Closing summary

Time for a quick recap....

UK wages have fallen at the fastest rate in at least 20 years, once inflation is taken into account, as the cost of living squeeze tightens.

The fall in real incomes came as Britain’s jobless rate nudged up in the last quarter, despite record vacancies at firms and another rise in payrolls.

Stephen Evans, Chief Executive of Learning and Work Institute, says the next year will be tough:

“The cost of living crisis is hitting hard with real regular wages falling more sharply this month than in any month this century.

We face a year of pain. The Chancellor has increased the help on offer and needs to prepare to do more. We also need an urgent focus on getting our economy moving again so living standards can rise.

The data helped to knock the pound down, as did worries about a potential trade war with the EU over Northern Ireland and a push for a new Scottish independence vote.

MPs have heard that some airlines have deliberately made it hard for customers to reclaim compensation for flight disruption.

Unions said the surge in delays and cancellations was partly the fault of airlines who aggressively pushed for redundencies, or ‘fire and rehire’ policies early in the pandemic.

The industry insists it is doing all it can to make the summer holiday season go more smoothly.

The pressure on motorists intensified, as petrol and diesel prices hit new records.

While the stock markets remain edgy, as investors brace for a sharp increase in US interest rates tomorrow.

Here’s the rest of today’s main stories:

Pressure grows to extend UK steel import quotas

The clock is ticking for the UK government to extend safeguards protecting Britain’s steel sector.

My colleague Jasper Jolly explains:

The government is facing pressure from the UK steel industry and Labour to extend metal import limits brought in after Brexit, after a warning that a flood of products could cost British producers £150m in lost sales.

The international trade minister, Anne-Marie Trevelyan, must decide by 30 June whether to keep “steel safeguards” set out last year or remove the import limits on five categories of products, which include tin mill products, steel quarto plates and wire rod.

High global steel prices have helped the industry in recent months after years of turmoil, but British steelmakers say the UK removing limits before the EU would disadvantage them compared with European rivals, who already benefit from relatively lower energy costs.

The protectionist 25% tariffs on imports above a set quota were first imposed by the EU in 2018, when the UK was still a member, and were designed to protect domestic industries from a glut of steel products diverted from the US after Donald Trump imposed tariffs on non-US steel.

More here:

The pound has weakened further against the euro, to a 13-month low around €1.153.

After a positive start, the main US stock indices are now down in what Reuters has dubbed ‘choppy trading’.

From Nick Colas at @DataTrekMB following surreal flurry of Fed leaks: "The Fed may go 75 bp on Wednesday if the WSJ/CNBC are right. Or it may not, if Futures are right. *This level of uncertainty is very damaging to equity valuations and no way for the US to run monetary policy.*

— Jeff Cox (@JeffCoxCNBCcom) June 14, 2022

The pound is continuing to sink... and has now dropped back to just above the $1.20 mark.

That means its down over a cent today at a new two-year low.

While sterling slides, the strengthening dollar has reached a new two-decade high against a basket of currencies ahead of tomorrow’s US interest rate decision.

Wall Street firms are now widely expecting a 75-basis point hike in borrowing costs, following media reports last night that this was now an option after US inflation surged again in May.

“We are now looking for the Fed to lift rates by 75bp tomorrow despite giving clear prior guidance of 50bp increases for the June and July FOMC. According to media outlets…” - TD

— Sam Ro 📈 (@SamRo) June 14, 2022

“Markets are fully pricing in a 75bp rate hike by the Fed tomorrow, and we acknowledge this is looking to be an increasingly likely scenario. At this stage, we cannot exclude the implied probability of a 100bp move to start rising, too.” - ING

— Sam Ro 📈 (@SamRo) June 14, 2022

Updated

UK consumer confidence has dipped for the sixth month in a row.

The latest survey from YouGov and Cebr found that:

- Consumer confidence falls again (-0.6) – the index has now spent half a year in decline

- Household finance measures for the past 30 days (+2.1) and next 12 months (+3.9) creep upwards following four months of rapid deterioration

- Retrospective (-3.8) and forward-looking (-6.5) home value measures deteriorate amid reports of market slowdown

- Job security and business activity measures remain stagnant

Kay Neufeld, Head of Forecasting and Thought Leadership at Cebr, says the index continued its downward spiral in May.

Looking for a silver lining, we note that at least the pace of falls has started to slow, with the 0.6-point contraction being the mildest since December 2021.

Importantly, households’ perceptions regarding their financial situation have started to improve this month, albeit from a low base. The announcement of the Chancellor’s £15 billion cost-of-living support package will have gone some way to alleviating the most pressing concerns.

Nevertheless, the fact that the four measures covering job security and home values have all fallen back suggests that the slowdown is starting to affect other sectors of the economy, with the housing market in particular looking set for a correction in the face of rising borrowing costs.”

Oil is rallying, with Brent crude up over 1.7% at $124.40 per barrel, and US crude back at $123.

Craig Erlam of OANDA says shortages are supporting energy prices:

Oil prices have steadied in recent days as economic fears and fresh Chinese restrictions have taken the wind out of the sails of the rally.

The market remains extremely tight and further disruptions in Libya, where production has reportedly fallen by more than a million barrels a day since last year, aren’t helping matters.

Updated

In New York, Wall Street’s main indexes have opened a little higher, a day after the S&P 500 officially lurched into a bear market.

The Dow Jones Industrial Average, which contains 30 large US companies, has gained 30 points or 0.1% to 30,547 points.

