Closing summary

Our main story today: following yesterday’s half-point rise in interest rates, the UK chancellor, Jeremy Hunt, has announced three measures to help those struggling with mortgage payments – but did not announce any help for renters.

My colleague Alex Lawson writes:

Struggling mortgage holders will be given a 12-month grace period before their repossession proceedings begin, in an agreement between Jeremy Hunt and Britain’s biggest lenders.

The chancellor held a meeting with Britain’s biggest banks and building societies on Friday to ask if they could do more to support households facing a sharp rise in monthly payments on their mortgages after the Bank of England intensified its battle to tame high inflation by increasing interest rates by half a percentage point to 5% on Thursday.

Hunt said three measures had been agreed, including that consumers’ credit scores would not be affected by discussions with their bank or mortgage lender, and that those agreeing to change the terms of their mortgage – by switching to interest-only payments or extending the life of the loan – could return to their original deal within the first six months.

He said that, for those who were “at risk of losing their home in that extreme situation”, a 12-month grace period would be introduced.

Hunt said: “There are two groups of people that we are particularly worried about. The first are people who are at real risk of losing their homes because they fall behind in their mortgage payments.

“The second are people who are having to change their mortgage because their fixed rate comes to an end, and they are worried about the impact on their family finances of higher mortgage rates.”

Consumer champion Martin Lewis said he was “pleased to see it looks like the chancellor has listened and those measures are going to be put in practice by the banks”.

Opposition parties Labour and the Lib Dems were not impressed however. Labour said the measures were “weak”. The party argues that mortgage lenders should be forced to allow borrowers to temporarily switch to interest-only payments or lengthen their mortgage period – an idea that the government has resisted.

The Lib Dems described the measures as a “sticking plaster for a gushing wound”.

Mark Harris, chief executive of mortgage broker SPF Private Clients, said the “payment shock is only affecting a small percentage of homeowners but any help to reduce stress is positive”.

My only question is - is six months long enough? What’s going to change in six months’ time?

Thank you for reading. Have a fab weekend. We’ll be back next week. Bye! – JK

Updated

Consumer champion Martin Lewis, founder of MoneySavingExpert.com, said:

The unprecedented steep rise in mortgage rates is causing a nightmare for many with variable mortgages and those coming off fixes. Therefore, the most important thing we can focus on right now is appropriate, flexible forbearance measures. While the Bank of England’s aim is intended to squeeze people’s disposable incomes, no one wants people’s lives to be ruined by arrears and repossessions – and that is the urgent protection we need to focus on.

I met the chancellor on Wednesday and reiterated that the minimum we needed was to ensure that when people asked for help from lenders, they knew that if things changed, it wouldn’t be detrimental to their financial situation and their credit scores would be protected as much as possible.

I’m pleased to see it looks like the chancellor has listened and those measures are going to be put in practice by the banks. We need to make sure everybody knows their rights if they are in trouble with their mortgage, so they can feel comfortable speaking with their lender and understand the measures that they can request for help.

Nikhil Rathi, chief executive of the Financial Conduct Authority, said:

Today’s productive meeting builds on the work we’ve done over the last year to ensure those who get into difficulty receive the tailored support they need. We’ll move quickly to make any changes needed to support today’s commitments.

Here’s a couple more charts on the mortgage market.

Updated

You can watch Jeremy Hunt’s statement here:

Updated

Labour has also responded, describing the government’s measures as “weak”.

Rachel Reeves, Labour’s shadow chancellor, said:

Today’s weak response from the government on a mortgage crisis they created shows just how little they understand what families are facing.

Questions remain on how voluntary these measures are. The government must offer clarity and confidence to homeowners by putting in place requirements now to reassure households.

Labour’s five-point plan to ease the Tory mortgage penalty offers practical help now, while our commitment to fiscal responsibility and growth will secure our economy for the future. Instead of shrugging their shoulders, the Tories should be taking responsibility and acting now.

