Nvidia shares moved higher in mid-day Tuesday trading, following their biggest market-value decline on record, as analysts continue to reset price targets and profit forecasts following the emergence of China's DeepSeek AI agent.

Nvidia (NVDA) plunged more than 17% on Jan. 27, shedding nearly $600 billion in market value, amid a broader tech selloff tied to concern about the success of China-based DeepSeek's new AI tool, which is now the fastest-selling app on the Apple APP store.

💰💸 Don’t miss the move: SIGN UP for TheStreet’s FREE Daily newsletter 💰💸

The AI startup, founded in 2023, claims to have built and developed a large language model system for less than $6 million, a fraction of the costs born by U.S. giants such as OpenAI and Meta Platforms (META) , with performance benchmarks that are equal to or better than those of the leading chatbots.

DeepSeek's founding research papers suggest it's using Nvidia-made H800 chips, a lower-end version of the tech giant's AI offerings, which are are designed to comply with U.S. export restrictions on the sale of tech gear to China.

Related: Some tech stocks rallied despite DeepSeek driven selloff

"Inference requires significant numbers of Nvidia GPUs and high-performance networking," Nvidia said in a statement. "DeepSeek’s work illustrates how new models can be created using that technique, leveraging widely available models and compute that is fully export control compliant."

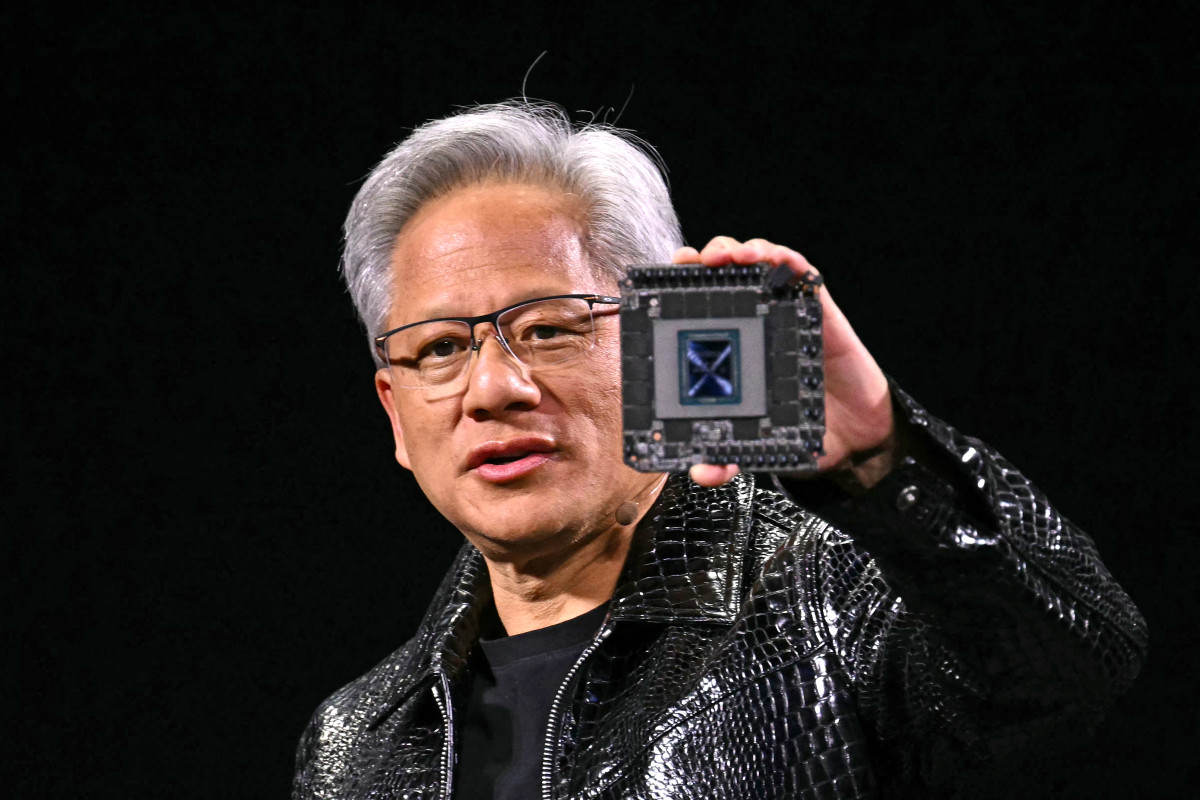

Nvidia's role in DeepSeek's development, however, didn't soothe investor concerns that it could lead to a plunge in demand for its more expensive chips, including the new Blackwell GPUs, as rivals look to duplicate the startup's success in developing powerful AI tools at a fraction of the current cost.

