Shares of Activision Blizzard (ATVI) and Microsoft (MSFT) are getting plenty of attention this week.

That’s as reports on Monday suggested that the software giant's proposed $69 billion buyout of the videogame stalwart is hitting another snag with overseas regulators.

Then, of course, Activision Blizzard reported earnings on Monday night.

ATVI shares are rising, up about 5% at last check, after the company beat on revenue estimates but missed on earnings expectations.

As if that all weren’t enough, Microsoft on Tuesday held an event centered on its AI efforts and its recent investment in ChatGPT parent OpenAI, the integration of ChatGPT, and its other AI advancements.

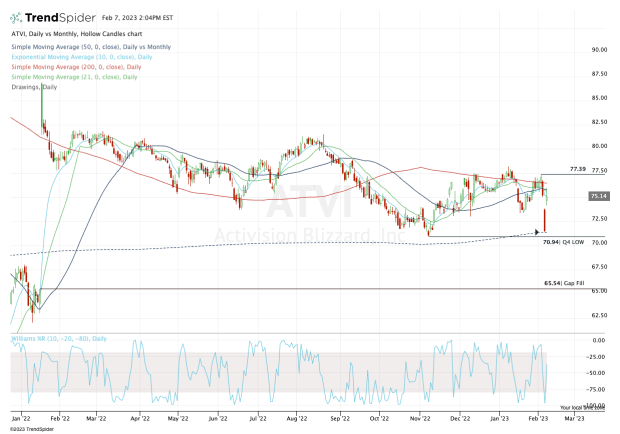

Trading Activision Blizzard Stock on Earnings

Chart courtesy of TrendSpider.com

Yesterday’s bearish action sent Activision Blizzard stock tumbling into the 50-month moving average and nearly into the fourth-quarter low.

We’re seeing a bit of a relief rally in those shares today, but with so much overhead resistance, the stock does not have an easy path forward.

Just above the current stock price are the 10-day, 21-day, 50-day and 200-day moving averages.

If Activision Blizzard stock can clear all these measures, as well as $77.50, it would open the door to potentially much higher levels from here. The low-$80s would be a good start. Keep in mind, the buyout price is all the way up at $95 a share.

On the flip side, a break of the fourth-quarter low near $71 would be quite bearish and open the door to a potential gap-fill down near $65.50.

Note: News tied o Microsoft’s buyout could have a binary impact on Activision Blizzard stock.

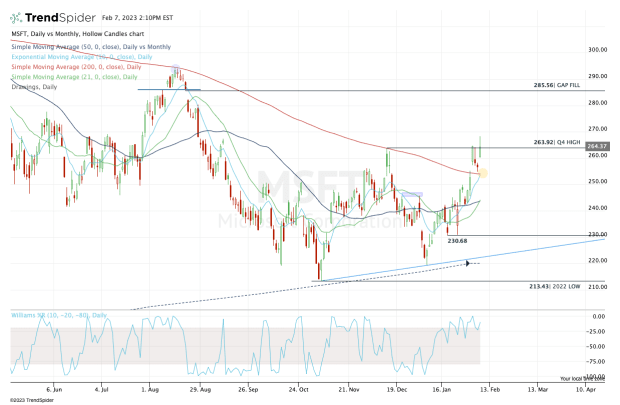

Trading Microsoft Stock

Chart courtesy of TrendSpider.com

Microsoft stock continues to struggle to clear the fourth-quarter high near $264.

If it can do so, Microsoft stock will sit above all its daily moving averages and open the door up to the gap-fill near $285.50.

On the downside, a pullback to the $253 area would likely bring out some buyers. That’s as Microsoft stock would be retesting the 10-day and 200-day moving averages. Or at least that's the case if it happens in the next day or two.

But a break of this level and a move below $250 opens the door down to the low-$240s. Currently, both the 21-day and 50-day moving averages are near $243, which would be a reasonable bounce spot for Microsoft should it fall that far.