The United States is on track to triple its semiconductor manufacturing capabilities by 2032, due to the CHIPS and Science Act, a new report released by the Semiconductor Industry Association (SIA) and the Boston Consulting Group (BCG) reveals. This growth includes a threefold increase in domestic semiconductor production, a massive surge in advanced logic manufacturing from zero to almost one third, and a notable rise in global capital expenditures share.

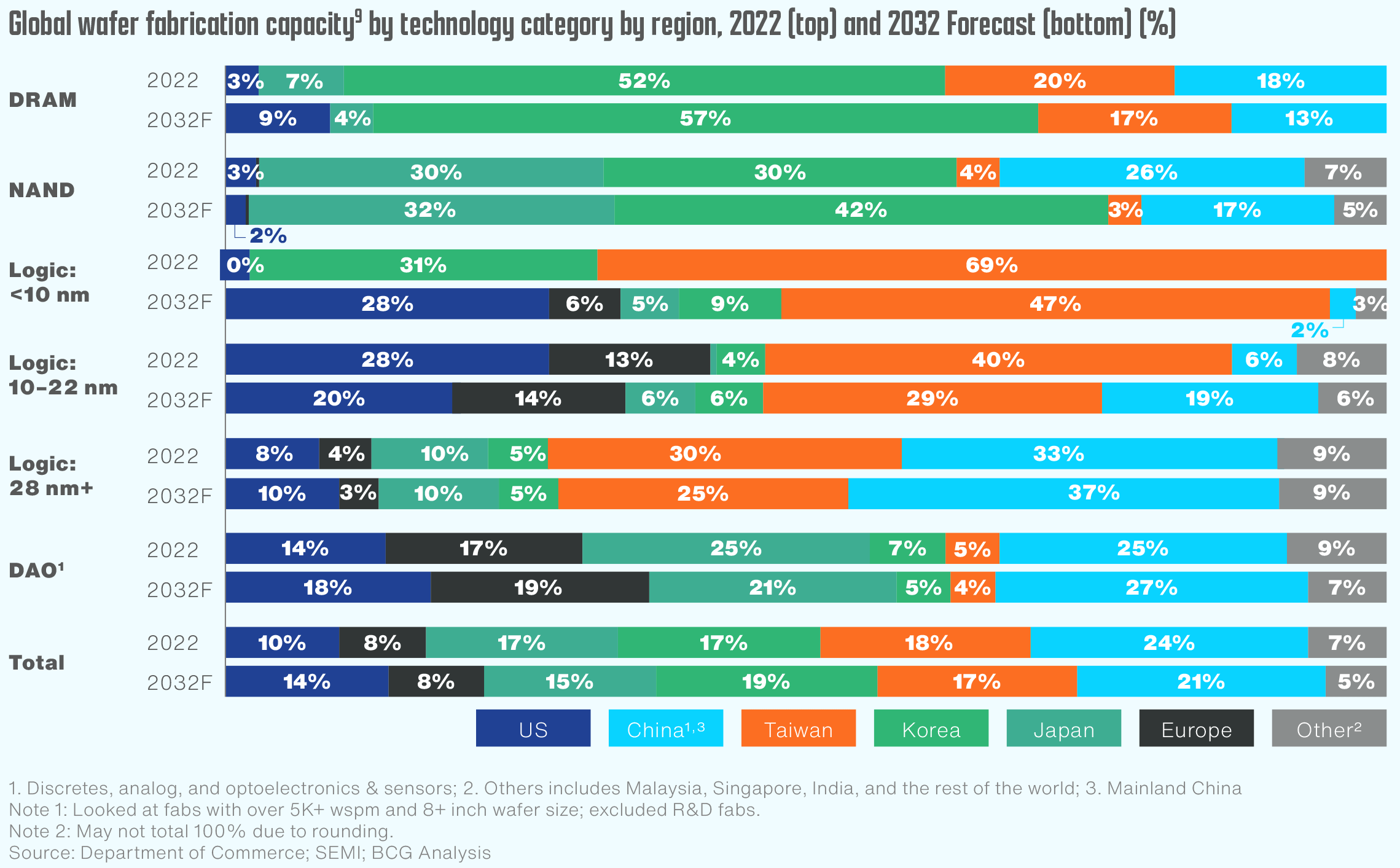

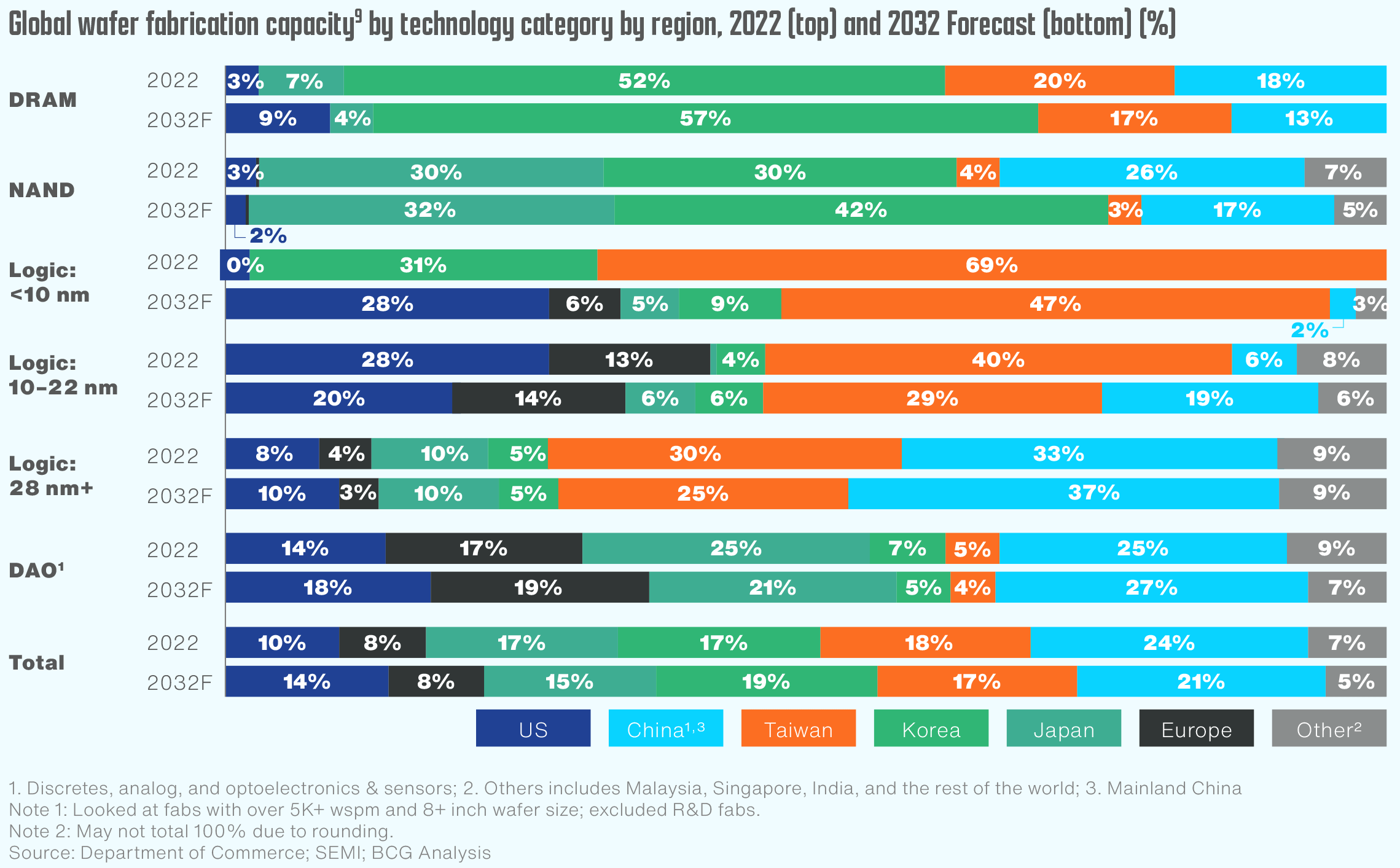

By 2032, U.S. semiconductor manufacturing capacity is anticipated to grow by 203% compared to 2022 levels. This means that 14% of the global chip production capacity will be located in America, up from 10% in 2022. The capacities will increase almost across the board as the U.S. semiconductor industry will increase the production of logic using various nodes; DRAM; and discrete, analog, optoelectronics, and sensors (DAO). This expansion represents the largest projected increase globally during this period. Such growth is primarily attributed to the enactment of the CHIPS and Science Act, which has been instrumental in promoting domestic semiconductor production.

When it comes to global rankings, the U.S. advancements will not reverse tables significantly: the U.S. will remain the world's fifth largest country by chip production capacity, behind China, South Korea, Taiwan, and Japan.

Perhaps more important are the U.S.'s advancements in the field of advanced logic manufacturing. It is projected that by 2032, the U.S. will increase its share of global advanced logic (below 10nm) manufacturing to 28%, up from virtually zero in 2022. This development is crucial as it positions the U.S. as a major leader in advanced chipmaking, just behind Taiwan with 47% of capacities. Yet, it looks like the report assumes that Samsung will not expand its advanced logic capacity in South Korea in the next eight years, which seems unlikely.