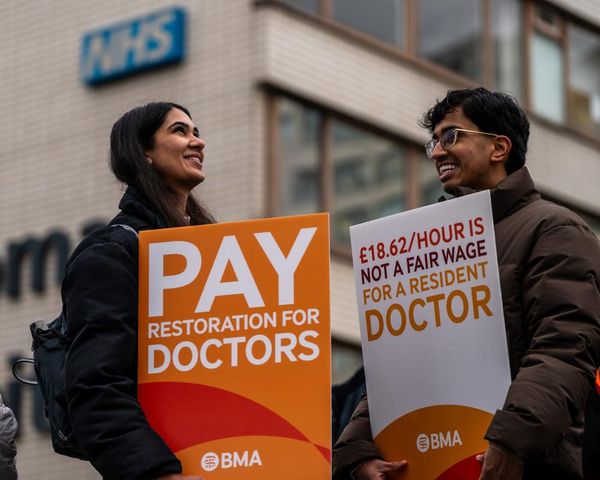

Lib Dems: measures 'sticking plaster for a gushing wound'

The Liberal Democrats weren’t impressed – calling the mortgage measures “a sticking plaster for a gushing wound”. They also noted that there is still no help for renters.

Liberal Democrat Treasury spokesperson Sarah Olney said:

This is a sticking plaster for a gushing wound. Even after today, bailiffs will still be knocking on people’s doors because the Government refused to help.

Struggling families still face the looming prospect of losing their homes because the government crashed the economy and sent mortgage bills spiralling.

Britain is facing a mortgage crisis and we have a chancellor who simply isn’t up to the job. Jeremy Hunt is failing on his inflation target and now failing to help families with the consequences.

It adds insult to injury that there is still no help for renters who face unbearable payments. Jeremy Hunt is failing families and pensioners. If he is not going to take decisive action then he should step aside.

Here are Jeremy Hunt’s comments in full, following his meeting with mortgage lenders. He told broadcasters:

Absolutely anyone can talk to their bank or their mortgage lender, and it will have no impact whatsoever on their credit score. That’s really important. A lot of people worry about that.

The second is that if you are anxious about the impact on your family finances, and you change your mortgage to interest-only or you extend the term of your mortgage, and you want to go back to your original mortgage deal within six months, you can do so, no questions asked, no impact on your credit score, and it’s going to give people a lot of comfort and stop people worrying about having conversations with their banks when they are worried about their financial situation.

And the final thing is for people who are at risk of losing their home: In that extreme situation, the banks and mortgage lenders have a number of things in place. The last thing that they want to do to repossess a home but in that extreme situation, they’ve agreed there will be a minimum 12 month period before there’s a repossession without consent.

Updated

UK mortgage holders to get 12-month grace period before repossessions

Mortgage lenders and the UK chancellor, Jeremy Hunt, have agreed that people should be given a 12-month grace period before repossession proceedings start, following yesterday’s shock interest rate hike to 5%. You can watch him talk here on Sky News. He told broadcasters:

There will be a minimum 12-month period before there is a repossession without consent.

The chancellor met with the heads of financial institutions this morning, including Lloyds Banking Group, NatWest Group, Barclays and Virgin Money.

They agreed that the repossession break should be introduced.

Banks and Hunt also agreed that people can go to their mortgage lenders and talk about their options if they are struggling with repayments, without it having an impact on their credit rating.

People who extend their repayment term or go on to interest-only plans can reverse this within six months without it impacting their credit rating.

But there was no announcement of support for tenants, despite soaring rents.

Updated

The UK government has indicated that the help for mortgage holders will be limited to making it easier for them to get existing support, rather than any subsidies, our Whitehall editor, Rowena Mason, reports.

Rishi Sunak’s official spokesman said:

We are doing a great deal to support mortgage holders already both on the macro scale and multi billions of pounds to help with energy bills and also specific products to help those that are struggling and the new FCA [Financial Conduct Authority] consumer duty which sets expectations on what lenders should be doing.

Pressed on whether direct support had been ruled out, the spokesman said:

The PM was clear that we are not looking to make any fiscal interventions in this space.

Asked whether banks should do more to publicise support to people, he said:

It’s important the public understand the support available to them.

