Uber Technologies, Inc (NYSE:UBER) reported first-quarter FY22 revenue growth of 136% year-on-year to $6.85 billion, beating the consensus of $6.13 billion. Lyft, Inc's (NASDAQ:LYFT) first-quarter revenue rose 44% Y/Y to $875.6 million, beating the consensus of $846 million.

Uber: Revenue from Mobility grew to $2.5 billion (+195% Y/Y), Delivery was $2.5 billion (+44% Y/Y) and Freight at $1.8 billion (506% Y/Y).

Gross Bookings grew 35% Y/Y to $26.4 billion, with Mobility Gross Bookings of $10.7 billion (+58% Y/Y) and Delivery Gross Bookings of $13.9 billion (+12% Y/Y).

Trips grew 18% Y/Y to 1.71 billion, or 19 million per day. The acquisition of Transplace by Freight and a change in the business model for the U.K. Mobility business drove the numbers.

Lyft had 17.8 million active riders during Q1, up 31.9% Y/Y. The average revenue per active rider reached $49.18, up 9% Y/Y.

Margins: Uber clocked Adjusted EBITDA of $168 million, with Mobility margins at an all-time high and Freight reaching Adjusted EBITDA profitability.

Uber's Adjusted EBITDA margin as a percentage of Gross Bookings was 0.6%, up from (1.8)% in Q1 2021. Lyft's margins improved from (12)% in the prior year, to a positive 6.3%.

Uber's EPS loss of $(3.04) missed the consensus loss of $(0.24). Uber held $4.2 billion in cash and equivalents and generated $15 million in operating cash flow.

"Our results demonstrate just how much progress we've made navigating out of the pandemic and how the power of our platform is differentiating our business performance," CEO Dara Khosrowshahi said.

Outlook: Uber expects Q2 Gross Bookings of $28.5 billion - $29.5 billion and Adjusted EBITDA of $240 million - $270 million. Lyft sees Q2 revenue of $950 million -$1 billion below the consensus of $1.02 billion.

Price Action: UBER shares traded lower by 0.24% at $29.35 in the premarket on the last check Wednesday. LYFT shares traded lower by 24.7% at $23.15.

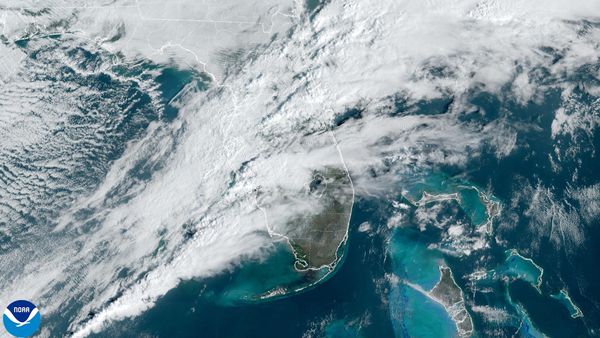

Photo by thought catalog via unsplash