Shares of Lyft (LYFT) are higher by almost 4% on Wednesday and are trading near the session high.

The move comes after the company reported earnings after the close on Tuesday.

While revenue grew 70% year over year last quarter, guidance fell short of expectations. As a result, shares were lower in pre-market trading.

However, that’s not the case now that the stock market is open. Of course, it helps that the overall market is higher on the day as well.

Now Uber (UBER) will report earnings tonight, a report that investors are watching to see if it can add more momentum to the duo and the "reopening trade" stocks as a whole.

Some have even speculated whether these Uber and Lyft could merge.

In the meantime, let’s look at the charts.

Trading Lyft Stock

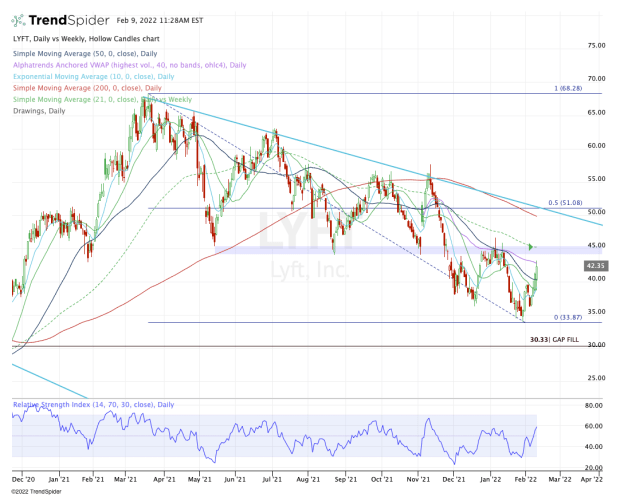

Chart courtesy of TrendSpider.com

There are positives and negatives going on here with Lyft stock. Shares are working on a fourth straight daily rally and have pushed through the 10-day, 21-day and — at least for now — the 50-day moving average.

However, it’s far from out of the woods. The stock continues to make a series of lower highs and lower lows.

Further, provided the stock can push through the daily VWAP measure, there is a very significant area near $45 just above.

Not only does this level contain the declining 21-week moving average, but it has been a significant support/resistance zone over the past several quarters. For now, investors should respect this level as potential resistance.

However, should the stock burst through it — potentially on a strong report or commentary from Uber — then there’s good reason to talk about the $50 area.

Not only is the $50 level psychologically relevant, that’s where we find the 50% retracement of the current range, downtrend resistance (blue line) and the declining 200-day moving average.

Trading Uber Stock

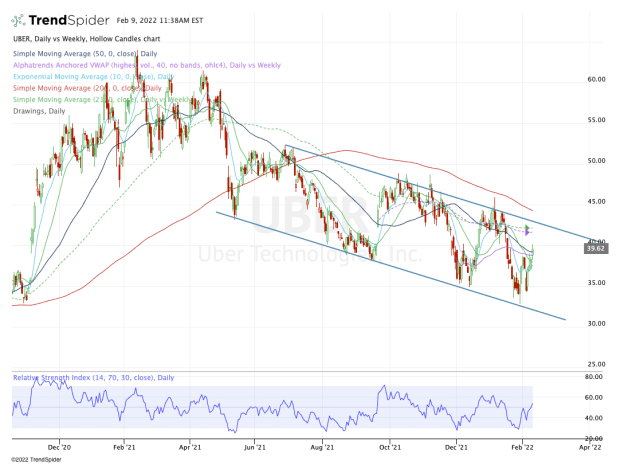

Chart courtesy of TrendSpider.com

As for Uber, the stock is set to report earnings tonight after the close.

Shares have been trapped in a bearish channel, as it puts in a series of lower highs and lower lows — sound familiar?

Like Lyft, it’s been unable to generate a meaningful bounce. If it rallies on earnings, see how it handles the $42 to $43 area. There it finds the declining 21-week moving, weekly VWAP measure and channel resistance.

A break out over the measures could put the 200-day moving average on the table.

On a bearish reaction, I’d like to see $35 hold as support, otherwise last month’s low and channel support are likely in play.