Bitcoin and ethereum are getting thrashed on Wednesday, which are down 9% and 13%, respectively. That’s as more fears continue to circulate throughout the industry.

On Tuesday, reports surfaced that Binance would buy FTX, as the latter struggled through some immense liquidity issues.

On Wednesday though, some reports are surfacing that the deal may fall through now that Binance has a better idea of what it’s getting involved with.

Coinbase (COIN) and Robinhood (HOOD) have also taken a beating, which shares both down more than 10% at one point today.

Worth noting is that FTX CEO Sam Bankman-Fried owns a notable stake in Robinhood.

While everything may work out just fine, "liquidity issues" are never something investors want to hear and it has them rightfully spooked.

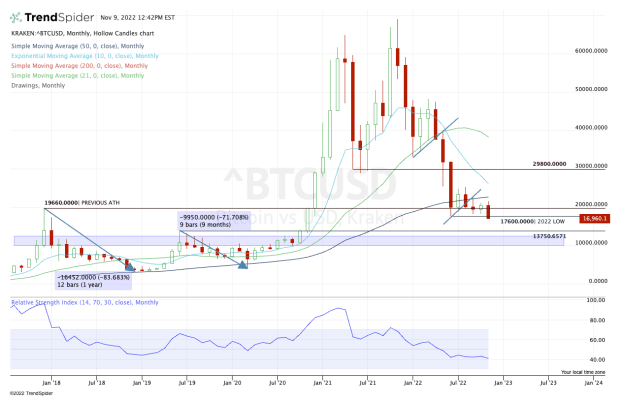

Trading Bitcoin

Chart courtesy of TrendSpider.com

Bitcoin is breaking to new 2022 lows with this week’s decline. Now down about 75% from the highs, it’s in between the correction size of its last two major declines.

That’s when it fell 83.6% in 2018 and 71.7% in 2020.

On the downside, two major levels stick out to me right now: $13,750 and the $10,000 to $12,000 zone.

The first level was a major breakout mark after the covid-19 pullback.

The second zone was a notable resistance area for several years, despite a few short-term rallies above it. A test of this area — particularly near $10,000 — would likely draw in buyers, at least for some temporary reprieve.

On the upside, watch the prior low at $17,600. That goes back to this summer when bulls saw a strong bounce from this area.

If bitcoin can reclaim this level, we may have a bullish reversal on our hands, opening the door to $20,000-plus.

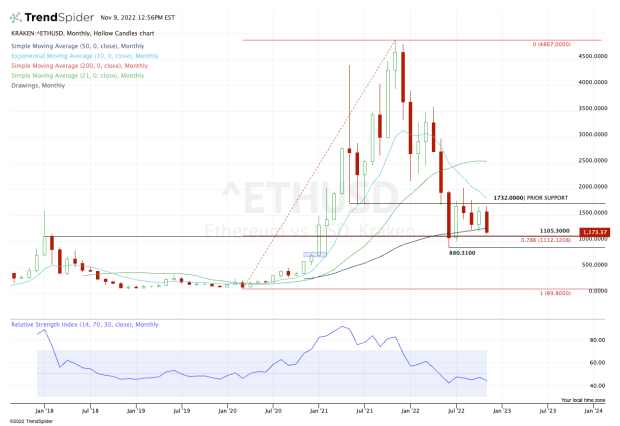

Trading Ethereum

Chart courtesy of TrendSpider.com

Looking at ethereum, it’s trading much better than bitcoin. For one, it hasn’t broken to new year-to-date lows.

Instead, it continues to chop around the $1,000 to $1,100 zone, trying to hold the 50-month moving average and the 78.6% retracement.

If it can do that and avoid making new lows below $880, then bulls have an argument for remaining long. The problem is, one bad bit of news can tank ether lower.

Below $1,100 opens the door to $1,000 and below that, the $880 low is back in play. If ethereum trades below all of these levels, then the $750 zone could be on deck.

On the upside, $1,700 to $1,750 remains resistance, alongside the 10-month moving average.

While that would represent a big rally from current levels, ethereum cannot enjoy a sustained uptrend until it clears this zone.