The benchmark S&P 500, which shed almost 4% on Monday, has inched up by 0.15%, from its lowest since March 2021.

The tech-focused Nasdaq Composite has risen by 0.2%, but still down over 30% this year.

Investors may be hunkering down as the Federal Reserve starts its two-day meeting, which could culminate in the largest US interest rate hike in decades.

Fiona Cincotta, senior financial Markets Analyst, at City Index, says:

US stocks are edging cautiously higher, rebounding from yesterday, after softer than forecast PPI data (see earlier post) and as the two-day FOMC meeting is due to kick off.

Stocks dropped sharply yesterday as fears over surging inflation and the Fed acting aggressively to tighten monetary policy, tipping the US into recession, hit stocks hard. High-growth tech stocks bore the brunt of the selloff, closing 4.7% lower.

After inflation shot up to 8.6% in May, the markets re-priced their expectations of a 75 basis point rate hike to it now being fully priced in. The move lifted the USD and hit stocks and gold yesterday.

Sterling hits fresh lows versus euro and dollar

The pound is racking up further losses today, amid worries about the UK economy, the risk of a trade war with the European Union, and the possibility of a new Scottish independence vote.

Sterling has hits its lowest level against the US dollar since early in the pandemic. It’s down over half a cent at $1.2068, the weakest point in over two years.

The pound has tumbled by one eurocent to €1.155, the lowest since last September.

A weaker currency will push up the cost of imports, such as consumer goods and motor fuel, adding to UK inflation.

This morning’s mixed unemployment data, showing the biggest drop in real wages in at least 20 years and a rising jobless rate, is weighing on the pound.

Yesterday’s GDP report, showing the economy shrank in April, has also cast some doubt over how far, or fast, the Bank of England will need to raise interest rates.

Modupe Adegbembo, G7 Economist at AXA Investment Managers, predicts the Bank will raise interest rates by 25 basis points on Thursday to 1.25%, but pause its hiking cycle once rates have hit 2% in November.

Adegbembo says:

We see the labour market as key to the BoE and suspect that slower growth and a more rapid slackening in labour market could see them pause earlier.

Naeem Aslam of Avatrade says there’s no shortage of self-inflicting injuries hitting the UK currency.

Now that the UK has set a bill to override the Northern Ireland section of the Brexit deal, a trade war could potentially take place between the EU and the UK.

Remember, it took the UK and EU over two years to hammer out the details of the Brexit deal in relation to Northern Ireland, and the fact that UK lawmakers have positioned the country for another self-inflicting injury would mean more trouble for the UK’s economy.

Reuters says the pound struggled after Scotland’s First Minister Nicola Sturgeon said she would share details on plans for a new independence referendum.

“If I were to isolate the (pound) move lower down to one event, I’d most probably say that the Scottish independence risk was the straw that broke the camel’s back,” said Simon Harvey, head of FX analysis at Monex Europe.

“The impact of the announcement by Nicola Sturgeon was inflated by the sheer pressure the pound is under from a multitude of factors”.

Thousands of Network Rail staff to be balloted on new strike

Thousands more UK railway workers are to be balloted for strikes in escalating disputes which threaten travel chaos this summer.

The Transport Salaried Staffs Association (TSSA) has served notice to ballot more than 6,000 staff at Network Rail (NR) in a dispute over pay, conditions and job security.

TSSA members at NR work in operational, control, management and safety critical roles on rail services across Britain.

TSSA is demanding a guarantee of no compulsory redundancies for 2022, no unagreed changes to terms and conditions, and a pay increase which reflects the rising cost of living. In the event of a yes vote, strike action could be held from July 25.

TSSA general secretary Manuel Cortes said balloting for industrial action was a last resort, but the union was preparing for all options, including “co-ordinated strike action.”

“We could be seeing a summer of discontent across our railways if Network Rail don’t see sense and come to the table to face the concerns of their staff.

Network Rail staff are asking for basic fair treatment - not to be sacked from their jobs, a fair pay rise in the face of a cost-of-living crisis and no race to the bottom on terms and conditions.

We also have fresh evidence that inflation is still running hot in the United States.

Goods makers and services companies have lifted their prices by 10.8% over the last year, and by 0.8% in May alone.

That shows producers are passing on higher energy costs, raw materials and wages to customers.

PPI up 0.8% month-over-month, 10.8% year-over-year https://t.co/d6VlAPu4U6 pic.twitter.com/YJb3bco7al

— Sam Ro 📈 (@SamRo) June 14, 2022

It could further spur the US Federal Reserve to lift US interest rates sharply higher tomorrow.

Naeem Aslam, Chief Market Analyst at Avatrade, has some instant reaction:

Another pipping hot reading has increased the pressure on the Fed. Traders must embrace for a more hawkish monetary policy and odds are as high as they can be for an interest rate hike of 75 basis in tomorrow’s meeting.

The dollar index is the dominant force and it is only the safe haven we believe as the US stock market is likely to continue to move lower.

Updated

Now the big question....will the travel chaos be fixed in time for the summer holidays?

Robert Courts MP says the government will do its bit....

We will everything that we can, in conjunction with the sector, to make the experience one that is smooth, that is enjoyable, to get people out and about flying.

That’s exactly what we all want to see as a global country.

Q: But why are some airlines, such as BA and easyjet, doing worse than others?

“Without sounding as if I’m on the fence, it’s complicated...”, Courts responds...

