally a potential increase versus a decrease.”

Atlanta Fed President Raphael Bostic made similar comments on Monday, saying that he would lean towards another rise in borrowing costs, not a cut.

Cleveland Fed President Loretta Mester: Central Bank Can ‘Do Its Part’ by Curbing Inflation #Ainvest #Ainvest_Wire #Fed #ratehiking #inflation

— AInvest Wire (@Ainvest_Wire) May 16, 2023

View more: https://t.co/RoG3eime4L pic.twitter.com/0djvv1mSXD

Wall Street has opened lower.

The Dow Jones industrial average has dropped by 130 points, or 0.4%, to 33,218 points.

The broader S&P 500 has lost 0.2%, with the tech-focused Nasdaq down 0.1%.

Home Depot is leading the fallers on the Dow, down 3.7%, after the DIY chain cut its annual sales forecast and projected a steeper decline in profit than previously expected today.

Home Depot warned that demand for tools and building materials was weakening as inflation-wary Americans cut back on spending, such as on home improvement.

Traders are also hoping to see signs of progress over the US debt ceiling today. Democratic President Joe Biden and top congressional Republican Kevin McCarthy are due to hold talks over how to raise the U.S. government’s $31.4 trillion debt ceiling and avert an economically catastrophic default.

Treasury secretary Janet Yellen has warned today that the US economy’s recovery from the Covid-19 pandemic would be undone and a new financial crisis would be triggered if the debt ceiling isn’t raised, leading to a default.

More economic data… and US factory output has jumped unexpectedlty.

US industrial production rose 0.5% in April, after flatlining for the previous two months.

In April, manufacturing increased 1.0%, driven by higher output of motor vehicles and parts.

The index for mining rose 0.6 percent, while the index for utilities dropped 3.1 percent, as milder temperatures in April lowered demand for heating.

Industrial Production in the United States increased 0.50 percent in April of 2023 over the previous month.https://t.co/d2vCgluAuV pic.twitter.com/2a3JRRMgY1

— TRADING ECONOMICS (@tEconomics) May 16, 2023

Canadian inflation picks up

Inflation in Canada has picked up for the first time in nearly a year, a handy reminder that the road out of the cost of living crisis isn’t smooth.

The Canadian consumer prices index rose by 4.4% in the year to April, up from 4.3% in the year to March, lifted by highe rent prices and mortgage interest costs.

This was the first acceleration in headline consumer inflation since June 2022.

The annual inflation rate in Canada rose to 4.4% in April of 2023 from the 19-month low of 4.3% in the previous month, well above expectations of 4.1% to halt the 10-month streak of slower inflation. pic.twitter.com/krwn06NhlO

— Bertin Balouki SIMYELI (@B_bakouki) May 16, 2023

It looks like there's been a bump in the road in the Bank of Canada's ongoing fight against inflation. https://t.co/Yldf2tye5K

— BNN Bloomberg (@BNNBloomberg) May 16, 2023

Gasoline prices rose by 6.3% in April compared with March, the largest monthly increase since October 2022, after the Opec group cut its output at the start of April, driving up crude prices.

The 0.4% month-on-month rebound in US retail sales in April indicates that higher interest rates and tightening lending standards are yet to deal a major blow to consumers, says Andrew Hunter, deputy chief US economist at Capital Economics.

Huntet adds:

That said, with the April gain coming after two months of declines, real consumption growth is still likely to slow quite sharply in the second quarter.

US retail sales miss expectations

US consumer spending was weaker than forecast last month, new economic data shows.

US retail sales rose by 0.4% in April, missing forecasts of a 0.8% rise, after a 0.7% drop in March.

Online spending (at non-store retailers) rose 1.2% month-on-month, and was 0.9% higher at health and personal care stores.

But spending deteriorated at furniture and home furnishing outlets (down 0.7%), and at electronics and appliance stores (-0.5%) and at sporting goods, hobby, musical instrument and book stores (-3.3%).

Department stores saw a 1.1% drop in spending.

Percent of US Retail Sales Occurring at Non-Store Retailers (mostly online) vs. Department Stores: pic.twitter.com/82bVa4BEkf

— Michael McDonough (@M_McDonough) May 16, 2023

IMF warns Germany's economic growth will remain muted in near term

The German economy has shown resilience over the last year thanks to a strong policy response and a mild winter, but economic growth will remain muted in the near term, the International Monetary Fund (IMF) said today.

Tighter financial conditions and the energy price shock have begun to weigh on near-term growth, the IMF warned in its country report for Germany.

It forecast growth in Germany’s gross domestic product (GDP) to stay near zero in 2023, before gradually strengthening to between 1% and 2% in the period of 2024 to 2026.

