KEY POINTS

- Most Americans would still choose cash over other assets, but 20.93% prefer crypto compared to 14% for banks

- Over 90% of the respondents demand 'complete transparency' over banks' management of their funds

- There is an apparent gap in the way the American public perceives traditional banking

The voice of people demanding change in the United States' current financial system is getting louder, as proven in a new survey by Web3 financial data platform TRES, which found that one in five Americans would opt for cryptocurrencies as an alternative to banks, stocks, and bonds.

TRES surveyed 1,032 respondents in the 18 to 60+ age range across the U.S. on Aug. 15, 2024 "to gauge their sentiments around the transparency and trust for banks today," as per a copy of the survey's results shared with International Business Times.

Public Trust in Banks Crumbling

The majority of Americans still trust banks, but approximately one in seven of them do not trust banks – the cornerstone of traditional finance (TradFi). "This statistic raises significant concerns as these institutions are an integral part in our everyday financial system," TRES' Banking on Trust: What Do You Really Know About Your Money Survey noted.

The report also found that "only 14%, or 7 out of every 50 people surveyed," chose banks as their most trusted asset class. A little over 22% of the surveyed chose real estate, and 28.88% opted for cash. Notably, 20.93% of the respondents chose cryptocurrencies.

Majority of Americans Demand 'Complete Transparency'

In terms of transparency, a staggering 90.70% of the respondents – almost exactly split between men and women – believe that banks should be mandated to provide "complete transparency" in their management and use of customer deposits.

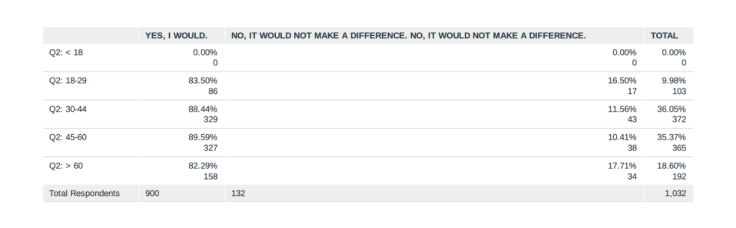

Respondents in the 30-60 age group were most concerned about transparency, with nearly 90% of them indicating that they would be "more likely to use a service that discloses how their money is being used."

Further proving the importance of transparency among American consumers, a total of 79.84% said they would no longer trust in their bank if they found out their money had been used to invest in risky ventures.

Knowledge About Traditional Banking

The survey found that more than 60% of adults aged 30-60 believe their money is always in the bank, while 55% of adults aged 18-29 and those over 60 believe their money isn't always in the bank. An overwhelming majority believe they can still withdraw all of their money deposited in a bank without problems.

"The survey also reveals a significant knowledge gap in how the public perceives banking operations, with many consumers unaware of how their deposits are actually managed and protected," TRES said.

For TRES, the survey's results uncover the current sentiment among Americans regarding traditional financial systems. It also provides banks with an idea of how U.S. consumers want their financial system to be: transparent, secure, and one that puts its clients' trust above all.