“That is the fence, minister,” BEIS chair Darren Jones points out.

And Courts is sticking to it, explaining that airlines work in a complex ecosystem, in which some have different ground handlers, for example.

[reminder: Unite told the committee earlier that BA’s decision to fire and rehire 10,000 workers had led to its problems]

Q: Is Which? right that some airlines are coping much better than others, and what lessons can be learned?

CAA chief Richard Moriaty says some airlines have fared better than others, and agrees with journalist Simon Calder’s list (which had BA and easyJet as the worst for cancellations, and Ryanair and Jet2 as the best).

Moriaty says airlines have got better at making refunds compared with early in the pandemic, and are now automatically reversing payments so people get their cash back for a cancelled flight quickly.

Government to scrutinise airline plans

Q: Why didn’t the aviation sector get targeted support, such as a longer furlough scheme, so they could retain staff and bring them back?

Robert Courts explains the government’s policy was to offer support to the whole economy, rather than specific sectors. He says the sector received other help beyond furlough (which ended last September), including business rates relief.

But the best thing the government could do was lift restrictions -- which has happened, Courts says.

He adds that ultimately, it’s the airline sector’s responsibility to see how many tickets it’s selling, how many customers it can service, and adjust where necessary.

Courts says he is taking a close interest in this:

Going forward, I will be scrutinising those plans on a very regular basis. Weekly, chaired by myself, and also officials at the same time.

Updated

Brexit is not to blame for the UK’s transport chaos, insists Robert Courts, parliamentary Under-Secretary of State for Transport.

Testifying to the BEIS committe, Courts expresses sympathy with the airlines, who he says have been through an extremely difficult since since the pandemic began.

It has been very difficult to know how fast demand would come back, he points out, and therefore to hire enough staff.

Q: We’ve heard that 30% of workers in the industry before Brexit were from the EU. Hasn’t that been a factor?

Courts argues that the travel industry goes beyond the UK - there have been problems in Amsterdam’s Schiphol airport, in Dublin, and in the US.

It’s a wider issue -- the reopening of a sector after it closed down, Courts says.

Courts argues that if there were spare airport workers in the EU, who couldn’t be in the UK, then there’s be less disruption at place like Schiphol.

Q: Is there any data to back this up?

Richard Moriarty, chief executive of the Civil Aviation Authority, says that between 2% and 4% of UK flights were cancelled over the half-term/Jubilee week. That’s up from 1% normally, and “clearly distressing, and clearly unacceptable”.

But other countries saw similar high cancellation rate that week -- 3% in France, and 11% in the Netherlands, Moriarty says.

Will passengers get their summer holidays?

BA, easyjet and TUI insist they are doing everything within their power to avoid summer holiday disruption -- while warning that external factors are beyond their control.

Q: Are you confident that customers who booked holidays in July and August will get their flights?

David Burling, CEO Markets and Airlines at TUI, tells the BEIS commitee he is “absolutely confident that we are putting every effort in” to minimise problems.

But if there are strikes, or major air traffic control problems, then all airlines will be hit.

Burling pledges:

I am absolutely confident that we are doing everything we can to make sure those holidays go ahead.

Sophie Deckers, easyJet’s Chief Operating Officer, makes the same point.

She says easyJet is controlling what it can control, and building a buffer to protect against external factors, based on the lessons learned over the last few weeks ‘that haven’t been good enough’.

If that means we need more people, or take flights out, we’ll review going forward, Deskers adds.

BA’s Lisa Tremble echoes the need to build in resilience into systems for the summer rush.

Travel firm Tui has written to customers promising that it has learned from the delays and cancellations that ruined the May half-term holiday for many travellers.

It’s in an attempt to build confidence before the key summer bookings period. More here.

Q: Is it fair to say that airlines are going out of their way to make it hard for passengers to get compensation (as MPs heard earlier)?

EasyJet’s Sophie Deckers says the airline is doing much better than at the start of the pandemic, and that it’s inaccurate to say that airlines are deliberately making it difficult for customers.

British Airways’ Lisa Tremble says BA has improved its communications too, insisting that getting compensation quickly should be ‘seamless’ for most passengers.

Most should get compensation within 14 days, but it can take up to 30 days for complicated bookings (ie if there were multiple legs to a journey).

TUI: incredibly sorry for disruption

David Burling, CEO of markets and airlines at TUI, tells MPs that “a number of factors” in the air travel ecosystem led to delays and cancelled holidays last month.

Burling explains that a combination of people caused the usual systems to melt down over the half-term break.

Security, loading baggage, the delivering of food, drink, and even fuel to aircraft all weren’t operating during May as they would in a normal year.

Then on the first weekend of the half-term week, severe weather in Crete caused many TUI planes to be stranded, and the company found most other spare aircraft were being used for the Champion’s League final

There were particular problems in baggage loading at Manchester, Burling explains.

And this means TUI cancelled 32 flights at the last minute.

The service we offered to customers was unacceptable, by our standards. We’re incredibly sorry and apologise for that.

Burling insists TUI contacted customers about compensation (an area where Which? said some airlines fell short), but that doesn’t make up for a cancelled holiday

TUI has now build a ‘firebreak’ by cancelling 43 flights a week from Manchester through June.

And he adds that TUI didn’t have enough customer service people in airports -- and the people it’s recently hired are now going through security clearance (causing delays getting them into service).