Over the longer term, average GDP growth is expected to fall back below 1% as the population ages and with no significant accelerations in productivity or labour supply foreseen.

Although headline inflation is falling steadily, core inflation is proving stickier, according to the report, which warned:

“A top priority in the near term is thus to support disinflation with a moderate tightening of the fiscal instance in 2023.”

The CBI has appointed a Chief People Officer to lead cultural change at the organisation, following a series of sexual misconduct allegations reported by the Guardian.

As Interim Chief People Officer, Elizabeth Wallace will start the process of implementing the 35 recommendations put forward by law firm Fox Williams, which held an independent investigation into allegations of misconduct at the business lobby group.

We are pleased to announce the appointment of Elizabeth Wallace as our new Interim Chief People Officer.

— CBI (@CBItweets) May 16, 2023

Read our full statement here 🔗 https://t.co/Yj2UZMgCby pic.twitter.com/2PkDX5GMVw

Rain Newton-Smith, the CBI’s new director general, said:

“I am so pleased to welcome Elizabeth on board as Chief People Officer.

Her role will be integral in reforming our people strategy- defining our shared values as we collectively recover from the challenges of recent weeks. With over two decades’ worth of experience, I’m confident that her guidance will accelerate our efforts to effect meaningful change across the CBI.”

Earlier this month the CBI appointed business ethics consultancy Principia Advisory to help overhaul its operations. It has scheduled an extraordinary general meeting for midday on 6 June, after more than 50 large businesses, including John Lewis and NatWest, suspended or cancelled their membership following allegations of sexual misconduct/

Elizabeth Wallace has previously worked as Head of Portfolio Talent at private equity group Hg and Director of Executive Search at investment group BlackRock.

Wallace says she will “lead the way on cultural transformation” at the CBI, adding:

Making sure the newly created Chief People Officer role becomes a permanent part of the CBI’s DNA will be front of mind, as I work with people across the organisation to strengthen our employee experience offering.”

The MPs also heard about the CMA’s concerns about the high profit margins at petrol retailers, particularly supermarkets:

🟡 Cardell flags rising retail margins in petrol and says this is "particularly" prominent in supermarkets.

— Helen Cahill (@HelCahill) May 16, 2023

🟡 She says "what troubles us is that we are not seeing that competitive response" from other supermarkets when one retailer increased internal targets

Sarah Cardell told MPs on the Business and Trade Committee.

“Supermarkets have historically been the cheapest suppliers by and large at the retail level,”

“And I should say that it remains the case that many of the factors driving up petrol and diesel prices are external factors, including obviously the impact of Russia’s invasion of Ukraine.

“But nonetheless, what our evidence is showing us is that the rise in margins doesn’t appear to be entirely due to factors outside of retailers’ control.

“What we appear to see is evidence that at least one of the supermarkets has increased its own internal targets for margins, we’re not seeing a strong competitive response from the other supermarkets there.”

Updated

CMA chief executive Sarah Cardell then declined to give a view on the possible merger of Vodafone and Three, CK Hutchison’s UK businesses, as a deal hasn’t been formally agreed.

She told MPs:

“The situation that we’re in is, because we don’t yet have that as a merger to review, we can’t give, in a sense, a view now.”

If a deal is reached, then a merger of Vodafone and Three would cut the number of UK mobile phone networks from 4 to 3.

Q: How much does the CMA discuss and co-ordinate with regulators in other juristictions when examining a deal, and specifically with the Microsoft-Activision deal.

Sarah Cardell explains that the CMA is looking at significantly more deals following Brexit.

Of course, the competition is ‘highly mindful’ of the need to ensure the continuity and integrity of analysis, but it’s the CMA’s role is to consider competition in the UK.

She explains that the CMA was given a ‘waiver’ by the parties in the MS-Activision deal, so its staff could hold discussions with the European Commission.

But towards the end of its discussions, it did not have a waiver to allow detailed discussions with the US FTC, so there was only limited discussions.

Cardell insists the CMA does not do the bidding of other authorities, following some speculation that the FTC had put pressure on the UK regulators.

MP insists to know more about interactions between CMA and FTC, but Cardell points to confidentiality restrictions.

— Florian Mueller (@FOSSpatents) May 16, 2023

The longer this takes, the more it looks like Activision's CEO may have had a point about an alleged Khan-Cardell conspiracy to block the deal in the UK.

🧵17/X

Updated

CMA hits back against criticism of MS-Activision decision

Q: Do you consider the implications of your decisions on the UK’s international reputation as a place to do business?

This is a clear reference to Microsoft president Brad Smith’s claim that the CMA’s decision to block the Activision deal was “bad for Britain”, and that the EU was a better place to start a business.

Sarah Cardell says the CMA absolutely committed to support competitive markets in a way that is “absolutely good” for the UK and its economy.

