The Dow Jones Industrial Average has been closely watched for more than 100 years. “Dow Drops 1,000 Points!” or “Dow Surges 750 Points!” really catches investors’ attention.

But this year many investors may not have noticed how much the index has lagged.

Of the four major U.S. stock market indexes — S&P 500, Nasdaq, Russell 2000 and Dow Jones Industrial Average — the Dow has been the worst performer so far in 2023.

Don't Miss: Buy the Dip in Nvidia Stock? Check the Chart First

The index sports a year-to-date loss of roughly 2%, trailing the Russell 2000’s 0.5% loss. The S&P 500 is up more than 4%, while the Nasdaq has soared over 13%.

The Dow is also the only index on the list that hasn't traded above its fourth-quarter high so far this year.

Oddly enough, despite a sluggish few months to start the year, the Dow’s 6.7% drop over the past 12 months is the best performance in the group, while the Nasdaq remains the weakest in that stretch, down 17.5%.

So where is the Dow heading next?

Trading the Dow Jones Industrial Average

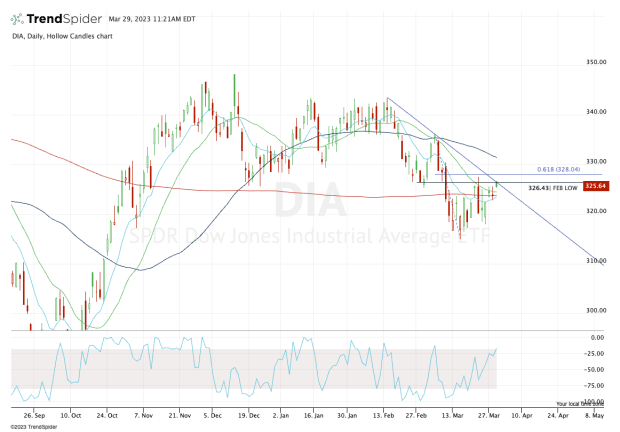

Chart courtesy of TrendSpider.com

For the chart above, I’m using the SPDR Dow Jones Industrial Average ETF Trust (DIA) rather than the actual index, as far more investors buy and sell and the DIA.

The DIA ETF has done a great job at finding support in the $316 to $318 range. It has also done well to get back above a majority of its daily moving averages, with the exception of the 50-day.

Now, though, it’s not hard to see where the DIA ETF is struggling.

The Dow needs to clear downtrend resistance (blue line) and regain last month’s low. It would also help if it cleared the 61.8% retracement of the current range (near $328).

If that's done by the week’s end, the DIA ETF will have technically avoided a monthly-down rotation.

While that doesn’t necessarily save it from more selling pressure, regaining the above levels would give a tremendous boost to the technicals and open the door back up to a test of the 50-day moving average.

Ultimately, the bulls are looking for a push back into the mid-$340s. On the downside, a break of $322.50 puts the DIA ETF back below all /its daily moving averages and opens the door back down to recent support.

Below the March low near $315 could put $310, then $300 on the table.

Action Alerts PLUS offers expert portfolio guidance to help you make informed investing decisions. Sign up now.