EasyJet: We haven't got it right

Sophie Deckers, chief operating officer, easyJet, begins with an apology for the flight chaos, telling MPs:

We haven’t got it right, and we need to get it right.

Deckers tells the BEIS committee that easyJet made 2,000 staff voluntarily redundant once the pandemic began, including 1,400 in the UK.

That included 1,000 cabin crew and 300 office staff, but no pilots -- they were offered part-time contracts instead.

Deckers says that 75% of the pilots who took that offer have chosen to come back full-time, but 25% would like to stay part-time (which suits easyJet’s seasonal flying pattern).

Deckers says easyJet is now recruiting -- but ID processing (for security reasons) is taking longer than expected, which caught the airline by surprise.

Airline executives are now facing MPs on the BEIS committee to explain the travel chaos suffered by passengers.

Chair Darren Jones focuses on the shortages that have disrupted services:

Q: British Airways has the most cancellations per day, after aggressively sacking and rehiring 10,000 workers. Isn’t it your own fault?

Lisa Tremble, chief corporate affairs and sustainability director of BA, says the airline had to take action to secure its future.

She says BA was losing £20m per day when that decision was taken, its schedule was 5% of 2019 levels, and there was no vaccine in sight.

There was also no certainty that the furlough scheme would be extended, Tremble points out, and anyway it was only covering 10% of the 2019 wage bill.

Q: But we’ve heard that the airlines who sacked the most staff now have the most cancellations. Do you accept the connection between sacking 10,000 staff, and not having enough staff to fly all your planes?

Tremble insists BA acted responsibly to protect jobs in a difficult, very complicated situation, and is now trying to recruit around 6,000 people.

Q: So why has Ryanair, which didn’t enforce redundancies, not suffered the cancellation problems as BA?

Tremble repeats her earlier points, but again doesn’t answer the question as to whether BA’s sackings directly led to disruption (as the MPs heard earlier from Unite).

Will the problems at Britain’s airports be fixed in time for the summer, asks BEIS committee chair Darren Jones MP.

“Unless we work together, no,” replies Oliver Richardson, National Officer for Civil Aviation at Unite, tells the committee.

Jude Winstanley, Managing Director of UK & Ireland at aviation services company Swissport, says he agrees with Richardson.

Karen Dee, chief executive of the Airport Operators Association, hopes it will be better but it won’t be totally fixed.

Daniel Brooks, of Virtual Human Resources, says it won’t.

Back at the BEIS committee, MPs are hearing how labour shortages caused disruption at airports.

Karen Dee, chief executive of the Airport Operators Association, explains that shortages of security staff led to the big queues suffered by passengers this summer.

She explains that the furlough scheme did help, but some security staff found other jobs. [the furlough scheme ended last September too].

Those shortages hopefully beginning to improve, she adds.

Oliver Richardson, National Officer for Civil Aviation at the Unite union, says that the airlines who were worst for cancellations were also the ones who made the most redundencies and changes to terms and conditions.

So Ryanair, who negotiated a deal with no redundencies, are in a better situation than BA, who went through a ‘fire and rehire’ process, Richardson says.

So, some airlines got rid of too many people, and also changed their terms and condtions so the jobs aren’t as attractive, Richardson explains.

He also points to the lack of sector-specific support, which could have helped the industry keep staff on.

Daniel Brooks of Virtual Human Resources, says there was a ‘big disconnect’ between the end of the furlough scheme last autum, and the reopening of travel this spring.

This led to airlines laying people off - and some have left the industry for good. Some have gone to do deliveries for companies like Amazon, while others have taken skilled jobs such as heating engineers, while older workers have decided to retire.

Key event

Back in the markets, the pound has hit an eight-month low against the euro, down 0.5% at 86.2p.

Sterling has also slipped to a new two-year low against the US dollar, at $1.2104.

Today's jobs stats are pretty grim.

— Tony Wilson (@tonywilsonIES) June 14, 2022

Largest fall in real pay on record, 'missing million' in labour market, highest worklessness due to ill health in two decades.

Crisis we prepared for isn't the one we've got - need to reinvest the £bns set aside for mass unemployment ASAP...🧵 pic.twitter.com/vy7JewkGBM

Which?: Airlines failing on consumer rights

Some UK airlines are blatantly flouting consumer rights and failing to put customers first, MPs are being told this morning.

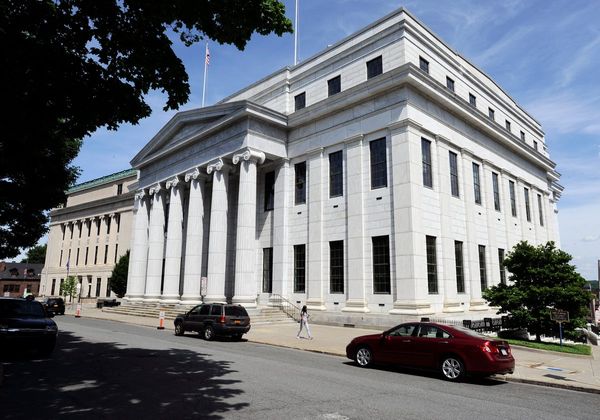

The Business, Energy and Industrial Strategy Committee is holding a heading on this year’s travel chaos (online here)

Sue Davies, head of Consumer Protection and Food Policy at Which?, told MPs that some well-known names feel able to flout consumer law.

It’s quite incredible that many airlines within their terms and conditions are breaking the law, with apparently no consequence.