The CMA’s chief executive explains to the Business and Trade committee that:

Competition is a keystone, an absolutely foundational block of UK competitiveness.

You want to have strong competition in markets, it promotes growth and promotes innovation.

Q: Everyone’s in favour of competition in markets… do you consider our international reputation at all in your decisions, and whether the UK looks ‘open to business’?

Individual cases need to be decided on their merits, Cardell insists. But ‘absolutely, the CMA thinks about the impact of its decisions when it considers its role strategically.

Cardell hits back against the claim that the CMA has undermined the UK’s reputation, saying:

I believe that strong competition is a very positive signal for the UK’s reputation externally.

CMA chair Marcus Bokkerink wades in to support this point.

Bokkerink tells MPs that all businesses know that there’s a big difference between building a business, or investing in a start-up, and buying an already well-established firm with established positions.

The two are not the same, Bokkerink points out, saying:

The UK has always encouraged, and it’s the CMA’s duty to support and encourage, open and competitive markets.

Bokkerink questions whether confidence in the UK will be helped by “turning a blind eye to anti-competitive mergers”.

Updated

CMA: not in hostile environment with tech

Q: It’s been reported that tech companies have been recruiting lots of lobbyists and persuaders to affect the work of the CMA – is that a concern?

CMA CEO Sarah Cardell says the overall experience of engagement with the tech industry has been ‘very positive’.

She meets regularly with senior representatives of tech companies and the industry.

This is a sector where we want to work together, and create the best conditions for competition, Cardell explains.

Of course, there will be individual decisions where we disagree, she adds, but:

I don’t find that we are operating in a hostile environment.

She cites a case against Google’s privacy sandbox, which was resolved constructively with a solution that’s now being rolled out worldwide.

Updated

Q: So why did the EC feel differently about Microsoft’s remedy than the CMA?

CMA CEO Sarah Cardell says we don’t have the detail behind Brussels’ decision yesterday to approve the deal.

But the question for the CMA is whether, or not, the remedies would allow a market to continue with the same competitive dynamics as if the deal had not happened.

The cloud gaming market is in early gestation, we want competition to flourish, Cardell declares, adding:

There was a real concern on the part of the [CMA] group that if you accept the proposal that was tabled by Microsoft, it would constrain the way the market would evolve going forward.

It would not replicate the conditions of full and fair competition that we would see in the absense of the merger.

Reminder, the Commission said yesterday that Microsoft had made this commitment:

A free license to consumers in the EEA that would allow them to stream, via any cloud game streaming services of their choice, all current and future Activision Blizzard PC and console games for which they have a license.

A corresponding free license to cloud game streaming service providers to allow EEA-based gamers to stream any Activision Blizzard’s PC and console games.

CMA defends blocking MS-Activision deal

Sarah Cardell, chief executive of the Competition and Markets Authority, begins today’s session by explaining why the CMA is opposing Microsoft’s takeover of Activision Blizzard.

Q": Where are we with the Microsoft-Activision deal?

CMA CEO Sarah Cardell explains that the CMA’s decided at the end of April to prohibit the deal, due to concerns that competition in the cloud gaming market would suffer.

Microsoft has a leading position in cloud, due to its cloud infrastructure, its Xbox gaming console and Windows.

The CMA was concerned about Microsoft’s ability to take that position and combine it with Activision, and its significant portfolio of games (such as Call of Duty), Cardell explaines.

It would lead to a lessening of competition, the CMA feared, as it would prevent other cloud gaming providers from competing effectively as the market develops.

The CMA considered the proposed remedy from Microsoft “very carefully”, Cardell insists, but concluded it would not be a comprehensive and effective remedy.

Microsoft, she says, offered a licencing deal that would set the terms of trade for the market for the next 10 years; determining the terms in which other cloud computing providers would get access to those games.

This is a very important, evolving market, and the CMA wants to ensure it can evolve unincombered by regulatory constraints.

The CMA has decided that the deal needs to be prohibited.

The EC, though, decided yesterday to approve the deal.

Cardell says the Commission did conclude there are competition concerns from the deal – so there is no difference between the EC and the CMA on that point.

However, the Commission accepted Microsoft’s proposed remedy.

Cardell adds:

We remain of the view, from a UK perspecive, that it was not appropriate to accept that remedy.

She reminds MPs that the US Department of Justice is also suing to block the deal.

MPs hold hearing with CMA

Over in parliament, MPs on the Business and Trade Committee have begun a hearing on “The work of the Competition and Markets Authority”.

Up before them, we have CMA chair Marcus Bokkerink, and chief executive Sarah Cardell.

