Walmart (WMT) stock is ripping higher on Tuesday, up more than 7% so far in the session after the retailer reported earnings before the open.

If the stock were to close here, it would mark Walmart’s biggest one-day gain since March 2020.

The company easily beat earnings and revenue expectations and at a time where investors are worried about inflation, a recession, and bloated inventories, management reassured them on that front too.

That came after they raised their profit forecast for the second time since summer.

Management now expects “adjusted earnings declining by between 6% and 7% from 2021 levels, an improvement from its prior forecast of a slump of between 9% and 11% and its July estimate of a 12.5% decline.”

A $20 billion buyback plan didn’t hurt, either.

It also helps that the overall market is rallying following a lower-than-expected inflation report this morning.

Trading Walmart Stock on Earnings

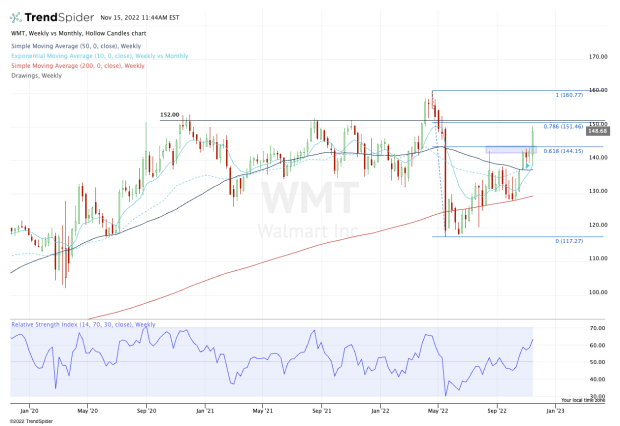

Chart courtesy of TrendSpider.com

Shortly after breaking out over the key $150 area, Walmart stock ran to $160 and then was crushed. In the span of just five weeks, shares cratered 27%, including a one-week decline of more than 20%.

In any regard, shares have been slowly but surely grinding higher, as the $117.50 to $120 area held as support.

With the rally on Tuesday, Walmart stock is vaulting over resistance in the $142 to $144 area.

As it pushes higher, I can’t look past the $150 area. Not only was this level a critical resistance mark for several years before a short-lived breakout earlier this year, but it’s also where the 78.6% retracement comes into play.

If the stock can somehow push through this area, then it opens the door back up to the $160 area.

However, the healthier setup would be to find the $150 to $152 zone as resistance and for Walmart stock to reset on the daily chart and find buyers at short-term, active support (like the rising 10-day moving average).

On the downside, holding $142 to $144 should be bulls’ top concern right now. If it can do that, Walmart stock looks relatively healthy as it trades well on earnings.