Q: Which airlines are doing well, or poorly, on cancellations?

Davies says that Which? are particularly hearing from people affected by cancellations at British Airways and easyJet, but there is a systemic problem across the sector.

Davies explains that some airline passengers who are entitled to be rerouted or be given compensation for a cancelled or delayed flight are being the wrong information, or no information.

And it can be “unbelievably complicated” to pursue this issue with an airline, Davies adds.

Travel journalist Simon Calder is testifying too.

He says that British Airways has cancelled the most flights (it axed 10% of flights from March to October). That took about 20,000 seats off the market each day.

They’re followed by easyJet, which has been cancelling flights much closer to takeoff.

Ryanair and Jet2 have coped best, Calder adds.

🗣️Our evidence session on flight delays and cancellations begins at 10.30am today. Full list of witnesses below 👇

— Business, Energy and Industrial Strategy Committee (@CommonsBEIS) June 14, 2022

📺You can watch the session live on ParliamentTV: https://t.co/kRECyL6ggT pic.twitter.com/Q21ISLeiki

Updated

Petrol and diesel prices hit record again

UK fuel prices have hit new records, just as the Government closed its scheme offering £1,500 grants for purchases of new electric cars.

The average price of a litre of petrol at UK forecourts reached a new high of 185.4p on Monday, according to data firm Experian - up 6.9p in just a week.

The average price of diesel also hit a new record on Monday, at 191.2p per litre.

The figures were released just hours after the Department for Transport (DfT) ended the Plug-in Car Grant for new orders, which let drivers claim up to £1,500 towards the cost of a plug-in car costing less than £32,000.

The decision to kill off the grant for cars sparked an angry response from the automotive industry, but the DfT said it will “refocus” funding to encourage users of other vehicles to make the switch to electric.

Yesterday, the AA predicted that the increase in petrol prices could “grind to a halt” this week, as wholesale prices start to fall.

Full story: Average UK wages fall at fastest rate for more than two decades

Average wages in the UK are falling at the fastest rate for more than two decades as annual pay growth fails to keep pace with the rising cost of living despite record numbers of job vacancies and low unemployment.

The Office for National Statistics said annual growth in regular pay, excluding bonuses, fell by 4.5% in April after adjusting for [CPI*] inflation – the biggest fall since comparable records began in 2001.

Average total pay, including bonuses, fell by 3.7% on the month after taking account of inflation as measured by the consumer price index, in a more modest decline thanks to a smaller boom in payouts in the finance sector.

British households are facing an intense squeeze on living standards as earnings growth fails to keep pace with soaring energy bills and the rising cost of a weekly shop, with inflation at the highest rate since the early 1980s.

“This is really grim news on pay and is only likely to get worse,” said Tony Wilson, the director of the Institute for Employment Studies.

“Despite the tightest labour market on record, nominal pay is broadly flat meaning that rocketing inflation is leading to the largest cuts in real pay in at least two decades.”

Here’s the full story:

* - the earlier calculation of a 3.4% fall is based on CPIH inflation, which has lagged behind CPI.

Over in Germany, economic confidence has improved, but remains deeply negative.

The ZEW Institute’s index of German economic sentiment climbed 6.3 points this month, which still left it at minus 28.0.

German ZEW Economic Sentiment Index

— FTMO.com (@FTMO_com) June 14, 2022

Actual: -28

Forecast: -27.5

Previous: -34.3 pic.twitter.com/pDzyC1VbzT

ZEW President Professor Achim Wambach explains:

“Financial market experts are less pessimistic about the economy.

However, the economy is still exposed to numerous risks, such as the effects of the sanctions against Russia, the unclear pandemic situation in China and the gradual change of course in monetary policy. So although expectations have improved, they are still deep in negative territory.”

Analysis: Weak UK pay and jobs figures hint at tougher times ahead

The UK’s slow earnings growth and rise in unemployment suggest the jobs market is starting to cool, our economics editor Larry Elliott writes:

It is always wise not to read too much into a single month’s figures or to cherrypick data to make a case. By any standards, the latest ONS figures suggest the labour market began what could be a tough period for the economy in good shape.

That said, one month’s figures often provide evidence of a turning point so it is a mistake to ignore them completely. The tick up in unemployment and the easing in earnings growth do not mean the labour market is collapsing or even about to collapse. They do suggest there could be tougher times ahead.

The early recovery in the stock markets has petered out.

The UK’s FTSE 100 is now only two points higher (+0.03%) than after yesterday’s tumble, while the French and Italian markets are now around 0.3% lower.

Russ Mould, investment director at AJ Bell, warns there coul dbe more turmoil ahead, after the US’s S&P 500 entered a bear market last night:

‘The US stock market has generated a lot of wealth for investors over the past decade, but this year has been a bucket of iced water – a shock to the system, leaving people cold, soggy and miserable.

“Unfortunately, markets don’t always go up in a straight line and, based on performance so far, 2022 will go down in history as being a wake-up call that investing can be challenging at times.

“There is a lot riding on the Federal Reserve’s policy update tomorrow. Investors look as if they increasingly fear the central bank will become more aggressive with the pace of interest rates to try and curb inflation, given May’s cost of living figures were higher than expected.

“The Fed is focused on inflation and the economy, not the markets, yet its actions have significant influence on the direction of stocks and bonds. A decision to raise rates by more than half a percentage point could cause chaos on the markets and put a bigger dent into investors’ portfolios than they’ve already seen this year.

