Intel (INTC) stock has been mixed on Tuesday, trading higher, then lower on the day.

Shares are currently back on the positive side in the early afternoon, up about 1.3% after Intel announced it will buy Tower Semiconductor (TSEM) for $5.4 billion.

The move sent Tower Semi soaring on the day, up more than 40% so far in the session.

That said, the stock is still trading well below the $53 buyout price.

While investors may find that stock more worthwhile in terms of an investment, I’m not here to look at Tower Semi or a potential arbitrage opportunity. Instead, I want to look at Intel.

Intel stock has not performed all that well lately, although it’s trying to find its footing. We could say the same thing about Advanced Micro Devices (AMD) and Nvidia (NVDA), the latter of which reports earnings later this week.

However, these two stocks have performed very well over the past year, while Intel continues to lag.

For now though, shares are holding a key level on the chart. Let’s have a look.

Trading Intel Stock

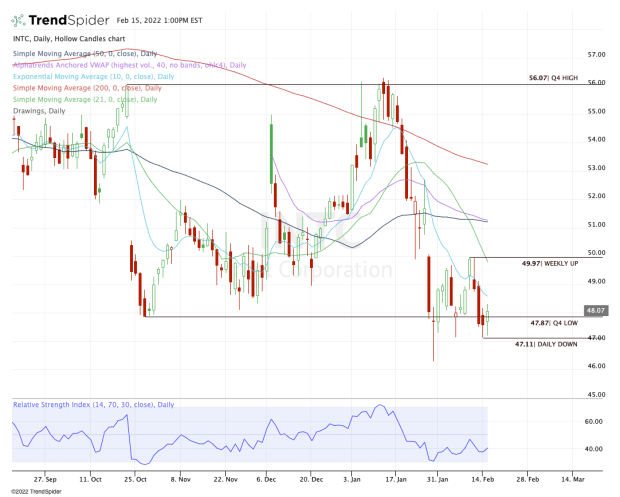

Chart courtesy of TrendSpider.com

Shares continue to dance around the fourth-quarter low at $47.87. This morning, Intel stock flirted with a daily-down move below $47.11, but buyers stepped in at just the right time.

Now back above the fourth-quarter low, bulls are looking to see if Intel stock can power up some more gains. If the stock can clear the 10-day moving average, then bulls can try for a run up to the $50 level.

Not only is that a nice round number to shoot for, but it’s also around the 21-day moving average and last week’s high.

On the downside, keep the fourth-quarter low on your radar. If at any point Intel stock drops below that level, then it opens the door down to the $47 area, where buyers have consistently come into play.

A break of this level is followed by the January low at $46.30, which is also the one-year low.

While all this may seem to make very little difference, these levels are important. A close below the January low could open the door down to the low-$40s, which has consistently been support over the last few years.