We want lenders to do whatever they can to help hard hit mortgage holders and others.

Updated

Rosanna Bryant, a partner at the law firm Addleshaw Goddard, said:

The chancellor will want to see from the lenders that they will continue to support customers including those in financial difficulty.

Banks and other mortgage lenders will need to continue to ensure that borrowers are supported in the most appropriate way possible by putting their customers’ needs first.

This latest increase to the Bank rate by 0.5 percentage points to 5% will inevitably lead to increased weakening of UK households’ resilience and a coordinated effort must be made to support as many households as possible.

Keir Starmer: public wants 'action, not words'

Sir Keir Starmer has said the public is looking for “action, not words” from ministers to help tackle the mortgage crisis.

The Labour leader, speaking to broadcasters at RAF Brize Norton in Oxfordshire, said there are “many mortgage holders, many families, across the country who are now even more worried about paying their mortgage”.

He added:

They know that the government’s been about for 13 years, they know the government crashed the economy last year.

What they want, I think, is a much stronger sense that the government is gripping this; action, not words.

Starmer said the government has to “take responsibility for the situation we find ourselves in” and that people do not want an administration that says “there is nothing we can really do about” the situation.

The opposition leader pointed to the Labour suggestion that lenders should be forced to allow borrowers to temporarily switch to interest-only payments or lengthen their mortgage period – an idea that the government has resisted.

He said ministers should “require lenders to take the steps” when it comes to mortgage holders that would “put in proper measures to shield them or support them”.

Updated

Looks like there won’t be any new help for struggling mortgage holders, such as more flexibility, for example by extending mortgage terms (but allowing customers to reduce terms again when their circumstances improve).

A senior industry figure with knowledge of today’s meeting between Jeremy Hunt and bank bosses told the Guardian:

Discussions fed more into how we communicate what we already offer customers in hardship, rather than changing commitments we have in place for those who are struggling.

Our full story is here:

Updated

Harriett Baldwin, a Tory MP who chairs the Treasury select committee, also said earlier this morning that banks were far too slow to pass on increases in the Bank of England base rate to savers.

We’ve all noticed that the day the Bank of England raises rates you get a message from your mortgage lender saying this has happened and it takes immediate effect on your mortgage if you’re on a variable rate, but they’ve been incredibly slow to pass on the increase to their loyal savers, particularly those savers who don’t feel comfortable shopping around.

I don’t think the high street banks have done nearly enough. They’ve taken it for granted that we’ve got used to not earning anything on savings.

Martin Lewis criticises 'outrageous' lag in savings rates

Consumer champion Martin Lewis has said it seems “absolutely outrageous” that bank savings rates are lagging behind the rates being charged to borrowers – and that the chancellor won’t provide much help to mortgage holders, because that would be “counter-productive” in the fight against inflation.

Speaking on ITV’s Good Morning Britain about the impact of interest rate hikes on mortgage holders, he said:

None of this is accidental. The fact that mortgage borrowers are paying a lot more is the policy.

Nobody needs to be under any uncertain terms that the idea that mortgage borrowers are being squeezed and their incomes are reducing is not an accidental by-product.

It is absolutely deliberately why interest rates go up. Interest rates are put up to try and take money out of the economy, so you put borrowing rates up so that borrowers have less money, and you want savings rates to go up so that people save more and they don’t spend more. That’s the theory behind this.

He added:

What that means is the chancellor is not going to call for help and more money to people who have mortgages. Because that would, if you’re following the theory, be counter-productive.

Lewis, who spoke to the chancellor earlier this week, said he had suggested lenders should be stopped from increasing their profits on the back of interest rates going up.

They should be doing what they can in return, because they’re too big to fail and, now, they don’t want us to fail. They should be doing what they can in return.

So to be increasing profits, increasing margins at this point seems absolutely wrong. It’s profiteering.

If I were the chancellor, and what I said to the chancellor obviously is, I think you need to make sure that they put savings rates up at least with the same rate as borrowing.

Because if you do that, you take money out of the economy and that’s another way of helping inflation that’s less painful than putting lending up.