Have AI capital-spending plans been reset?

Capital-spending plans for the biggest U.S. hyperscalers, including Microsoft (MSFT) , Amazon (AMZN) , Google parent Alphabet (GOOGL) and Facebook parent Meta, have soared over the past year and are likely to reach at least $300 billion over the next one.

Should these key customers — the largest providers of cloud infrastructure and services — pull back on spending, and on their purchases of high-end graphics-processing units such as Blackwell — investors will need to overhaul their revenue, margin and profit assumptions for what is now the world's third-largest tech company.

Related: DeepSeek rattles tech stocks ahead of Microsoft, Meta earnings

"If DeepSeek’s innovations are adopted broadly, an argument can be made that model training costs could come down significantly even at U.S. hyperscalers, potentially raising questions about the need for 1 million XPU/GPU clusters as projected by some." said Raymond James analyst Srini Pajjuri.

"A more logical implication is that DeepSeek will drive even more urgency among U.S. hyperscalers to leverage their key advantage [access to GPUs] to distance themselves from cheaper alternatives," he added.

Morgan Stanley analysts, led by Joseph Moore, argued that the market's reaction to DeepSeek's innovations was "probably more important than the cause" and sees the potential for a pullback in spending assumptions but remains bullish on the sector more broadly.

The investment bank's analyst lowered his price target on Nvidia stock by $14 to $152 a share in a note published Tuesday. He suggested that DeepSeek's rapid development using export-compliant chips could lead to tighter regulations from the U.S. government.

DeepSeek is 'wakeup call'

President Donald Trump called DeepSeek's emergence a "wakeup call" for U.S. tech firms that are set to spend billions in the global AI race, adding that "we need to be laser-focused on competing to win."

Last week, the president unveiled a three-way AI joint venture among Oracle (ORCL) , Microsoft-backed OpenAI and Japan's SoftBank (SFTBY) , called Stargate. He said it would attract $500 billion in investments in U.S.-based infrastructure while creating 100,000 new jobs "almost immediately."

Commentary from Microsoft, Meta and Apple (AAPL) , each of which reports December-quarter earnings this week, will likely play a larger role in the market's recalibration of AI-spending assumptions and the impact that DeepSeek's developments will have on the broader sector outlook.

Related: Top analyst revisits Nvidia stock price target amid DeepSeek threat

"The dust is now settling after Monday’s long overdue AI reckoning," said Emily Bowersock Hill, founding partner and CEO of Bowersock Capital Partners in Lawrence, Kan. "And while we still believe in the AI-driven productivity story, investing in this sector going forward may not be as easy as it was over the past two years."

"If China has truly learned to develop a powerful AI model with a fraction of the budget and much less infrastructure, that would constitute a shock, but likely not big enough to derail this bull market," she added.

More AI Stocks:

- Veteran fund manager reveals startling AI stocks forecast for 2025

- Meta’s new vision could change both AI and social media

- Analysts reveal AI stock picks for 2025, including Palantir

Nvidia, which is set to post fiscal fourth-quarter earnings on Feb. 26, told investors last autumn that it expected a revenue tally of $37.5 billion at the end of January.

For its Blackwell processors alone, Wall Street analysts expect several billion of revenue in Nvidia's fourth quarter, with totals of $62 billion in 2025 and $97 billion in 2026.

Nvidia shares were last marked 7% higher in mid-day Tuesday trading and changing hands at $126.74 each.

Related: Veteran fund manager issues dire S&P 500 warning for 2025