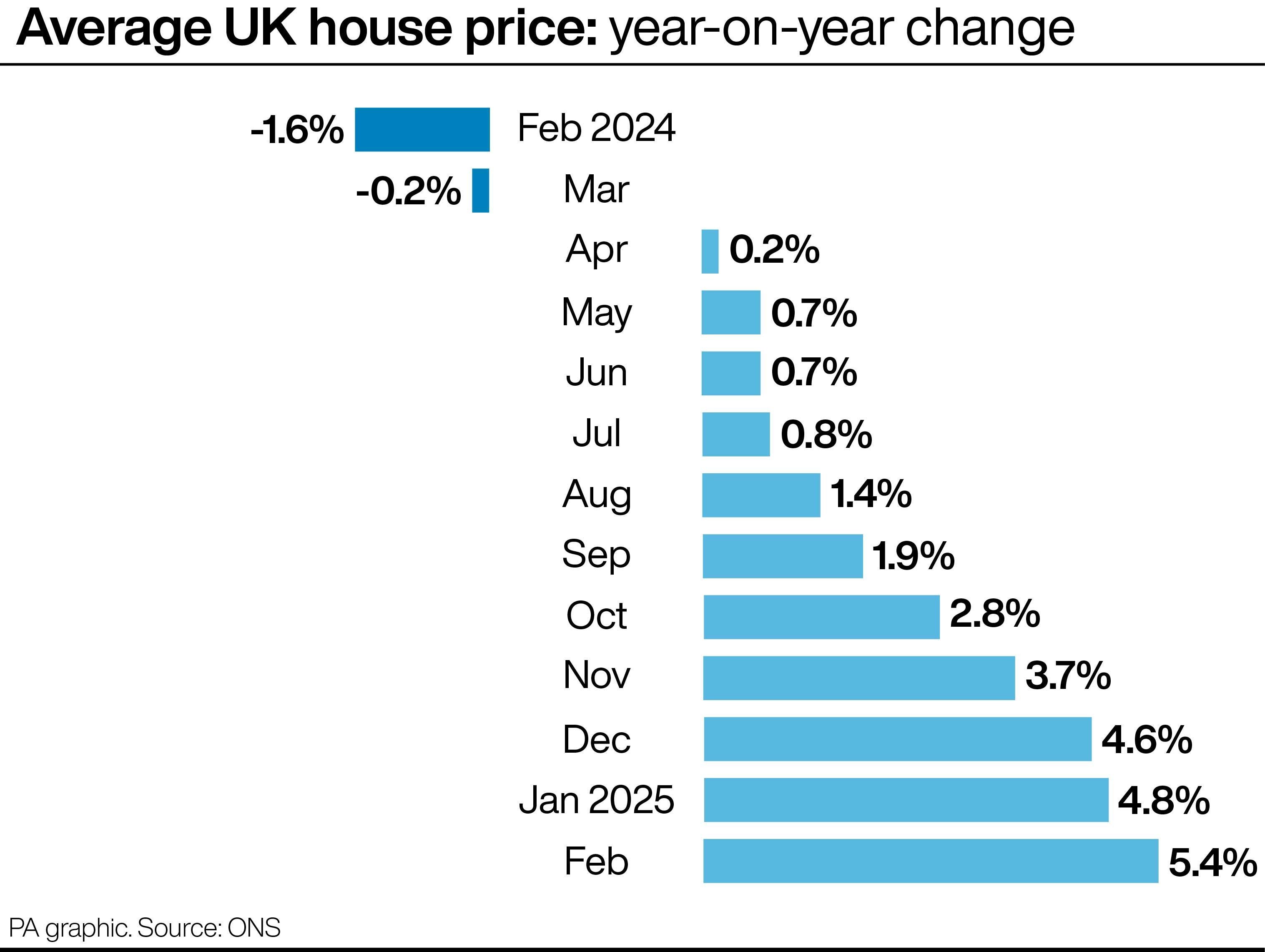

UK house prices surged 5.4 per cent in the year to February, marking the fastest growth rate in over two years, according to the Office for National Statistics (ONS).

This acceleration, up from 4.8 per cent in January, follows a trend of rising prices and increased buyer activity since last summer, likely driven by buyers aiming to avoid stamp duty increases.

February saw higher house prices across the UK compared to the previous year. In England, the average price reached £292,000, a 5.3 per cent annual increase.

Wales saw a 4.1 per cent rise to £207,000, while Scotland experienced a 5.7 per cent jump to £186,000. Northern Ireland, with data covering October to December 2024, recorded a significant 9 surge, bringing the average price to £183,000.

Regional variations within England highlighted the North West as having the highest house price inflation at 8 per cent, contrasting sharply with London's more modest 1.7 per cent growth.

Experts said there was a rush among home buyers to complete their purchases ahead of stamp duty discounts becoming less generous.

From April, first-time buyers started paying stamp duty on properties costing more than £300,000. They were previously exempt from paying the tax on properties up to £425,000.

Stamp duty applies in England and Northern Ireland.

Santander UK said its data showed house purchases tripled in March, compared with a year ago, as the stamp duty deadline “sparked a new lease of life into the housing market”.

Elliott Jordan-Doak, senior UK economist for Pantheon Macroeconomics, said: “Official house prices will be boosted for at least another two months by the flurry of activity ahead of the stamp duty changes.

“But there is genuine strength in the housing market.”

House price inflation rose to the highest rate since December 2022 in February, “illustrating the resilience of the housing market to a barrage of headwinds in high borrowing costs, easing GDP (gross domestic product) growth, fiscal events, and geopolitical uncertainty”, he said.

Sarah Coles, head of personal finance at Hargreaves Lansdown, agreed that February’s figures showed the “peak of activity, as buyers rushed purchases through the system before the stamp duty holiday ran out at the end of the month”.

Jason Tebb, president of property search portal OnTheMarket, said: “Affordability remains a challenge but with a number of lenders reducing their mortgage pricing over the past few weeks, this may continue to ease if swap rates decline and other lenders follow suit.

“Cheaper mortgage rates would certainly help boost activity and transactions, which are of benefit not just to the housing market but wider economy.”

Swap rates – which are used by lenders to price mortgages – have dipped since US president Donald Trump’s tariffs announcement earlier in April, amid expectations that interest rates will be cut further in the coming months.

Experts said this could feed through into lower mortgage pricing with lenders rolling out cheaper deals.

The reason why UK seaside property is taking weeks longer to sell

London housing market experiencing stamp duty ‘hangover’

Two ways UK households could save thousands of pounds per year

5 things to consider when replacing your doors

The pitfalls to avoid when buying a home with a friend

Three in ten adults have changed their shower habits in a bid to save money