But also they need to put money aside to help with forbearance. Because even if the idea is we want to, not me, as a state, we want to squeeze borrowers ’til the pips come out so that they haven’t got that much disposable income, then what you don’t want is people defaulting or going into arrears or being repossessed.

NatWest boss: Meeting with Hunt 'very productive'

Following the bank bosses’ breakfast meeting with the UK chancellor, Jeremy Hunt, at Downing Street, Alison Rose, chief executive of NatWest Group, said:

We had a very productive meeting. We’re doing everything we can to help customers and help with the anxieties.

She added they were “very keen” to help everyone.

The chief executive of Lloyds Banking Group, Charlie Nunn, said there had been a “good working discussion with the chancellor” on supporting struggling households, following the latest rise in interest rates.

He said an announcement would be made by the chancellor later today.

UK economy slows, inflation pressures stay high – PMI

Britain’s economy slowed this month and inflation pressures stayed high, according to the latest snapshot from S&P Global and the Chartered Institute of Procurement & Supply (CIPS).

Growth in the UK’s private sector – manufacturers and service sector firms – has eased to its slowest level for three months. The closely-followed UK purchasing managers’ index, the flash reading, fell to 52.8 in June from 54 in May.

This was a sharper slowdown than expected, with economists forecasting a figure of 53.7 for the month. Any reading above 50 shows the sector is growing.

Chris Williamson, chief business economist at S&P Global Market Intelligence, said:

June’s flash PMI survey indicates that the UK economy has lost momentum again after a brief growth spurt in the spring, and looks set to weaken further in the months ahead.

Most notably, consumer spending on services, which was a core growth driver in the spring, is now showing signs of faltering as the reality of higher interest rates, the increased cost of living and gloom about the outlook sets in and overrides the brief boost to spending enjoyed from the pandemic tailwind. The manufacturing sector meanwhile continues to report recessionary conditions.

Services firms put up their prices sharply again this month, although by a bit less than in May, while manufacturers cut the prices they charged for the first time in more than seven years.

Williams said:

One notable area of resilience in the economy is the labour market, with jobs growth accelerating in June as companies in the service sector continue to fill vacancies. While falling backlogs of work suggest this hiring trend could also fade in the coming months as the economy weakens, for now it is generating higher wage growth, in turn feeding through to still-elevated inflation pressures in the service sector.

Richard Donnell, executive director of property website Zoopla, said on Twitter:

Cant see much changing here other than commitment to forbearance and use of interest only for worst impacted households - these just kick the can down the road for those whose circumstances have changed - case by case rather than national schemehttps://t.co/svjLtr6O4T

— richard donnell (@richard_donnell) June 23, 2023

Updated

Food poverty campaigner: 'fish and chips without peas'

This morning, Kathleen Kerridge, who campaigns against food poverty, was on BBC radio 4’s Today programme, talking about the impact of the rising cost of living on people – “it’s a gradual stripping back” until there’s nothing left to cut.

She said people are cutting back on luxuries like:

side dishes on dinner plates, like for example, if you have fish chips and peas, you might end up with just fish and chips; smellies, luxury items, such as branded cleaners and branded foods even, and you tend to go to supermarket brands and then budget brands. It’s a gradual stripping back. At first it is so incremental that you don’t really notice it and you feel like there’s nowhere else to go, and there’s nothing else that you can do.

Tom Pollard, head of social policy at the New Economics Foundation think tank, tweeted:

We've all felt the pinch of rising energy & food prices but it's been widely recognised that low income households are suffering the most

— Tom Pollard (@PollardTom) June 23, 2023

I fear the brewing mortgage crisis could be more divisive, sapping attention & empathy from the plight of those in the toughest circumstances

Joseph Elliott, analysis manager of the Joseph Rowntree Foundation, tweeted:

Kathleen Kerridge, anti food poverty campaigner, on today programme:

— Joseph Elliott (@J_Elliott94) June 23, 2023

"People are cutting back on luxury items and non-essentials.. [luxuries like] side dishes on dinner plates (no peas with fish and chips) branded cleaning products and foods.."

