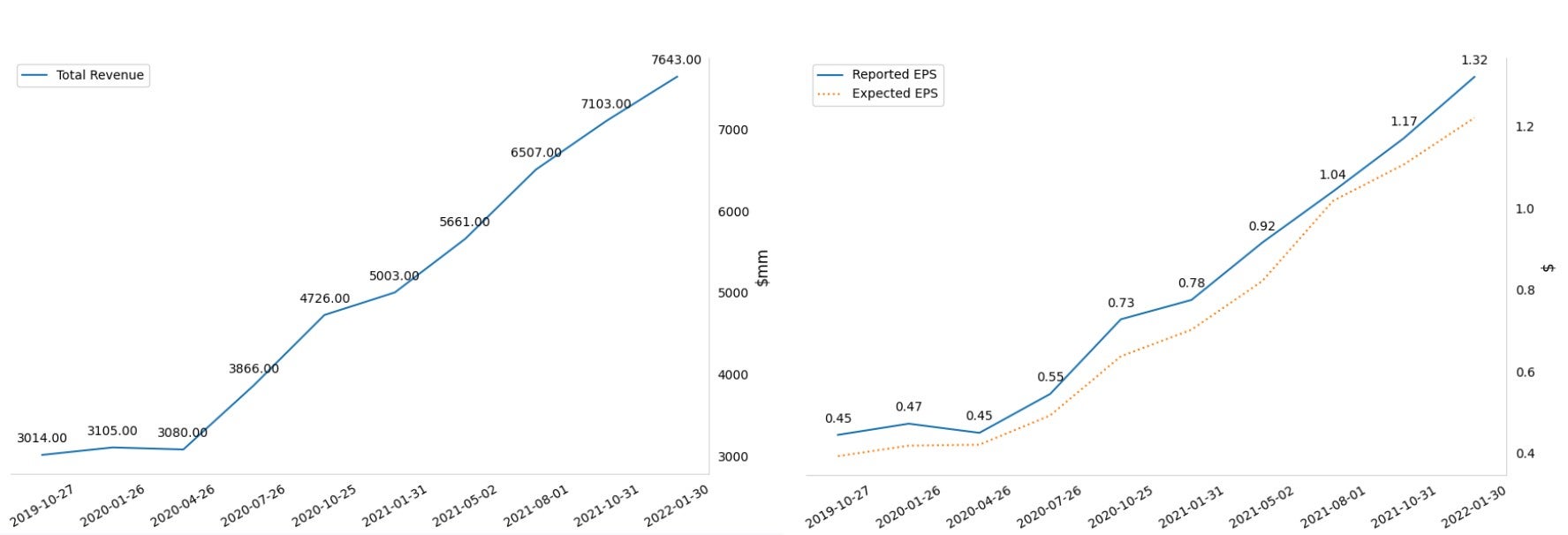

Fundamentals

Nvidia Corporation reported its earnings for the quarter ended March 31, 2022 on 05/25/2022 after market close.

The company expected revenues of $8.09 billion, indicating a 43.1% YOY increase and a 5.9% increase from the previous quarter. The company anticipated earnings per share of $1.29, indicating a 40.2% increase from the prior-year but a 2.3% decline from last quarter. The reported revenue and EPS were $8.29B and $1.36, beat analysts' estimates by 2.40% and 4.98% respectively.

Price Actions

Semiconductor stocks has been following the general market downtrend over the past few months. Stock price of NVDA has been down more than 50% from its peak last November. It was closed at $161.5 on May 24th, near one year low. The stock bounced back about 2% as of noon 05/25 and closed at $169, and 5.1% jump from the previous day. The put-call ratio is currently 0.67, implies that the market has a neutral to slightly bullish view for NVDA's post-earning move.

Implied Volatility

Going into the earnings, the IV has been expanding significantly primarily driven by the overall market selloff. The current IV percentile (as of 05/24 after market close) is 88.9% and IV Rank is 70.8%. This means the current IV is close to its peak over the course of last 252 trading days. Therefore, a volatility crush strategy seems reasonable.

