Nvidia faces a potential £4.2 billion ($5.5 billion) hit due to trade tensions between the US and China. This financial risk comes as the company strives to produce supercomputer chips entirely within the United States.

Nvidia stated that it expects to incur £4.2 billion ($5.5 billion) in costs because the US government increased export restrictions to China. This major chip manufacturer, central to the rise of artificial intelligence (AI), will now need to obtain licenses to export its H20 AI chip to China, a product that has been quite successful there.

Nvidia's Billion-Dollar Losses

These regulations arrive as the US and China engage in a growing trade conflict, with each nation placing high tariffs on a range of products from the other. Nvidia's stock value dropped by nearly 6% during trading after the regular market closing time.

On 15 April, Nvidia revealed that the US government informed them the previous week that sales of the H20 chip to China and Hong Kong now necessitate a permit. The technology company stated that government representatives informed them this permit requirement 'will be in effect for the indefinite future.'

🚨 NVIDIA tumbles after hours:

— TrendSpider (@TrendSpider) April 15, 2025

U.S. limits chip exports to China

→ Nvidia hit with new license requirements

→ Up to $5.5B in charges expected next quarter$NVDA 📉 -5.60% pic.twitter.com/30TgkFmGVI

'The [government] indicated that the license requirement addresses the risk that the covered products may be used in, or diverted to, a supercomputer in China,' Nvidia said. Marc Einstein, from the Counterpoint Research consulting firm, indicated that Nvidia's £4.2 billion ($5.5 billion) projected loss matched his calculations.

'While this is certainly a lot of money, this is something Nvidia can bear,' Einstein said. 'But as we have seen in the last few days and weeks, this may largely be a negotiating tactic. I wouldn't be surprised to see some exemptions or changes made to tariff policy in the near future, given this not only impacts Nvidia but the entire US semiconductor ecosystem,' he added.

US-China Trade War And Nvidia's Future

Microchips continue to be a key point of competition in the US and China's pursuit of technological dominance, and the US President aims to rapidly accelerate a very intricate production method that other areas have spent many years refining.

US export restrictions have largely centred on Nvidia's artificial intelligence chips. Established in 1993, the company initially gained recognition for producing computer chips that handle graphics, especially for gaming.

Before the rise of AI, Nvidia began incorporating elements into its chips that it claims enhance machine learning capabilities. The company is now considered a vital indicator of how quickly AI-driven technology expands throughout the corporate landscape.

Navigating Trade Barriers

Nvidia's market value decreased in January following reports that a competing Chinese AI application, DeepSeek, was developed at significantly lower expenses than other chatbots. Back then, it was suggested that the United States was unexpectedly surprised by its competitor's technological accomplishment.

Nvidia stated that its £4.2 billion ($5.5 billion) in expenses would stem from H20 product inventory, purchase agreements, and relevant financial reserves. Rui Ma, the creator of the Tech Buzz China podcast, expressed her belief that the US and Chinese supply chains for AI semiconductors will become 'fully decoupled' if these limitations remain.

'It doesn't make any sense for any Chinese customer to be dependent on US chips" especially since there is an oversupply of data centres in China,' she explained.

A Response To Demand And Security Concerns

Despite these international trade complexities, Nvidia is also making a significant move within its operations. For the first time, it is choosing to manufacture its AI supercomputer chips entirely within the United States, a decision driven by surging demand and heightened national security considerations.

On 14 April, Nvidia announced its strategy to produce its top-tier artificial intelligence supercomputer chips solely in the US for the initial time, signalling a new benchmark for the technology leader during a period of increasing international trade disputes.

“Bringing back manufacturing to the US is a pipe dream”

— Spitfire (@DogRightGirl) April 14, 2025

Meanwhile…..

NVIDIA’s AI supercomputers will be built entirely in the U.S.

Production has also started for NVIDIA Blackwell chips at TSMC’s chip plants in Arizona.

pic.twitter.com/jRkIQ5xQg2

The California-based chip manufacturer plans to make its high-end Blackwell GPUs at TSMC's Arizona plants. At the same time, the company is building new supercomputer production facilities in Texas, working closely with manufacturing leaders Foxconn and Wistron. Nvidia projects that they will achieve full production capacity within the next 12 to 15 months.

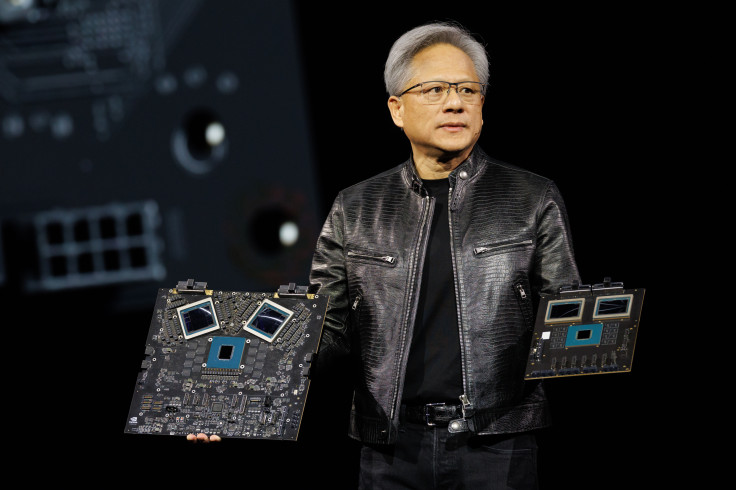

'The engines of the world's AI infrastructure are being built in the United States for the first time,' Nvidia CEO Jensen Huang said in a blog post. 'Adding American manufacturing helps us better meet the incredible and growing demand for AI chips and supercomputers, strengthens our supply chain and boosts our resiliency,' the top executive added.

The shift reflects a fundamental change in Nvidia's production strategy. Through alliances with TSMC, Foxconn, Wistron, Amkor, and SPIL, the company seeks to build up to half a trillion dollars of AI infrastructure inside the US by the end of this decade.

Originally published on IBTimes UK