Shares of Tyson Foods (TSN) were hammered on Monday, falling more than 16% and making 52-week lows.

Tyson stock is hitting its lowest level since March 2020 and the selling has not abated on Tuesday, with the foods giant's shares down another 4% at last glance.

Fueling the decline is the company’s quarterly results, which clearly disappointed investors.

The company reported a top- and bottom-line miss for its fiscal second quarter, with sales of $13.13 billion missing expectations by almost $500 million.

Worse, management referenced thinner-than-expected margins and lowered its full-year outlook.

Don't Miss: Salesforce Stock: a Breakout Is Looming; Here's the Trade

As a result, the shares opened lower by about 10% on Monday. However, there was a key level it could have held if the bulls had bid the stock higher off the open.

Instead, investors opted to sell the stock. Where will support come into play? Let's check the chart.

Trading Tyson Foods Stock on Earnings

Chart courtesy of TrendSpider.com

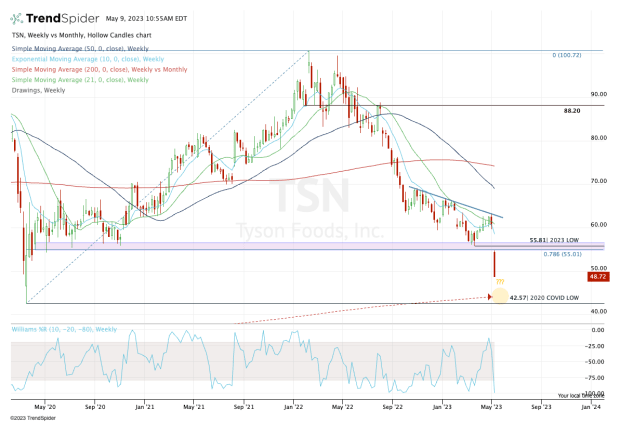

Notice how Tyson Foods stock opened just below $55. That’s where the 78.6% retracement comes into play, while the 52-week low was near $55.80.

I call this deliberate price action because investors deliberately jammed the stock down below a key level, then sold it right out of the gate. They made no attempt to get it back above the $55 to $56 area, which should have told investors that there was no demand for Tyson on Monday morning.

Now the stock is trading below $50 and investors are wondering just where support may come into play.

Don't Miss: AMD and Microsoft Team Up to Fuel AI Ambitions. Time to Buy?

Investors interested in this name should keep an eye on the $42 to $44 area. In this zone, we find the 2020 covid-19 low near $42.50, as well as the rising 200-month moving average.

This area should provide some sort of stability. Even if the support is only temporary, Tyson Foods stock should find some buyers in this zone if it falls that far. It would leave the shares trading at or just below 10 times this year’s earnings estimates.

For investors who believe the company’s issues are short term in nature, this is a cheap price to pay. Not to mention: The stock would pay a dividend yield near 4.5%.