Here’s a piece from earlier this month, about the CMA’s global ambitions – which have included blocking Microsoft’s takeover of Activision Blizzard, and taking a look at the underlying systems – or foundation models – behind AI tools.

🟡 CMA chair Marcus Bokkerink and CEO Sarah Cardell are in front of the business and trade ctte this morning

— Helen Cahill (@HelCahill) May 16, 2023

🟡 The session is on tech takeovers and there's plenty of M&A drama to talk about

https://t.co/g7o5du0KPY

Analysis: UK interest rate rises are taking the labour market off the boil

There are signs the Bank of England’s interest rate rises are making businesses think twice about hiring staff, bringing down the number of vacancies, my colleague Phillip Inman writes.

Pushing in the same direction, the high cost of living is driving more people back into the workforce.

The effect shows up in the latest labour figures from the Office for National Statistics (ONS) as a fall of 55,000 in the number of vacancies in the three months to April and a 156,000 drop in the number of inactive workers.

Separate HMRC figures showed a 136,000 fall in PAYE employees between March and April – the first reduction since February 2021.

Put together, these figures tell us the UK’s pressure-cooker labour market – with lots of advertised jobs and too few workers to fill them – has begun to come off the boil.

When the Bank of England’s main concern relates to the tightness of the labour market, which is reflected in a high vacancy rate, then these trends will be welcomed by anyone who wants interest rates to fall and growth to pick up….

More here:

The IFS have published a handy thread explaining how more workers will be dragged into paying higher rate income tax over the next few years:

The six-year freeze to income tax allowances & thresholds is set to add 2.5m more people onto higher tax rates by 2027.

— Institute for Fiscal Studies (@TheIFS) May 16, 2023

This would make it the single biggest tax-raising measure since Geoffrey Howe doubled VAT in 1979.

What will this mean? THREAD: [1/6] pic.twitter.com/5mcYX2jRAu

In 1991, just 1.6 million people in the UK were paying higher rates of income tax (40% and above), equivalent to 3.5% of UK adults.

— Institute for Fiscal Studies (@TheIFS) May 16, 2023

By 2027, it will be 7.8 million people (14% of UK adults).

[2/6] pic.twitter.com/qmQCjzWuem

The higher-rate threshold is currently £50,270.

— Institute for Fiscal Studies (@TheIFS) May 16, 2023

For the same fraction of people to be paying the 40% higher rate in 2027 as were paying it in 1991 (3.5% of UK adults), the higher-rate threshold would need to be nearly £100,000.

[3/6]

Higher rates of income tax used to only impact those on the very highest incomes.

— Institute for Fiscal Studies (@TheIFS) May 16, 2023

Now it impacts a much more substantial share of the population: one in four teachers and one in eight nurses will be higher-rate taxpayers by 2027–28.

[4/6] pic.twitter.com/vERj3r7x4T

This freeze will compound the challenges facing workers, whose earnings have not been keeping up with inflation.

— Institute for Fiscal Studies (@TheIFS) May 16, 2023

One third of the expected record fall in household incomes this year is likely to be a result of this tax rise.

[5/6]

"This represents a fundamental and profound change to the nature and structure of our income tax system."

— Institute for Fiscal Studies (@TheIFS) May 16, 2023

Read Isaac Delestre and @TomWatersEcon’s report here: https://t.co/vMi4z4idJ4

[6/6] pic.twitter.com/r9byvTFsql

German investor morale tumbles as recession fears rise

German investor sentiment fell more than expected in May, suggesting that Europe’s largest economy is deteriorating and could fall into recession this year.

The ZEW economic research institute’s gauge of investor morale in Germany has tumbled to -10.7 points, down from 4.1 points in April.

Economists polled by Reuters had expected a smaller drop, to -5.3.

This brought the ZEW indicator back into negative territory for the first time since December 2022.

GERMAN ZEW SURVEY MAY 2023 REPORT https://t.co/EF9HLg8mbE

— alfred (@macronewswire) May 16, 2023

ZEW president Achim Wambach said.

“As a result, the German economy could slip into a recession, albeit a mild one.”

Wambach said that fears of further interest rate hikes by the European Central Bank weighed on morale, adding that the US debt ceiling deadlock was another factor:

A possible default by the United States in the next few weeks also increases the uncertainty with regard to international economic development.

Full story: UK payroll numbers fall as unemployment rate rises to 3.9%

The number of workers on UK employers’ payrolls dropped for the first time in two years last month amid signs that the flatlining economy has started to take a toll of Britain’s labour market, our economics editor Larry Elliott reports.

Fresh figures from the Office for National Statistics showed a 136,000 fall in employees between March and April – the first reduction since February 2021.

