The U.S. government is weighing the possibility of allowing Nvidia to export advanced AI GPUs to Saudi Arabia. These processors would aid the kingdom in developing its own cutting-edge large language models (LLMs) and AI services. Thus, the country would be able to diversify its economy, reports Semafor. At the same time, the U.S. government wants to ensure that its adversaries, such as China, will not get access to these GPUs through the cloud.

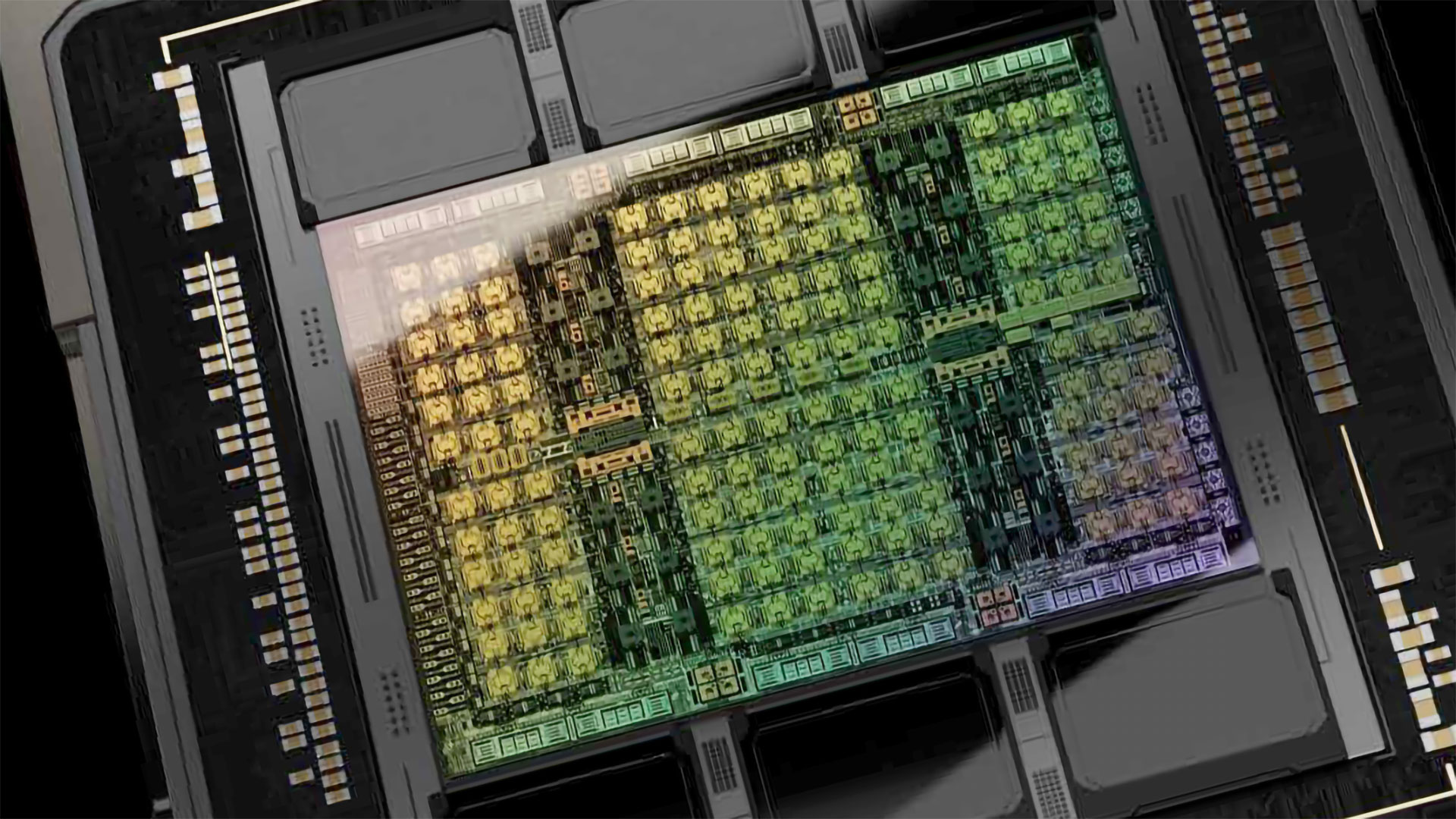

The possible sale of Nvidia's AI GPUs, such as H100 and H200, was a key albeit unofficial topic at the Global AI Summing (GAIN) in Saudi Arabia recently. The event brought together representatives from companies like Groq, Google, and Qualcomm, alongside Saudi government officials.

Last November, the U.S. government obliged Nvidia (and its partners) to get an export license from the U.S. Department of Commerce's Bureau of Industry and Security if they sell advanced AI or HPC processors (such as A100, A800, H100, H800, L40, L40S, and GeForce RTX 4090) to entities in China, Saudi Arabia, the United Arab Emirates, and Vietnam. Such licenses are usually reviewed with a presumption of denial, which is damaging to the plans of the Middle Eastern nations to diversify their economies beyond oil.

In response, Saudi Arabia has been working to meet U.S. security requirements to gain access to Nvidia's H200 processors, according to Semafor's sources at Saudi Data and AI Authority. Nvidia and the U.S. government spokespeople declined to comment. Nvidia's H200 GPUs are the most advanced offerings that Nvidia can ship right now. These processors are essential for developing LLMs like OpenAI's GPT-4 or Meta's Llama 70B.

One of the U.S. government's primary concerns is about Saudi Arabia's history of collaboration with Chinese tech giants like Huawei. So, the country had to reconsider its ongoing work with these companies. At GAIN, there was a noticeably smaller presence of Chinese participants, signaling a pivot toward the U.S. In previous years, Chinese companies like Alibaba and Huawei played a more prominent role, but this year saw fewer of their representatives on the convention floor. Still, while Saudi Arabia has reduced its collaboration with Chinese firms, it has kept the option open in case the U.S. restricts access, Semafor reports.

On the other hand, the U.S. needs to maintain a balanced approach in this situation. While it wants Saudi Arabia to reduce its ties with China, it must also weigh the implications of allowing sensitive intellectual property to flow into the kingdom. Despite these concerns, deals between Saudi Arabia and major tech companies, such as Groq's partnerships with Neom and Aramco, continue to flourish.

Saudi Arabia is currently competing with the UAE (whose AI leader G42 also works both with U.S.-based Cerebras and China's Huawei) in the AI race. Both countries face challenges due to the absence of advanced AI hardware capable of training large LLMs in sufficient quantity. The lack of access to these processors has slowed the progress of tech companies in the kingdom, limiting their ability to keep pace with the rapid advancement of AI technologies in the U.S. and China.

Despite the challenges, Saudi Arabia is investing heavily in AI and leveraging its abundant energy resources, which are critical for powering large-scale AI systems. However, the country still relies on foreign expertise to develop and implement advanced technologies. Yet, some experts remain skeptical of Saudi Arabia's ability to become a global tech hub, given its reliance on external knowledge, its human rights issues, and its harsh environment, the report says.