Shares of Take-Two Interactive Software (TTWO) are now down less than 1% on Monday, following some disheartening news for its developers.

Game-play footage leaked from its highlight anticipated Grand Theft Auto VI.

On the plus side, the stock has clawed back. At its low, the shares were down 2.5% shortly after the open. The stock in the premarket was lower by as much as 6.5%.

Still and all, the run for videogame stocks this year has not been easy.

Shares of Take-Two Interactive are down 19% over the past 12 months and 31% this year. Electronic Arts (EA) has fared better — down 7.9% so far in 2022 — but has fallen more than 8% in the past month.

Even Activision Blizzard (ATVI) has been under pressure. That comes as Microsoft’s (MSFT) pending acquisition of the game maker hits some regulatory snags.

Videogame stocks have surely been struggling lately. Let's focus on a key member of the group.

Trading Take-Two Stock After GTA IV Leak

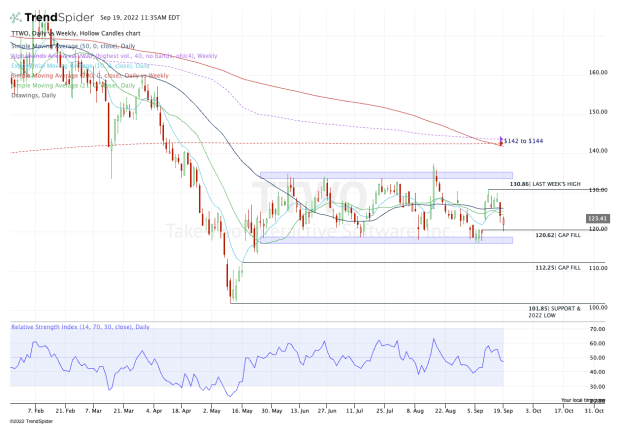

Chart courtesy of TrendSpider.com

The chart for Take-Two stock is pretty cut and dried: The shares are range-bound between support at $118 to $120 and resistance near $133.

In that range, the shares continue to chop around the 10-day, 21-day and 50-day moving averages. Take-Two has had no real direction since its sharp rebound off the $102 area.

The stock dove lower in May, carved out a low in the $100s over a three-day span, then surged higher on earnings. Amid that post-earnings pop, Take-Two shares were able to reclaim the $118 to $120 zone, which has gone on to become strong support.

This morning’s dip filled the gap from earlier this month at $120.62. With a bounce under way, there’s not much for traders to do until the range breaks.

Put another way, buyers are likely to step in around $118 to $120 and sellers are likely to step in around $132 to $135.

If support gives out and Take-Two stock trades lower, look to the gap-fill level at $112.25 as one potential destination. Below that opens the door back down to $102.

If resistance gives out, look first for a test of the August high near $137.50. Above that opens the door to the $142 to $144 area, which contains the 200-day and 200-week moving averages, as well as the weekly VWAP measure.