Although the ONS said the data was provisional, the numbers on payrolls provide the most timely guide to the state of the jobs market and will be seen as evidence of a cooling in demand for labour. Despite April’s fall, payrolls are more than 800,000 higher than they were in February 2020, the month before the UK went into its first Covid-19 lockdown.

The official figures showed employment and unemployment up in the first three months of 2023. With the cost of living crisis hitting household budgets, there was a record flow of people out of inactivity and into work. The unemployment rate rose unexpectedly to 3.9% from 3.8%.

Job vacancies fell by 55,000 to just over 1m in the three months ending in April, the 10th consecutive quarterly drop. The number of people inactive as a result of long-term sickness reached a fresh record of 2.55 million.

The ONS director of economic statistics, Darren Morgan, said:

“Employment and unemployment both rose again in the first three months of 2023, driven in particular by men.

This means the number of those neither working nor looking for work continues to fall, although the number of people not working due to long-term sickness rose again, to a new record.”

Despite the highest pay growth in the public sector for two decades, the ONS said workers in public and private sectors were becoming worse off because prices were rising faster than wages. Average regular pay growth for the private sector was 7.0% and for the public sector was 5.6% in January to March, but the cost of living rose by 10.1% in the year to March.

Meanwhile, the number of days lost through strikes rose from 332,000 in February to 556,000 in March, with 80% of the total the result of action in the health and education sectors.

More here:

Company insolvencies fall

Some good news: there’s been a drop in the number of companies collapsing.

The number of registered company insolvencies in England and Wales fell to 1,685 in April, 15% lower than the 1,988 which failed in April 2022.

It’s also a third less than in March, when there were 2,471 insolvencies.

Most of these were creditors’ voluntary liquidations (CVLs) in which a firm’s directors choose to close their company because it is insolvent.

But the number of compulsory liquidations almost doubled, year on year, to 183.

The Insolvency Service explains:

Numbers of compulsory liquidations have increased from historical lows seen during the coronavirus pandemic, partly as a result of an increase in winding-up petitions presented by HMRC.

Carla Matthews, head of contentious insolvency and asset recovery at PwC, says:

“The number of insolvencies last month (1,685) was 15% lower than in the same month last year and down on the 2,457 seen in March. On the surface this looks encouraging and is likely due to increased business confidence and directors taking a more optimistic view of the economic outlook. Simultaneously, the Easter court break may have contributed to the reduction in compulsory liquidations.

“However, we’re not out of the woods yet. The trading environment remains challenging for business, and while energy costs are starting to drop, both inflation and the cost of servicing debt remains stubbornly high, with commodity prices continuing to cause pressure across a range of sectors, so the outlook for the rest of the year may still be turbulent.

ING: nothing in UK wage data screaming the need for another rate hike

Today’s UK labour market report (coverage starts here) shows that the heat is coming out of the UK jobs market, explains ING’s developed markets economist James Smith .

Smith argues that there’s nothing in the UK wage data that screams the need for another rate hike either.

He says:

“Last month’s surprisingly strong UK wage growth figure was almost certainly a key driver behind last week’s Bank of England decision to raise interest rates further. This month though, the story appears more benign. The headline rate of regular pay growth, which compares the past three months to the same period last year, notched up to 6.7%. But the level of average weekly pay (ex bonuses) increased by only £2 in the past month, a slower pace than we saw through much of 2022 and indeed in the previous month (which now looks like an aberration).

“Smoothing out recent volatility and comparing the most recent three months to the three months before, the rate of private sector wage growth has clearly slowed since 2022. That trend is also supported by the BoE’s own survey of businesses, which indicates that both price and pay pressures beginning to ebb.

“Elsewhere there are further signs that the heat is coming out of the UK jobs market, albeit steadily. The unemployment rate inched up to 3.9%, while we saw the first monthly fall in employment since early 2021, at least according to the experimental payrolled employees measure.”

High street bakery chain Greggs continues to grow its sales amid the cost of living squeeze.

Greggs reported that like-for-like sales so far this year are up 17.1% – partly because sales in early 2022 were hit by the Omicron variant of Covid-19.

Greggs told the City it is seeing “particularly strong growth” in hot food and snacks including chicken goujons, wedges and pizza.

Greggs continues to expand its range of plant-based food, with a vegan Mexican chicken-free bake.

So far this year it has opened 63 new stores, and closed 26.

Greggs warned this morning that it expects tto see “ongoing material cost inflation”, but it has covered itself against price rises in key commodities.

As a shareholder I'm content with Greggs update, sales rising strongly and coping well with inflation. Shares down 0,8% but not a worry after strong rise over past 12 months. I'm staying in.

— Rodney Hobson (@RodneyHobson) May 16, 2023

Victoria Scholar, head of investment at interactive investor, says,

Gregg’s value proposition is holding up amid the backdrop of a softening consumer with strong demand for hot food and its growing plant-based offering after the success of its vegan sausage roll. However weaker disposable income and higher costs continue to be challenges for the bakery.