In terms of financial investments, the U.S. is expected to attract 28% of the global semiconductor capital expenditures from 2024 to 2032, positioning it second only to Taiwan, which leads with 31%. Without the incentives provided by the CHIPS Act, the U.S. would have secured just 9% of these expenditures by 2032, according to SIA.

Private sector investments have also surged following the enactment of the CHIPS Act. More than 80 new projects have been announced across 25 U.S. states, representing nearly $450 billion in private investments. These projects are expected to generate over 56,000 direct jobs within the semiconductor sector, significantly boosting local economies and the national job market.

The increase in U.S. manufacturing capacity contrasts starkly with the modest 11% increase observed from 2012 to 2022. The report also notes that the U.S. continues to lead globally in high-value semiconductor technology areas, including chip design, electronic design automation (EDA), and wafer fab equipment.

The report cautions that while the CHIPS Act has catalyzed growth, industrial policies might create supply chain bottlenecks, emphasizing the need for targeted, distributed, and market-based investments. It highlights the potential risks of non-market-based investment leading to overconcentration or oversupply in certain segments of the semiconductor supply chain and the lack of capacity in the other.

"The CHIPS and Science Act has put America on course to significantly strengthen domestic semiconductor production and R&D, but more work is needed to finish the job," said John Neuffer, SIA president and CEO. "We look forward to working with government leaders to advance policies that broaden the STEM talent pipeline, invest in scientific research, promote free trade and access to global markets, and expand and extend critical CHIPS incentives."