Jeremy Hunt’s meeting with the heads of the UK’s main mortgage lenders is over. NatWest Group’s chief executive Alison Rose and the head of the banking industry body UK Finance, David Postings, have been seen leaving Downing Street.

The CEBR added:

While the [home repossession] figures make for grim reading, they are still quite a way down from the previous squeezes seen during the 1990s housing market crash and following the financial crisis.

This is partly due to the more stringent regulations which were put in place after the previous crises, assuring that borrowers need to pass a range of stress tests before they are approved. Moreover, UK housing wealth has increased substantially in recent years, meaning mortgage holders have a larger safety margin and are not as likely to fall into negative equity as was the case during the 1990s.

Nevertheless, as the Bank of England continues to fight inflation, the economy is entering unchartered territory. With interest rates raising so rapidly in such a short amount of time, it is not only mortgage holders but also the wider financial system that will come under strain. At the same time, the risk of recession, which had seemed to fade away in recent months, is now rising again which could lead to a more rapid increase in unemployment than currently expected. The difficult economic times look set to stay with us for some time to come.

6% base rate would mean nearly 10,000 extra home repossessions – CEBR

An interest rate of 6% (predicted by the end of the year), would mean nearly 10,000 extra home repossessions in the next three years, the Centre for Economics and Business Research has warned.

Gilt yields, which had been trending up since the start of the year, have risen sharply over the past month on the back of data showing high UK wage growth and two recent disappointing inflation releases. The latest figures this week showed core inflation rising to a more than 30-year high of 7.1%. All of this has caused mortgage rates to climb, with the average two-year fix exceeding 6% earlier this week.

The interest rate squeeze won’t be over anytime soon with the market-implied path for interest rates averaging ‘around 5.5%’ over the next three years, the CEBR said.

As mortgage holders roll off their old fixed deals and onto new contracts with much higher interest rates, they will face a substantial cut to disposable incomes. Previous Cebr research estimated the average increase in the annual cost for households who remortgage this year at £3,900, with this rising to as much as £7,300 for those with a mortgage in London.

Will the increase in interest rates lead to a similarly large uptick in mortgage repossessions? Historically, periods of rapid interest rate rises have frequently led to housing market crashes and high numbers of repossessions. More than 200,000 homes were repossessed in the three years to 1993 as the housing market crashed. This compares to 127,000 repossessions at the height of the financial crisis between 2008 and 2010.

The latest data by UK Finance show that in the first quarter, repossessions rose by 42% on the quarter to 1,160. While the increase seems large, the overall level is still low as a result of pandemic support provided by the government and lenders.

If interest rates rise above 6%, as currently implied by markets, more households would be unable to meet repayments and would eventually have to hand back the keys to their home. The CEBR’s ‘high rates’ scenario assumes that the Bank of England meets current market expectations and raises rates as high as 6.25% by early 2024, with the bank rate still standing at 5.00% by the end of next year.

This would lead to more than 9,400 additional repossessions between 2023 and 2025, implying a total of 61,600 repossessions for the period.

Two-year fixed mortgages unchanged at 6.19%

Two-year fixed mortgages remain unchanged following the Bank of England’s shock half-point base rate rise to 5% yesterday.

According to the financial data firm Moneyfacts, the average two-year fixed residential mortgage is 6.19%. The average five-year fix is 5.83, up a tick from 5.82% yesterday.

The two-year tracker has gone up to 5.66% from 5.49%.

The number of residential mortgage products out there has fallen, to 4,444 from 4,507.

Updated

1.2m UK households to become insolvent this year – NIESR

More on the NIESR estimates.

The National Institute of Economic and Social Research, a well-regarded think tank, estimates that 1.2m UK households – 4% of all households – will run out of savings because of higher mortgage repayments and become insolvent by the end of the year.

This will take the total proportion of insolvent households to nearly 30%, or around 7.8 million.

With the Bank Rate rising at their fastest pace since the Bank of England gained independence in 1997, millions of households will be affected by higher mortgage repayments.