Shares in Greggs are trading flat today but are up more than 18% year-to-date, sharply outperforming the wider market thanks to its resilient low price point offering.”

One in five workers will be higher-rate taxpayers by 2027 – IFS

One in four teachers and one in eight nurses will be higher-rate taxpayers by 2027 as a result of the government’s record freeze on income tax allowances and thresholds, according to a leading thinktank this morning.

The Institute for Fiscal Studies said better-paid public sector workers will be among the almost 8 million people – one in five of all taxpayers – who will pay income tax at 40% or above as result of the Treasury’s attempt to reduce the UK’s budget deficit.

In what it described as the biggest tax-raising measure since the incoming Conservative government doubled VAT to 15% in 1979, the IFS said an additional 2.5 million people would no longer be basic rate taxpayers by the time the six-year freeze on allowances and thresholds came to an end in 2027-28.

Here’s the full story:

The news adds to the “mounting unrest” among Conservative PMs, The Times says,

TIMES: Fifth of all taxpayers will now be in 40p band #TomorrowsPapersToday pic.twitter.com/VeIXQyOxcL

— Neil Henderson (@hendopolis) May 15, 2023

Tesco announces price cuts on pasta and cooking oil

Tesco has announced another round of price cuts on its own-brand pasta and cooking oil as it sees deflation making its way through to cupboard essentials.

The UK’s biggest supermarket is dropping the price of 30 products, with 15p off 500g and 1kg packs of own-brand pasta, 14p off its one litre vegetable oil and 15p off its one litre sunflower oil.

Tesco group chief product officer Ashwin Prasad said:

“As we see deflation coming through on key cupboard essentials such as pasta and cooking oil, we’re pleased to pass on these savings to customers.

“We hope that by reducing prices on these 30 products which are bought week-in, week-out, we can help customers spend less.”

According to the UN, global wholesale food prices hit record levels last April after the Ukraine invasion, but then fell over the next year.

The announcement comes on the day Downing Street hosts a “Farm to Fork Summit”, bringing together farmers’ representatives and food and retail trade bodies along with supermarket chiefs to discuss boosting co-operation across the supply chain and the sector’s resilience – and tackling rampant food inflation, which jumped by over 19% in March.

Updated

British firms’ demand for workers is cooling just as the workforce expands, the Resolution Foundation thinktank reports.

Resolution points out that almost all of the post-pandemic rise on inactivity among those under 50 has now been unwound.

This fell by 156,000 in the last three months alone – allaying fears that the pandemic has permanently put younger people off work, Resolution say.

However, the longer-time rise in inactivity due to ill-health has reached a fresh record high of 2.55 million.

Hannah Slaughter, senior economist at the Resolution Foundation, explains:

“Britain’s workforce continued to expand and normalise in the early 2023 – allaying fear that the pandemic had permanently shrunk the workforce. But older workers – a large cohort of whom took early retirement during the Covid crisis – remain inactive in greater numbers than pre-pandemic.

“But while the workforce is expanding, firms’ appetite for new workers is falling as vacancy levels continue to decline. How this affects unemployment and pay growth levels in the months ahead will be weighing on policy makers minds.

While pay packets continue to shrink in real terms, the strength of pay growth in both the public and private sector, combined with likely falls in inflation in the months ahead, suggests that real wage growth could return soon.”

556,000 working days were lost due to strikes in March 2023, the second highest figure in the last decade (the highest was Jan 2023 with 836,000), according to new ONS figures. https://t.co/WhFihOkzhS pic.twitter.com/rBlNdRmBQ4

— Emiliano Mellino (@Mellino) May 16, 2023

IES: More work needed to help people into work

Despite dropping by 156,000 in the last quarter, there are still 8.73m people classed as economically inactive in the UK.

That’s 361,000 more than before the pandemic.

Tony Wilson, Director at the Institute for Employment Studies, explains how rising sickness is keeping people out of work:

“The stand-out figure in today’s data is another sharp increase in the number of people off work with long-term health conditions, up by nearly a hundred thousand in the last quarter to over 2.5 million people.

This is now comfortably the largest number of people out of the labour market due to long-term health problems that we have ever seen. This is being masked to some extent by a fall in overall economic inactivity, which is mainly being driven by big falls in the number of students, with student numbers almost back to where they were before the pandemic. So it looks like those people closer to work are still moving into jobs, while those more disadvantaged in the labour market are getting left behind.

Long Covid is one factor, with many sufferers reporting unfair treatment or lack of support from employers.

Long NHS waiting lists are another cause. The number of people in England waiting to start hospital treatment rose to a new high of 7.22m in February.