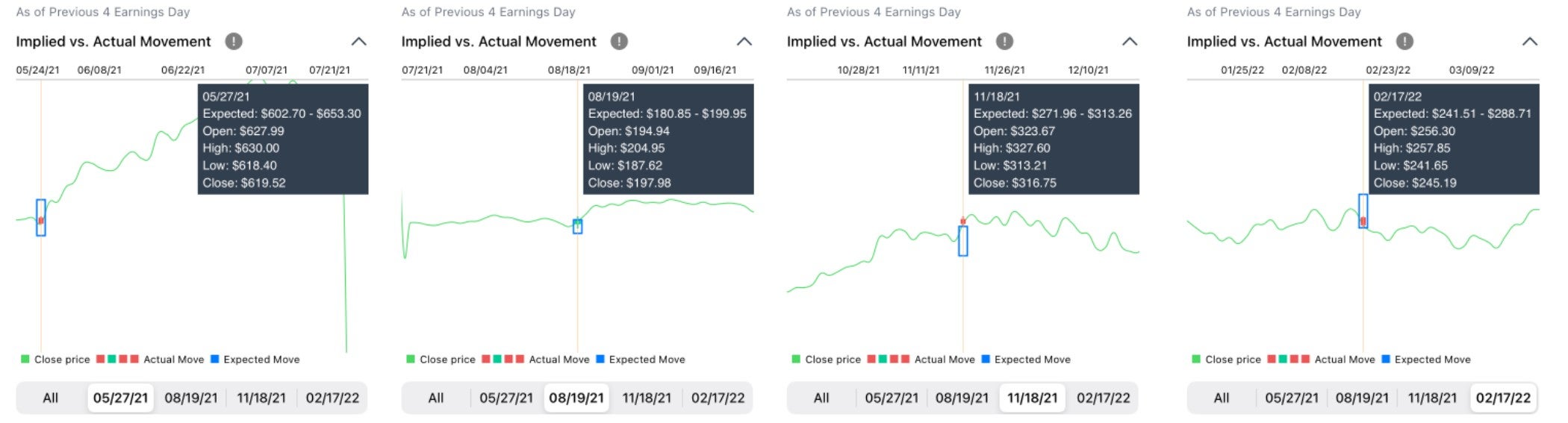

Implied vs. Actual Moves

NVDA stock was closed around $169 on May 25th. The at-the-money straddle expired on May 27 is priced at $18. This means that the market expectation of the post-earning price move is between $169± $18. This is known as the implied move. The closest strike price to the stock price then was $167.5. The chart below is a demonstration of how the straddle is constructed. The breakeven points is equivalent to the expected post-earning moving range.

During the last 4 earnings, the actual moves by-and-large closed within the market expectations except for the one in November when NVDA stock was at its peak. The market environment however has been dramatically changed since then, and leave less potential for such a bullish move.

Iron Condor Setup and Management

Enter

On May 25th before market close, NVDA stock price was at $168 and straddle cost was $18, so the iron condor was built in the following way:

Strike prices for the short legs are based on the implied moves:

Step 1: Sell $150 (168-18) Put

Step 2: Sell $187.5 (168+18) Call

Selection of the strike prices for the long legs are based on my risk tolerance:

Step 3: Buy $145 (150-5) Put

Step 4: Buy $192.5 (187.5+5) Call

Expiration date for all 4 contracts is May 27th, 2022. I choose $5 width spreads on both the call and put sides. The breakeven points at expiration date are $148.5 and $191.5. The total credit (max profit) collected from this trade is $150, and the max loss $350 ($5*100 - $150). The probability of profit of this trade is above 70% before earnings announcement. This chance is much higher if the earnings effect is eliminated.

The current spread of $5 is based on my risk tolerance and is relatively small. With a smaller spread, the Greeks on the long and short are more similar, so you won't see much profit until the Greeks start to collapse much closer to expiration. You'll also see a favorable shift in your break evens and probability of profit with wider spreads. Yet a wider spread will also introduce higher max loss. Therefore it's up to you to choose spread size.

Outcome

NVDA stock crashed down 6% after earnings announcement, the lowest it got was $153, which was still within the expected range. Shortly after market open on 05/26, stock rallied back up and led to a non-mover situation, and my Iron Condor generated $130 profit in total. Seeing that the stock continues going up, I rolled up my put spread from 145/150 to 162.5/167.5 and collected $50 credit but leave the call spread intact. So now I have a new Iron Condor with a smaller gap between the put and call sides. The current ATM straddle is priced at $7, which is well within Iron Condor's profit range. If the stock price remain at the current level and the IV continuously drop, I'm expecting a additional $30-$40 profit.

Caveats

- It is NOT recommended to hold the strategy through expiration even if the price looks safe. Gamma risk can be dangerous.

* Disclaimer: this is just my personal insight which is not construed as investment advice.

Research tool by: www.odds.trade