Semiconductor stocks were seeing a surge in price on the morning of Nov. 15.

The better-than-expected PPI report helped add fuel to the recent rally in the overall stock market and tech stocks have been trading quite well lately — particularly semiconductor stocks.

In fact, we recently looked at a setup in Nvidia (NVDA), as well as a setup in Advanced Micro Devices (AMD), as both stocks have traded quite well lately.

However, the latest action in the space comes as Warren Buffett’s Berkshire Hathaway (BRK.B) (BRK.A) filed its Form 13F with the SEC.

It showed that Berkshire acquired more than 60 million shares in Taiwan Semiconductor (TSM) in the third quarter, spending more than $4 billion in the process.

With today’s 12% rally, that stake would be worth just a hair under $5 billion. That’s of course, if Buffett & Co. haven’t altered the position by adding more or taking some profits.

Trading Taiwan Semiconductor After Buffett’s Buy

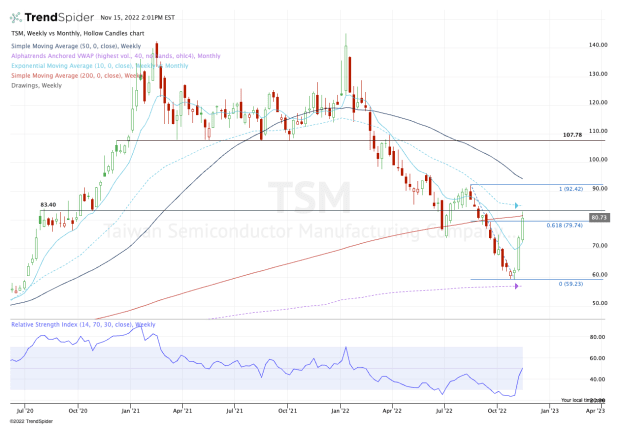

Chart courtesy of TrendSpider.com

Even amid a horrendous year where shares of Taiwan Semi suffered a peak-to-trough decline of 59%, the stock remains a titan within the space. Commanding a market cap of more than $400 billion, it’s not one to ignore if an investor is looking for exposure to semiconductor stocks.

With a valuation of just 12 times this year’s earnings — even after rallying 37.5% off the recent low — one can imagine why Buffett was enticed.

Chips Stocks Shows Signs of Life

I am rooting hard for the chip stocks. Not only are they leading indicators in the market, but they are fan-favorites among investors. When times are good, bulls can’t seem to get enough AMD, Nvidia and Taiwan Semi.

This rally is a reminder of just how much investors want to own these stocks, even when they are struggling.

As much as I want to see Taiwan Semi rally from here, it’s hard to ignore the significance of where it’s trading on the charts.

The $80 to $83 area includes the 200-week moving average and the 61.8% retracement of the current range. It also includes the very notable breakout area from 2020.

Aided by some news-related selling in the overall market, Taiwan Semi stock is fading a bit from this area.

On the downside, bulls would love to see the stock stay north of $74 and the 10-week moving average. That keeps the bulls in active control.

On the upside, a move over $84 and the 10-month moving average opens the door to the low-$90s and the 50-week moving average. Above that puts $100 in play.