A significant proportion of the population will see their savings wiped out because of the rise in interest rates and higher mortgage repayments. The largest impact will be felt in Wales and the North-East where up to 6% of households are projected to be insolvent by the end of the year as a direct result of higher mortgage repayments.

Also, the analysis finds that the rising repayments will wipe out 0.3% of UK GDP, costing all households with mortgages a total of £12bn per year.

🚨OUT NOW🚨

— National Institute of Economic and Social Research (@NIESRorg) June 22, 2023

🏘️1.2 million UK Households will be insolvent this year as a direct result of higher #mortgage repayments, with Wales and the North-East the areas most affected 📈

⚡️Read our latest analysis here⬇️#InterestRate #interestrates #EconTwitterhttps://t.co/f2kkXF8a5r

Other key points include:

Monthly mortgage repayments will rise by nearly 50% on average: this rise is above typical stress-tests households are subjected to when applying for a mortgage.

Fixed-rate monthly mortgage repayments will rise from around £700 to £1,000 on average: this applies to nearly 2m households when needing to remortgage.

Variable-rate monthly mortgage repayments will rise from around £450 to £700: this applies to 1.5m households on variable-rate mortgages.

The institute called on the government to consider intervening in forbearance agreements, which allow households to agree to create repayment plans based on what they can afford when they are unable to repay their debt.

Max Mosley, NIESR Economist, said:

The rise in interest rates to 5% will push millions of households with mortgages towards the brink of insolvency. No lender would expect a household to withstand a shock of this magnitude, so the government shouldn’t either. Some investment should be done in forbearance agreements, giving households and lenders the ability to create payment plans that work for each other.

Updated

A 50-year-old accountant who lives in South Wimbledon, London, has seen his mortgage payments triple in the last three months.

For the last five years, he said he had been on a fixed-rate mortgage, which he came off about two months ago and is now on a variable rate. He told the PA news agency:

I gambled a bit, I work in financial services, and I thought interest rates were actually going to go down, so I went on a variable rate.

The conclusion of that is my rates gone from 1.7% to 5.1% on a very modest terraced house in South Wimbledon. So it is quite remarkable.

He said that while he can “probably swallow that”, saying the price of paying rent on his street is “probably more than that”, he said “it’s a bit silly paying away a lot of money in interest”.

He added:

The fact that I pay three times more for my mortgage, that’s insane. I don’t see any logic in this.

Updated

While the majority of UK mortgaged homeowners are on fixed-rate deals, meaning they will not immediately feel an impact of rising interest rates but they will feel the pain when they come to remortgage, those on tracker mortgages will be hit immediately by yesterday’s 0.5% increase.

Nicholas Wilson, 66, who is on a standard variable rate mortgage, said he is is at a point where his mortgage payments equal his pension. He told Danielle Desouza and Hannah Cottrell at the PA news agency that he is going to challenge his mortgage because he thinks “the whole thing is a scam”.

Wilson is a mortgage prisoner, the term given to homeowners who typically took out a mortgage before 2008, whose mortgage was sold to an inactive lender, who have paid a high interest rate for 15 years, and now cannot remortgage because of the changed affordability tests.

The anti-corruption campaigner, who lives in Hastings in East Sussex, told PA:

Last year, my mortgage was about £440 (per month), it’s now over £900 – every time the bank puts the interest rates up, my mortgage goes up.

I’m stuck in this mortgage and I obviously can’t go elsewhere. I do get donations from some of my followers, which just about tides me over, but that’s not going to be sustainable any longer.

He was diagnosed with stage three prostate cancer last October, which means he regularly has to go to the hospital for radiotherapy, and said that while battling cancer, he worries about dealing with potential repossession proceedings.

There’s going to be millions of people facing repossession… it’s just going to be a disaster.

In my case, I’m going to challenge this mortgage because I think the whole thing is a scam.

Yesterday, Rishi Sunak insisted that he was “totally, 100% on it” in his efforts to ease the cost of living crisis and said “it is going to be OK,” as Guardian’s economics correspondent Richard Partington and political correspondents Ben Quinn and Kiran Stacey write.