Wilson says a lot more could be done to help people out of work to prepare for work and to get back in, and particularly those with long-term health conditions.

The announcements at the Budget on this were a start, but will largely only replace provision that is already in place and due to end next year.

So we need to see more focus in our existing employment services like Jobcentre Plus and the Restart Scheme on helping these groups, and more investment in the sorts of specialist employment support, occupational health and workplace practices that will make a difference.”

This chart shows how the decrease in economic inactivity during the latest quarter was largely driven by those aged 16 to 24 years.

While more of those younger workers found jobs, or registered as unemployed, there’re wasn’t much change in the over-50s.

Indeed the inactivtiy rate among 50-64 year olds who were economically inactive rose in the last month, as that chart shows.

Updated

Rising costs mean UK businesses are hesitating to hire workers, the Institute of Directors reports.

Kitty Ussher, chief economist at the IoD, says this has pushed up the unemployment rate:

“A combination of high costs and cash-strapped consumers is now causing some businesses to hesitate before hiring, uncertain as to what the future holds. As a result, the number of employees has fallen for the first time in over two years, and the unemployment rate is starting to rise from its post-pandemic low.

Ussher adds that firms are struggling to find workers with the right skills:

“But there is also evidence of a skills mismatch, with other organisations finding it hard to recruit the talent they need even as unemployment goes up – there are still 282 thousand more vacancies in the UK than before the pandemic.

Government policy needs to work harder to ensure that our education and training system is providing the types of skills that employers are looking for.”

Unions are understandably alarmed that real wages are continuing to fall, with inflation outpacing earnings growth (see 7.42am post).

TUC General Secretary Paul Nowak says ministers must give public sector workers a fair pay rise to end the industrial action hitting the economy.

“Workers have lost more than £1,000 from their pay over the last year. But there’s still no end in sight for the longest wages slump in modern history.

“Real wages remain below where they were in 2008, and the already 15-year pay squeeze is set to last another three years, until 2026.

“It is little surprise that workers are having to take strike action to defend their living standards. They have been pushed to breaking point.

“Ministers must focus on resolving all of the current pay disputes.

“And they must act now to put money in people’s pockets – starting with giving our public sector workers a real pay rise, boosting the minimum wage to £15 per hour, and ending their attack on the right to strike for better pay and conditions in the Strikes Bill.”

Updated

Minister Opperman: continuing to see progress in the labour market

It may sound odd that unemployment and employment could both rise in a quarter, as they did in January-March.

But this graph shows how it happened: more people stopped being economically inactive, and either moved into jobs or were registered as out of work:

The minister for employment, Guy Opperman MP says there are signs of progress in today’s labour force data:

“We’re continuing to see progress in the labour market as we take action across government to grow the economy. Employment is up; economic inactivity is down; and vacancies have fallen in successive quarters.

“As well as helping deliver on our priority to grow the economy, we know that being in work remains the best way for people to get on in life. That’s why I’m focused on matching jobseekers with roles, and businesses with a resilient and skilled workforce. Through partnerships with local employers, we have thousands of placements in sectors such as banking and engineering, helping people to achieve new qualifications and build rewarding careers.”

Hunt: must support those who want to work

Chancellor the Exchequer Jeremy Hunt (who has been trying to chivvy the over-50s back into work), says:

“It’s encouraging that the unemployment rate remains historically low but difficulty in finding staff and rising prices are a worry for many families and businesses.

That’s why we must stick to our plan to halve inflation and help families with the cost of living, while delivering our childcare reforms and supporting older people and disabled people who want to work.”

Hunt is correct that a 3.9% jobless rate is historically low. But, the unemployment rate has been rising since last summer – it was just 3.5% in June-August 2022, the lowest since 1974.

Vodafone to cut 11,000 jobs worldwide

The troubled mobile operator giant Vodafone is to cut 11,000 jobs from its global workforce over the next three years.

The company, which has seen its share price slump to a two-decade low, said it needed to restructure its business to compete against rivals and improve the experience for its tens of millions of customers.

The job cuts, which follow the announcement in November of a €1bn (£870m) cost savings plan, mark the first big move by the new group chief executive, Margherita Della Valle.

“Today I am announcing my plans for Vodafone,” said former finance chief Della Valle, who was appointed chief executive last month.

“Our performance has not been good enough. To consistently deliver, Vodafone must change.”

More here:

ONS: Employment and unemployment up; wages still lagging inflation

Here’s ONS director of economic statistics Darren Morgan to explain today’s UK labour market report report:

“Employment and unemployment both rose again in the first three months of 2023, driven in particular by men. This means the number of those neither working nor looking for work continues to fall, although the number of people not working due to long-term sickness rose again, to a new record.

