KEY POINTS

- From around $83,000 on Saturday, Bitcoin plunged to around $78,000 Sunday

- $XRP and other major altcoins, including $ETH, were also in the red overnight

- Trump's tariffs have been affecting global financial markets in recent weeks

- Crypto executives are positive things will turn around for the better soon

The cryptocurrency market is in a wild downturn, crumbling over 8% in the last 24 hours amid a broader financial market crash amid the intensifying impact of U.S. President Donald Trump's global tariffs.

The crypto market is down 8.5% in the day, with Bitcoin among the leading losers over the weekend, plunging to $78,000 on Sunday, as per data from CoinGecko.

Bitcoin, $XRP, Other Major Altcoins Plummet

While Bitcoin's plunge over 5% Sunday was a big blow to the crypto industry, the crash of other major altcoins also contributed largely to the overall sector's downturn as they followed in BTC's downward spiral.

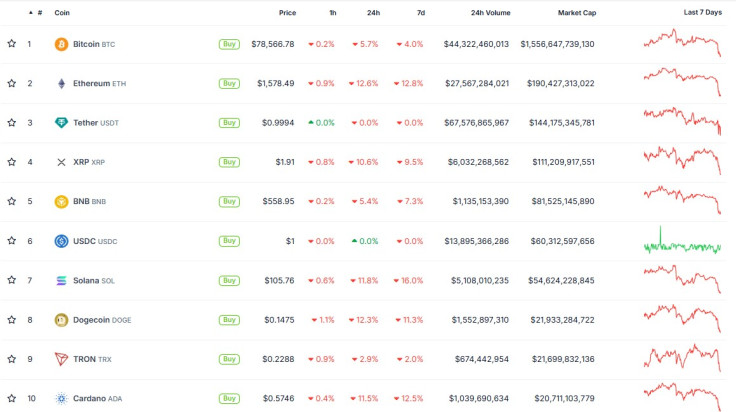

Ethereum (ETH), the world's second-largest crypto asset by market value, plunged 12.6%, XRP was down 10.6% to trade at around $1.91, Solana (SOL) shed 11.8%, Cardano (ADA) decreased by 11.5%, and BNB bled 5.4%.

Over in the meme coin segment, even the largest meme tokens were also down, including Dogecoin (DOGE), which was down over 12% overnight. Shiba Inu (SHIB) decreased 8%, Trump's official Trump token shed 14%.

A day earlier, Bitcoin was trading up to $83,000, but after the White House announced Sunday that over 50 countries have sought talks with Trump after last Wednesday's tariffs announcement, the world's most valuable digital asset saw a sharp drop.

Crypto Executives Attempt to Calm the Storm

Amid the rocky ground crypto is standing on due to "Crypto President" Trump's tariffs, crypto executives are attempting to calm down newbie crypto users and others who have been waiting long enough for BTC to bounce back above $100,000.

Cardano blockchain founder Charles Hoskinson said late Sunday that he still believes Bitcoin will hit $250,000 "within a year." He said it will be "a bumpy ride" to that price target, but as the crypto market has done in the past, "it bounces back."

"The markets seem hopeless and broken, but the bull market will be spectacular," Hoskinson projected.

Tyler Winklevoss, who co-founded the Gemini exchange with his twin, Cameron, said the world should note how Bitcoin held steady at $80,000 while the rest of the financial market plummeted.

For the first time in history, bitcoin is not moving in lockstep with the stock market. It's now behaving like a hedge to geopolitical uncertainty. When the stock market plunged during Covid, so did bitcoin. And this was always case over the last 10+ yrs. But not this time.…

— Tyler Winklevoss (@tyler) April 6, 2025

"It's starting to look less and less like a risk-on asset. We are in new territory," he said.

Pierre Rochard, the vice president of research at Bitcoin miner Riot Platforms, said that despite the ongoing broader market crash, BTC "is proving itself to be easier to liquidate" than stocks, real estate, gold, and bonds.

It remains to be seen whether Bitcoin will recover in the coming days should positive news emerge from talks between Trump and countries where his tariffs are having a negative impact.