Rishi Sunak’s pledge to ease the cost of living crisis is in tatters after the Bank of England was forced to raise interest rates to 5% in an inflation-busting move that risks driving the economy into recession.

With the prime minister under fire over the soaring cost of borrowing, the central bank pushed through a half-point hike, deploying what economists described as “shock and awe” tactics.

Mortgage holders are bracing for more pain, with rates now at their highest level since the 2008 financial crisis, and markets betting on a further rise to 6% by Christmas.

The prime minister said he supported the Bank’s move, despite warnings that the economy may have to be pushed into recession in order to tame the steepest price rises in the G7.

Speaking on a visit to an Ikea distribution centre in Kent after the Bank’s decision, Sunak sought to reassure workers by arguing he was “totally, 100% on it” in his central mission to ease the pressure on living costs.

“It is going to be OK and we are going to get through this and that is the most important thing I wanted to let you know today,” he said.

Jim Pickard, deputy political editor at the Financial Times, writes:

Many borrowers coming off variable mortgage rates or having to replace their fixed-rate mortgages are being offered two-year fixed deals over 6%, resulting in big jumps in their monthly repayments. Andrew Bailey, BoE governor, admitted on Thursday that the 13th consecutive rise in rates since December 2021 would cause “difficulty and pain” for many.

Yet Hunt has ruled out calls for a return of mortgage interest relief, which was known as MIRAS.

The chancellor has also rejected the idea of giving fiscal support to households struggling with the rising cost of mortgages, arguing that the government’s priority is to “strangle” inflation, which has remained stubbornly high.

The Liberal Democrats have called for a new multibillion-pound support scheme for vulnerable householders, but Hunt believes that pumping more money into the economy will put further upward pressure on inflation and interest rates.

Instead, the chancellor will encourage lenders to show forbearance to struggling customers, including offering mortgage term extensions or letting borrowers switch to interest-only repayment holidays.

Jeremy Hunt meets banks in effort to tackle UK mortgage crisis https://t.co/s41h7kLyzs

— Financial Times (@FT) June 23, 2023

Zoe Schneeweiss, western Europe economy leader at Bloomberg, tweeted this chart:

Stubborn UK inflation triggers a mortgage crisis for millions https://t.co/tJYkGm4ztG via @PhilAldrick @irinaanghel12 pic.twitter.com/w1Q4XNM2Ki

— Zoe Schneeweiss (@ZSchneeweiss) June 23, 2023

Philip Aldrick and Irina Anghel at Bloomberg write:

Britain’s mortgage market has become a horror show for borrowers and the government as soaring interest rates threaten to leave households destitute and the economy on the rocks.

The dream of a soft landing that would have the Bank of England squeeze out inflation without condemning the country to a recession looks increasingly remote. Inflation is cooling only slowly, forcing the central bank to go hard on Thursday with a bigger-than-expected hike that took the key rate to 5%.

Updated

The senior Tory MP Jake Berry told chancellor Jeremy Hunt in the Commons on Tuesday:

People are very concerned about what is being described as the mortgage bomb about to go off.

According to the Institute for Fiscal Studies, a respected think tank, some 1.4 million mortgage holders will see their disposable incomes fall by more than 20% because of the interest rate hikes.

The mortgage crisis will wipe out the savings of 1.2m families this year and push many into insolvency, economists have warned, the Telegraph reports.

Max Mosley from the National Institute of Economic and Social Research said:

The rise in interest rates to 5% will push millions of households with mortgages towards the brink of insolvency.

“Households having to remortgage face their bills rising by nearly 50%, according to the National Institute of Economic and Social Research (NIESR). Pushing the total number of families with no savings to 7.8m equivalent to 28% of all households” https://t.co/L1zb84eCtL

— Emma Fildes (@emmafildes) June 23, 2023

Updated

We are hearing that the breakfast meeting between Jeremy Hunt and mortgage lenders is due to start at 8am.

Those at the meeting include Nikhil Rathi, head of the Financial Conduct Authority, as well as bank chief executives including Charlie Nunn of Lloyds Banking Group, Debbie Crosbie of Nationwide, Britain’s biggest building society, Alison Rose of NatWest Group, David Duffy of Virgin Money and Mike Regnier of Santander UK (the Spanish bank’s UK head).

