Tyler Perry has criticised insurance company cancellations amid the ongoing catastrophic Los Angeles wildfires raging through Southern California.

Several blazes have destroyed more than 35,000 acres of land across Southern California – the largest being the Palisades Fire and Eaton Fire – resulting in the death of 25 people. Several celebrities, including Paris Hilton and When Harry Met Sally star Billy Crystal, have lost their homes.

The American filmmaker and actor shared a message calling out unnamed insurance companies who had either chosen not to renew their policies or to stop writing new ones, especially for high-value homes located in areas of high-risk fire-prone areas.

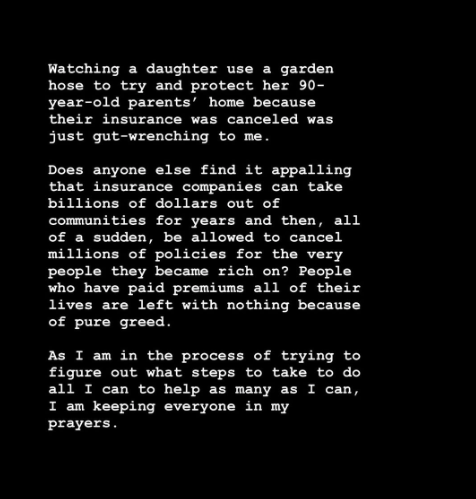

In a post shared on Instagram on Monday (13 January), Perry said that he finds it “appalling” that insurance companies can “take billions of dollars out of communities for years and then, all of a sudden, be allowed to cancel millions of policies for the very people they became rich on”.

Follow live updates on the California fires here

“People who have paid premiums all of their lives are left with nothing because of pure greed,” he added.

Perry continued: “As I am in the process of trying to figure out what steps I can take to do all I can to help as many as I can, I am keeping everyone in my prayers.”

According to the Los Angeles Times, many fire victims reported that insurers had dropped their policies last year.

The state’s largest home insurance company, State Farm General, announced in March 2024 that it would not be renewing 30,000 homeowner policies, including 1,626 in Pacific Palisades, when the expiry date was due.

Insurer Chubb stopped writing new policies for high-value homes at risk of wildfires in 2021, while Allstate has stopped writing new policies in 2022 and Tokio Marine America Insurance Co and its subsidiary Trans Pacific Insurance Co stopped offering insurance coverage in LA last year. The Independent has contacted the relevant insurers for comment.

However, California Insurance Commissioner Ricardo Lara recently announced a ban on insurance companies from cancelling or not renewing policies for homeowners affected by the Palisades and Eaten fires for one year.

The ban covers the 90-day period between 8 October and 7 January, when the Palisades and Eaton fires began.

“Your insurance company should do the right thing and retain you as a valued policyholder,” Lara said.

In the Pacific Palisades, about 10 per cent of homeowners and fire insurance policies were not renewed from 2020 to 2022, while in Altadena during the same period, the figure was roughly eight per cent.

Firefighters are currently bracing for the return of Santa Ana winds, which are expected to fan the flames of the existing wildfires.

At the time of writing, the combined area burnt by the fires around Los Angeles is reportedly about 60 square miles, while the National Weather Service has warned of a “particularly dangerous situation” in the days ahead.