Apple (AAPL) stock has been on fire, helping lead the megacap-tech rally, which in turn has helped propel the stock market higher.

The Nasdaq and S&P 500 sport strong gains as we near the halfway mark of the year.

The Nasdaq is up about 30%, while the S&P 500 is up roughly 15%. Both figures, however, lag Apple, the world’s largest public company. Apple stock sports a year-to-date gate of about 46% and is on the verge of hitting a $3 trillion market cap — again.

The stock made its 52-week low on Jan. 3, the first trading day of 2023, and it has rallied in every month this year. The stock is up about 7% so far in June and that streak doesn’t look as if it will come to an end this month.

Microsoft (MSFT) — the second largest U.S. stock — is on a similar streak, which helps explain the performance of the S&P 500 and Nasdaq in 2023.

Don't Miss: Nvidia Falls on Chip-Export Worries. Here's Where to Buy The Dip.

More recently, Apple's run has been particularly impressive.

If Apple finishes higher this week, it will be its 13th weekly gain in the past 16 weeks. In that span, the shares have rallied almost 30%, while the three down weeks were just 0.15%, 0.12% and 0.58%.

In other words, it’s more than just Warren Buffett out there buying this name.

Trading Apple Stock

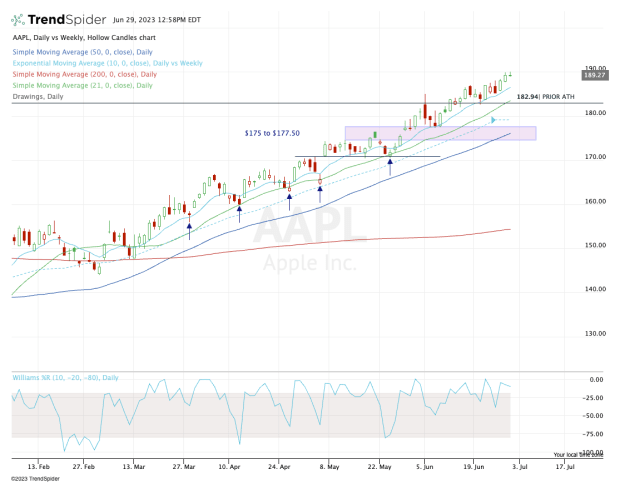

Chart courtesy of TrendSpider.com

I’m not a doomsday writer by any stretch, but I can’t help but think about the last time Apple was knocking on the door of — and momentarily breached — the $3 trillion mark.

It last did so in January 2022, right at the cusp of an all-time high in the stock market and right before the volatility really picked up pace.

To be certain, I’m not saying that that will happen again, but it’s hard not to think about as Apple hits another high and as investors still have plenty of worries and concerns about the Federal Reserve and the economy.

Don't Miss: Alphabet Has Helped Drive the Nasdaq; Here's Where to Buy the Dip

Over the past few months, buyers have been stepping in on each dip to the 21-day moving average.

If there’s a quick pullback in the stock that aligns with the 21-day moving average and the prior all-time high near $183, that’s a potential buying opportunity.

Otherwise, the bulls might consider waiting for a dip into the $175 to $177.50 zone. Not only was this a key support/resistance zone amid the rally, but it’s about where the 10-week and 50-day moving averages come into play.

July 4th Sale! Receive full access to real-time market analysis along with stock, commodities, and options trading recommendations. Sign up for Real Money Pro now for 65% off.