Updated

Introduction: Hunt to meet mortgage lenders today

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

The UK chancellor, Jeremy Hunt, is meeting mortgage lenders this morning and will ask them if they can do more to support struggling households after a shock half-point interest rate hike to 5% yesterday, which deepened the mortgage crisis.

The financial markets are predicting UK interest rates will hit 6% by the end of the year, and remain at that level until next summer.

Hunt is meeting large lenders including HSBC and Santander in Downing Street, amid growing pressure on the government to act. Both he and Rishi Sunak, the prime minister, have ruled out a financial intervention, after the Bank of England hiked rates for a 13th time in an attempt to bring down stubbornly high inflation.

Labour has called for banks to be forced to help struggling mortgage holders, while some backbench Tories have demanded support for those borrowers.

However, the chancellor is expected to use the meeting in No 11 to press lenders on whether they are living up to their commitments to offer tailored support to those struggling to pay.

Earlier this week, he said:

I will be meeting the principal mortgage lenders to ask what help they can give to people who are struggling to pay more expensive mortgages and what flexibilities might be possible for families in arrears.

Harriett Baldwin, a Conservative MP and chair of the Treasury select committee, said it was important that banks show people forbearance, as they did during the Covid pandemic, but rejected the idea that lenders should be instructed by the Financial Conduct Authority or the government to do so. She said people who are worried about their rising mortgage costs should speak to their lenders themselves.

Talking on BBC radio 4’s Today programme, she said:

It is very important that he [Hunt] speak to them this morning.

We’re planning another session with the mortgage lenders [at the committee] because one of the things that we wrote to the regulator about, the Financial Conduct Authority, is making the changes that are necessary to put in, almost enshrine in their rulebook, the kind of forbearance that people were shown during the pandemic

There will be a lot of your listeners who are worried about that renewal of their fixed rate or their on a variable rate. If you are worried, the first thing you should do is contact your lender because it won’t affect your credit record. You should have a grown up conversation with them. And there will be a variety of things that they will do to help you through what is clearly going to be a difficult period.

She added:

We just had a big debate about how independent do we want our independent regulators to be and where both the government and the opposition ended up, was that it’s best to leave the regulators to be independent and not to take a call in power as it were.

She said a new consumer duty will apply to banks from next month that will “require banks to demonstrate how they are treating their mortgage customers with the right degree of forbearance during this difficult time”.

Meanwhile, retail sales in Great Britain were better than expected, rising by 0.3% in May, following April’s 0.5% increase. The Office for National Statistics said online retailers selling outdoor-related goods and summer clothing had strong sales, boosted by warmer weather.

Food sales were down 0.5%, despite increased spending on takeaways and fast food because of the extra bank holiday for the king’s coronation; however retailers also indicated that the increased cost of living and food prices continued to affect sales volumes, the ONS said.

Erin Brookes, European retail and consumer lead at the professional services firm Alvarez & Marsal, said:

The King’s coronation was cause for celebration across the High Street as the extra bank holiday boosted sales in May. With consumers in a festive mood for the once-in-a-lifetime event, and good weather throughout the month, retailers saw elevated demand for outdoor goods and summer clothes.

The challenge for retailers will be to continue to attract footfall as the macroeconomic environment worsens. A well-managed blend of newness will drive consumer interest even when demand is weaker, alongside a core assortment to maintain loyalty and drive healthy margins. Summer sales have also begun earlier this year as retailers seek to rotate stock – those who can do this effectively and avoid costly warehousing will emerge as winners.

The Agenda

8am BST: Spain GDP growth final for Q1 (forecast: 0.5%)

8.15am BST: France HCOB PMIs flash for June

8.30am BST: Germany HCOB PMIs flash for June

9am BST: Eurozone HCOB PMIs flash for June

9.30am BST: UK S&P Global/CIPS PMIs for June

2.45pm BST: US S&P Global PMIs for June

Updated