Things didn't look good this morning for investors in Royal Caribbean (RCL). The cruise line's shares opened lower by 7% on Thursday after the company reported earnings.

The lower open came after the stock declined about 10% over the prior sessions and followed the company’s mixed third-quarter results.

The company beat on earnings expectations with non-GAAP profit of 26 cents a share and posted in-line revenue of $2.99 billion. But it reported a disappointing top- and bottom-line outlook for the fourth quarter.

It didn’t help that the stock market gapped lower to start Thursday’s session following its bearish close on Wednesday after the Federal Reserve FOMC meeting.

But investors quickly flipped the script, erasing Royal Caribbean stock’s 7% loss and pushing it to a 5% gain.

It's having a positive impact on its peers as well, as Carnival Cruise (CCL) and Norwegian Cruise Line (NCLH) both opened lower on the day as well but are now up 3% and 4%, respectively.

Trading Royal Caribbean Stock

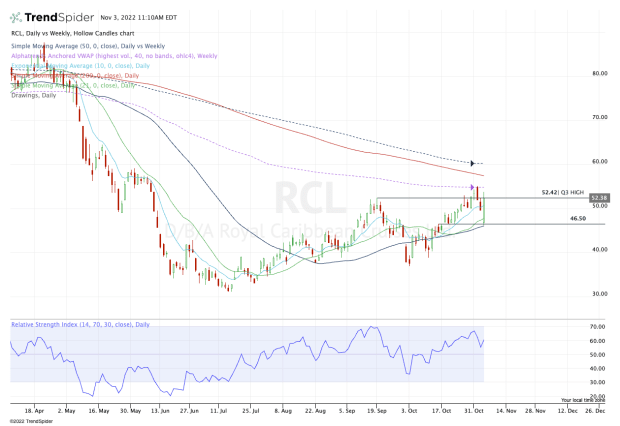

Chart courtesy of TrendSpider.com

When you look at enough charts, certain things jump out at you right away. Sometimes that occurs even when you’ve just glanced at a particular chart.

For Royal Caribbean stock, two things immediately jump out.

The first is the rapid “red to green” move we saw this morning, as the shares flipped from negative territory to positive territory after a test of the 50-day moving average.

Second, I see the stock approaching a big-time hurdle in the mid-$50s, with plenty of potential overhead resistance. On top of that, it’s struggling with its third-quarter high of $52.42.

Let’s not mince words: Royal Caribbean stock is not out of the woods. But today’s reaction -- particularly amid broader market weakness -- is highly encouraging for the bulls.

At the very least, the longs now have a risk level to measure against, down near $45 to $46.

A break of this zone not only puts Royal Caribbean stock below the post-earnings low and the key reversal level, but also below all its short- and intermediate-term moving averages and recent support near $46.50.

Below all those measures and the bulls lose their justification for being long (from a technical analysis perspective).

On the upside, the bulls need to see the stock reclaim the third-quarter high. Above that opens the door to the recent high at $55.05, along with the weekly VWAP measure.

Above that could put the 200-day moving average in play near $57.50, followed by the 50-week moving average near $60.