TUC: real wages falling off a cliff

Unions are urging ministers to raise public sector pay, to help workers with the cost of living crisis.

Today’s jobs report shows that total public sector pay only rose by 1.5% per year in February-to April, while total private sector pay rose 8.0% [this is all before inflation].

TUC General Secretary Frances O’Grady said:

“Working families deserve financial security.

“But real wages are falling off a cliff as the cost of living soars.

“Millions of workers are being forced to choose between paying their bills or feeding their families. That isn’t right.

“We urgently need action to get people the pay rise they deserve. That means boosting the minimum wage, a real public sector pay rise, and the government supporting – not attacking – unions who are campaigning hard for fairer pay.

The trade union movement are holding a march across London on Saturday, to demand action on the cost of living (details here).

Gary Smith, GMB General Secretary, says the drop in real wages means people are hurting:

“But this Prime Minister – and the boss of the Bank of England – are happy to tell workers to show restraint; that they shouldn’t ask for a proper pay rise.

”It’s out of touch and tin-eared. They just don’t understand what people are going through.”

Minister for Employment, Mims Davies MP, says the government is offering help to get people into jobs:

“Today the unemployment rate remains close to a 50 year low, and still below pre-pandemic levels, with almost 2 million more women in work than 2010. That’s fantastic news, but there’s more to do.

“Work is the best way for people to provide for their families – those going into full time employment could be at least £6,000 better off than out of work on benefits. That’s why we’ve launched the Way to Work campaign to get half a million more people into jobs.

“From job opportunities in Jobcentres to skills bootcamps for people considering a new industry, there’s a huge amount of help out there, and our Work Coaches are working tirelessly to get people at any age, or career stage, into fulfilling and stable employment.

This chart shows just how sharply wages fell behind inflation in April -- the month in which the energy price cap jumped 54%.

Stunning chart. Average UK wages were 3.4% lower in April compared to the previous year when adjusted for inflation.

— Siraj Datoo (@dats) June 14, 2022

Another problem: wages are rising too slowly for workers but growing too quickly for companies. https://t.co/9JoW571zqQ pic.twitter.com/lweAtuEQQ7

It shows that the spending power of UK households fell the most in at least 21 years as wage increases were eaten up by the fastest inflation in decades, as Bloomberg explain here.

Updated

The fall in regular real pay shows that fears of a wage-price spiral are misplaced, explains Torsten Bell of Resolution Foundation.

If you're looking for a turning point in today's jobs data this is it: first rise in short term unemployment since 2020, and overall unemployment actually rose in April. Too early to tell for sure, but some in @bankofengland will welcome signs of a cooling labour market pic.twitter.com/nnheyDk2Lz

— Torsten Bell (@TorstenBell) June 14, 2022

Little sign of older workers that have dropped out of the labour market are returning - fall in inactivity is largely about pandemic surge in students unwinding. I really wouldnt be counting on this cohort of older workers ever returning pic.twitter.com/7gizdvTjvb

— Torsten Bell (@TorstenBell) June 14, 2022

Big picture remains a strong labour market for this stage in the recovery, pay growth reflects that (especially if you get a bonus in finance) although it's being wiped out by the highest inflation in four decades. But the news? There are some signs of cooling off setting in

— Torsten Bell (@TorstenBell) June 14, 2022

If you want more good news for the @bankofengland note typical pay actually FELL on the month in May in the HMRC data, as did mean pay in April. That's in cash terms - anyone that sees a wage/price spiral in that data has something strong in their coffee this morning

— Torsten Bell (@TorstenBell) June 14, 2022

UK pay falls at fastest rate in more than 20 years

Regular real pay in the UK fell at the fastest rate in over two decades in April, as wages fell further behind rising prices.

In April alone, regular pay packets (excluding bonuses) shrank by 3.4% once you adjust for inflation (the ONS’s preferred measure, CPIH).

That’s the biggest monthly fall, year-on-year, in at least 20 years, today’s data from the Office for National Statistics shows (these figures go back to 2001).

Stephen Evans, Chief Executive of Learning and Work Institute, says we face a year of pain.

“The cost of living crisis is hitting hard with real regular wages falling more sharply this month than in any month this century.

We face a year of pain. The Chancellor has increased the help on offer and needs to prepare to do more. We also need an urgent focus on getting our economy moving again so living standards can rise.

Tony Wilson, director of the Institute for Employment Studies, says this is “really grim news” on pay and is only likely to get worse.

Despite the tightest labour market on record, nominal pay is broadly flat meaning that rocketing inflation is leading to the largest cuts in real pay in at least two decades. The picture is particularly bad for public sector workers, with real pay falling by nearly 6% year on year.

At the same time while employment is starting to pick up, there’s still a million people missing from the labour force compared to pre-pandemic trends – particularly older people, those with health conditions and overseas workers. The large rises in long-term ill health are particularly concerning, with a quarter of a million more people outside the labour force than before the pandemic.

Updated

European markets open a little higher

European stock markets have risen in early trading, after sharp tumbles on Monday as global stocks were hammered by recession fears.

The FTSE 100 index has nudged up by 22 points, or 0.3%, to 7227 points (after losing over 110 points on Monday)

Banks and housebuilders are leading the risers, with HSBC up 2.6%, Natwest gaining 2.2% and Barratt Development 2.1% higher.

Germany’s DAX has gained 0.8%, while France’s CAC is up 0.5%, as they also claw back some losses.