“However, the number of people on employers’ payrolls fell in April for the first time in over two years, though this is an early estimate that could be revised later.

“Despite continued growth in pay, people’s average earnings are still being outstripped by rising prices.

“The number of days lost to strikes rose again in March, with education and health making up four-fifths of the total this month.

Pay continues to lag inflation

UK workers continued to be hit by falling real wages, with earnings continuing to lag behind rising prices.

Average total pay, including bonuses, rose by 5.8% per year in the January-March quarter.

Regular pay (excluding bonuses) rose to 6.7%, up from 6.6%.

Average regular pay growth for the private sector was 7.0% and for the public sector was 5.6% in January to March 2023. A larger rise for public sector pay was last seen in August to October 2003 (5.7%), the ONS says.

However, CPI inflation was 10.1% in March, so real wages are still falling.

Updated

Strike action intensified in March, the labour market report shows.

There were 556,000 working days lost because of labour disputes in March 2023, up from 332,000 in February 2023.

During March, teachers, doctors and civil servants all held strikes, in industrial action in rows over pay and conditions.

The number of people out of work, and economically inactive because of long-term sickness increased to a record high in the last quarter, today’s jobs report shows.

Introduction: UK unemployment rate rises, as payroll numbers fall

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

The UK’s unemployment rate has risen, with companies shedding workers as the jobs market cools, and more people look for work.

Figures just released by the Office for National Statistics show that the UK’s jobless rate rose to 3.9% in the January-March quarter, up from 3.8% a month earlier.

The increase in unemployment was largely driven by people unemployed for over 12 months, the ONS says.

More timely data shows that firms cut their payrolls by 136,000 in April, to 29.8 million.

This is the first fall in total payrolled employees since February 2021, the ONS says (adding that the data may be revised next month).

A sign that the economy has lost momentum, with higher interest rates weighing on demand.

The number of employees on the payroll fell by 136,000 in April 2023, its first fall since February 2021. It is now 838,000 above its pre #COVID19 pandemic level.

— Office for National Statistics (ONS) (@ONS) May 16, 2023

➡️ https://t.co/0X3dcQxySA pic.twitter.com/kFw1GvDSBC

In another sign that the labour market is weakening, the number of vacancies fell by 55,000 on the quarter to 1,083,000 in February-April.

The ONS says:

Vacancies fell on the quarter for the 10th consecutive period and reflect uncertainty across industries, as survey respondents continue to cite economic pressures as a factor in holding back on recruitment.

But, there has also been a notable move of people back into the labour market – either finding work, or looking for it. This has pulled the UK’s economic inactivity rate down by 0.4 percentage points on the quarter, to 21.0% in January to March.

The ONS says:

The decrease in economic inactivity during the latest three-month period was largely driven by people aged 16 to 24 years. Looking at economic inactivity by reason, the quarterly decrease was largely driven by those inactive because they are students or inactive for other reasons

Flows estimates show that, between October to December 2022 and January to March 2023, there has been a record high net flow out of economic inactivity. This was driven by people moving from economic inactivity to employment.

This has also nudged up the UK’s employment rate to 75.9% in January to March 2023, 0.2 percentage points higher than October to December 2022.

The increase in employment over the latest three-month period was driven by part-time employees and self-employed workers, the ONS says.

Headline indicators for the UK labour market for January to March 2023 show:

— Office for National Statistics (ONS) (@ONS) May 16, 2023

▪️ employment was 75.9%

▪️ unemployment was 3.9%

▪️ economic inactivity was 21.0%

➡ https://t.co/WM5mt69w4r pic.twitter.com/tRwdxUfWvn

Also coming up

MPs from the Business & Trade Committee will quiz the leadership of the Competition and Markets Authority (CMA) on their ambitions for the body today.

CMA chief executive Sarah Cardell and chair Marcus Bokkerink will be quizzed about the regulators interventions in high-profile merger attempts, including Microsoft’s purchase of gaming firm Activision Blizzard.

That deal received the green light from the EU yesterday, with Brussels accepting Microsoft’s concessions on cloud gaming,

The European Commission has required Microsoft to license popular Activision Blizzard games automatically to competing cloud gaming services. This will apply globally and will empower millions of consumers worldwide to play these games on any device they choose.

— Brad Smith (@BradSmi) May 15, 2023

Elsewhere in Westminster, farmers, retailers and others from across the UK food chain will attend a summit to discuss the food crisis at Downing Street today.

The agenda

7am BST: UK labur market report

9.30am BST: Government hosts Food Summit

10am BST: ZEW economic sentiment index

10.30am BST: Business & Trade Committee quiz the Competition and Markets Authority

1.30pm BST: US retail sales for April

Updated