Richard Hunter, Head of Markets at interactive investor, says it’s been a bruising start to the week as fears of recession begin to mount - driving Wall Street into a bear market last night.

Unsurprisingly, the sour mood passed over into Asian markets, where the prospects of a delayed reboot to the Chinese economy in light of further lockdowns added to the global growth concerns. More positively, the possibility of some monetary easing from the Chinese authorities and that much of the bad news is being priced in has left the optimists with some small room for manoeuvre.

In the UK, a positive open for stocks did little to erase the damage caused by the previous day’s decline. Having spent much of the year in positive territory as compared to many of its global peers, the FTSE100 is now down by 1.6% in the year to date.

Today’s respite could yet prove to be brief, especially if there are any further shocks to come on the scale of central bank tightening.

There are still nearly 450,000 more people neither working or looking for work than before the pandemic, despite a small drop in economic inactivity in April.

That includes 225,000 more people with long-term sickness, and 26,000 temporarily ill.

“Economic inactivity” has fallen slightly but the number of people in the UK who are not in work and not looking for a job is c450,000 higher than pre-COVID.

— Joel Hills (@ITVJoel) June 14, 2022

This is colossal change and not often talked about.

More demand in system + fewer people in work = more wage pressure. pic.twitter.com/rvTzByNbzR

Capital Economics: early signs of softening

Today’s jobs report could be an early sign that the slowdown in economic activity this year is hitting the labour market, says Paul Dales, chief UK economist at Capital Economics.

The 177,000 rise in employment in the three months to April beat the consensus forecast of a 107,000 again, but even so the unemployment rate edged up from 3.7% to 3.8% (consensus 3.6%).

What’s more, the single month data showed that employment fell by 254,000 in April itself and the unemployment rate rose from 3.5% in March to 4.2%.

What’s more, the number of job vacancies hardly rose at all, from 1.296m in April to 1.300m in the three months to May. And our own seasonal adjustments of the single-month data suggest that vacancies fell in May for the first time since COVID-19 was rife in December.

Political reaction

Chancellor of the Exchequer, Rishi Sunak, says his £15bn cost of living package will help families through the cost of living squeeze.

“Today’s stats show our jobs market remains robust with redundancies at an all time low.

“Helping people into work is the best way to support families in the long term, and we are continuing to support people into new and better jobs.

“We are also providing immediate help with rising prices - 8 million of the most vulnerable families will receive at least £1,200 of direct payments this year, with all families receiving £400.”

But Jonathan Ashworth MP, Labour’s Shadow Work and Pensions Secretary, says the government is far too complacent about the challenge:

Work should be the best defence from the rising cost of living yet millions in work are in poverty, real wages are plummeting, the numbers in overall employment are below pre-pandemic levels, and the numbers on out of work benefits not looking for work is higher than pre-pandemic.

“With record vacancies in the labour market and inflation at the highest level for 40 years, ministers have shown utter complacency about the huge levels of economic inactivity.

“In contrast, Labour will reform employment support to help people return to work, tackle the rising the cost of living, and build a prosperous economy with quality well-paid jobs.”

Updated

Bonuses are making a huge difference to the impact of rising prices.

Include them, and total pay outpaced inflation, just. That’s partly due to a boom year in the City -- British bankers collected the biggest bonuses since before the 2008 global financial crisis ealier this year.

But most people don’t get bonuses -- and their basic pay saw the biggest drop since 2011 after inflation.

The biggest decline in inflation-adjusted regular pay in the UK since late 2011 at -2.2%... BUT bonus payments continue to make total average pay +ve in real terms (+0.4%). pic.twitter.com/TmO4TQ90Qe

— Stuart McIntyre (@stuartgmcintyre) June 14, 2022

The belt-tightening intensifies as prices rise faster than wages.

— Joel Hills (@ITVJoel) June 14, 2022

Strong bonuses have kept total pay rising in line with inflation. But for anyone who hasn’t had a bonus (most people) disposable income (February - April) fell in real terms by 2.2% on the year. pic.twitter.com/8wz82sxNKJ

Kitty Ussher, Chief Economist at the Institute of Directors, says firms are hiring as fast as they can, with payrolls and vacancies both up in the last quarter.

This suggests order books remain strong and there is still plenty of demand in the economy.

“Encouragingly for businesses struggling with staff shortages, more people are now also being tempted to re-join the labour market having slipped into inactivity during the pandemic: the employment rate is up 0.2% on the previous quarter. If this trend continues, it should make future vacancies easier to fill, and also reduce inflationary pressure.

“However, there are also early signs that the labour market is beginning to settle, with the rate of unemployment steadying at its new low level in recent months, a small increase in short-term unemployment, and a slowing of the rate of increase in vacancies.”

Here’s some snap analysis of the jobs report, from Sam Avanzo Windett, deputy director at the Learning and Work Institute:

Today's @ONS stats show interesting changes in unemployment - people becoming unemployed (up to 6months) saw the largest increase since late 2020. People unemployed between 6 -12 months has decreased to a record low, and unemployed 12 months+ also continued to decrease.

— Sam Avanzo Windett (@SamanthaWindett) June 14, 2022

We may be seeing the rise in economic inactivity top out, with today's @ONS figures showing the economic inactivity rate decreased by 0.1 percentage points to 21.3% in February to April 2022 (the drop largely driven by students)

— Sam Avanzo Windett (@SamanthaWindett) June 14, 2022

Whilst we see the cost of living continue to bite, with real terms regular pay (exc. bonuses and adjusted for inflation) falling on the year by 2.2% @ONS

— Sam Avanzo Windett (@SamanthaWindett) June 14, 2022

ONS: It's a mixed picture

Today’s jobs report continues to show a mixed picture for the labour market, says Sam Beckett, head of economic statistics at the Office for National Statistics (ONS).

“While the number of people in employment is up again in the three months to April, the figure remains below pre-pandemic levels.

“Moreover, although the number of people neither in work nor looking for a job has fallen slightly in the latest period, that remains well up on where it was before Covid-19 struck.

“At the same time, unemployment is close to a 50-year low point and there was a record low number of redundancies.

“Job vacancies are still slowly rising, too. At a new record level of 1.3 million, this is over half a million more than before the onset of the pandemic.”

“The high level of bonuses continues to cushion the effects of rising prices on total earnings for some workers, but if you exclude bonuses, pay in real terms is falling at its fastest rate in over a decade.”

Introduction: UK jobless rate rises as basic pay lags inflation

Good morning, and welcome to our rolling coverage of business, the world economy and the financial markets.

The UK’s unemployment rate has risen, as regular pay continues to fall behind inflation at the fastest rate in a decade.

The latest jobs data, just released, show that the unemployment rate rose to 3.8% in the three months to April, as more people look for work.

That’s up from 3.7% in the quarter to March (which was the lowest in 50 years), and may show the UK’s jobs recovery is softening.

⚠️ First uptick in the UK unemployment rate since the Covid crisis. May be a blip... but the message is clear: the easy part of the UK economic recovery is behind us & things are starting to turn. Watch the UK closely... will be a canary in the coalmine for a global downturn $GBP pic.twitter.com/4J1lb8eFsc

— Viraj Patel (@VPatelFX) June 14, 2022

Basic pay continues to lag behind rising prices too, as the cost of living crisis hits households.

Regular pay rose by 4.2% in the February-April quarter, well behind inflation which hit 9% in May.

Total pay, including bonuses, was much stronger though -- up 6.8% thanks to surging bonuses in the financial sector.

So in real terms (adjusted for inflation), total pay grew by 0.4% in the quarter while regular pay tumbled by 2.2% on the year.

That’s the biggest drop in real regular pay since late 2011, adding to pressure on families struggle to pay food and energy bills.

After taking inflation into account, average pay including bonuses rose 0.4% in the year to February to April 2022, thanks to strong bonuses.

— Office for National Statistics (ONS) (@ONS) June 14, 2022

However, excluding bonuses, pay fell by 2.2% in real terms https://t.co/iB6VqmLG3N pic.twitter.com/LJL6vVrPQF

Headline indicators for the UK labour market for February to April 2022 show that

— Office for National Statistics (ONS) (@ONS) June 14, 2022

▪️ employment was 75.6%

▪️ unemployment was 3.8%

▪️ economic inactivity was 21.3%

➡️ https://t.co/4xI3y3IZwv pic.twitter.com/5FmyXyxgYM

Firms are still taking on staff, though. The number of people on company payrolls increased to a fresh record high, up 90,000 in May to 29.6 million.

The number of job vacancies in March to May 2022 rose to a new record of 1,300,000. However, the rate of growth in vacancies continued to slow down.

Redundancies decreased on the quarter and are at record low levels, as firms hold onto staff.

But, the employment rate is still below pre-pandemic levels, due to the drop in self-employment in the pandemic.

The number of employees on payroll continued to grow in May 2022 and is now 627,000 above its pre-pandemic level https://t.co/Pk4K4DLFy5 pic.twitter.com/JFVfcwslt2

— Office for National Statistics (ONS) (@ONS) June 14, 2022

More details and reaction to follow...

Also coming up today

Stock markets are in a very nervous mood, after Wall Street fell into a bear market last night.

The S&P 500 index tumbled almost 4% and closed over 20% below its record high, while US government bond prices surged, on growing expectations that the US Federal Reserve could lift interest rates very sharply on Wednesday.

A 75 basis-point rise , triple the usual move, is now seen as an option to get a grip on inflation.

This has intensified fears that central banks could push economies into recession, which has driven up the yield on government bonds dramatically.

This is not oil, a meme stock or even a scam. It’s U.S 2-year bond yield pic.twitter.com/OIttlMFY4j

— Genevieve Roch-Decter, CFA (@GRDecter) June 13, 2022

Asia-Pacific stock markets were pounded overnight, with Australia’s main index dropping almost 4% and Japan’s Nikkei shedding 1.5%.

European stocks are due to open a little higher after Monday’s rout, but it could be another volatile day.

Bonds yesterday. Here’s hoping exhaustion sets in and they spend the day sleeping it off. So far, a nervous-looking Turnaround Tuesday…2s and 10s together at 3.34%, S&P futures up 1%, dollar a little softer. UK jobs and US PPI ahead. pic.twitter.com/Tks2BdxBZ5

— kit Juckes (@kitjuckes) June 14, 2022

The agenda

- 7am BST: UK unemployment report for May

- 10am BST: ZEW index of Gemran investor confidence

- 10.30am BST: The Business, Energy and Industrial Strategy (BEIS) Committee holds a hearing into the UK’s flight cancellations

- 11am BST: NFIB small US business optimism index

- 1.30pm BST: US PPI index of producer prices

Updated