We talk a lot about what traders should do to remain disciplined as they wade through the often choppy waters of the market. Today, we’re looking at the opposite: what traders shouldn’t do. We’re breaking out our list of the top 5 best ways to lose money trading options.

Well known options trading subreddit Wall Street Bets has famously perfected this art, so alongside each of these warnings will be a cautionary tale sourced from Reddit’s most popular stock market community. If you’re easily offended by soul-crushing option losses, this is your trigger warning: turn back now.

Still here? Good. Let’s start with an easy way to lose money trading options:

5. Buying options that are too far out-of-the-money

This one is common amongst option trading newbies. It goes like this:

- You think stock XYZ is going up.

- You buy a call option.

- The stock is $100 per share, but you’re buying the $150 strike call with a delta of 0.0067.

- Over the week, the stock rises 5% to $105 per share! What a gain!

- Wait a second… Why aren’t my options going up?

Answer: You bought options that have a very low probability of profit. Yes, you were right about the direction of the stock movement, but it wasn’t moving fast enough to increase the probability of your option expiring in-the-money by the expiration date you chose!

In short: Theta ate your options

To avoid this mistake, get familiar with delta. Delta is the option greek that measures your option’s sensitivity to dollar moves in the underlying stock. But many also view delta as a proxy for an option’s probability of expiring in-the-money. That 0.0067 delta option you bought? You can think of that as having a 0.67% chance of expiring ITM.

Translation: You may as well buy a scratch off ticket if you’re looking for those odds.

Speaking of expiration dates, theta decay, and buying low quality options, here’s another common way that option traders lose money:

4. Buying options that are too close to expiration

This story is similar to the last one.

- You think stock XYZ is going up.

- You buy a call option.

- The option expires tomorrow.

- As the day goes on, the stock churns around, ending the day flat.

- But wait… the stock didn’t go down between the time I bought the option and now, so why is my option constantly losing value?

Answer: Long options like calls and puts are subject to something called theta decay. Like delta, theta is an option greek. However instead of measuring sensitivity to dollar moves in a stock (like delta), theta measures an options sensitivity to time. The closer your option is to expiration, and the further out of the money your option is, the more sensitive your option becomes.

In short: You got theta’d again! At least the premium collector who sold you that option is happy.

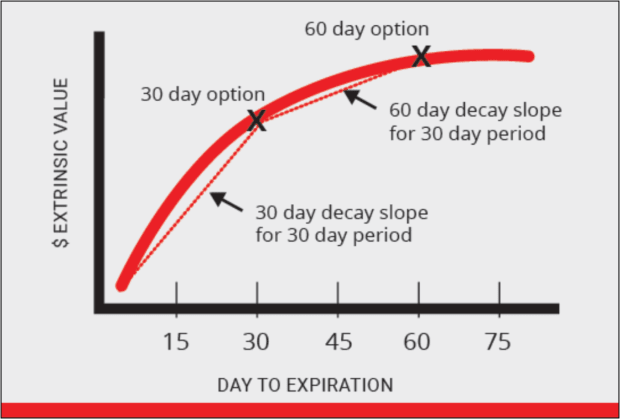

To avoid this mistake, get familiar with the theta decay curve.

Basically, time decay isn’t so bad if your option has more than 60 days to expire. But as time passes the decay begins to accelerate, hitting max velocity around the 14-day mark. If you’re trading an option with less than 14 days to expiration, that’s okay — but you better have a plan. Market Rebellion Co-Founder Jon Najarian calls these short-term option trades “the deep end of the pool”.

Translation: If you’re new here, this is an area you might want to avoid… unless you have guidance from a licensed professional.

Want to make short term option trades with guidance from a licensed CMT? Try Rebel Weekly. Get two easy to follow momentum-driven trade ideas designed to capture technical breakouts and breakdowns — delivered to your inbox every week.

Alright, maybe you’ve traded a few options before. You know the basics — don’t go too far OTM, be careful about short-dated options… But here’s one more way that option traders may trap themselves in a low-quality position:

3. Trading Illiquid Options

This is especially common when entering multi-legged option trades in low-volume stocks. It goes like this:

- Stock XYZ doesn’t get a lot of action — you think it’s going to trade flat for a while.

- You sell a short iron condor — a four-legged spread.

- As you enter the trade, you notice the bid/ask is several dollars wide.

- You have trouble getting filled at the mid price, and so you must continually ratchet down your maximum credit in order to get filled.

- You finally get filled for an unfavorable price, and you start the trade off at a “paper loss”.

- As the week goes on, the stock remains mostly flat — this is what you wanted! But now, you must contend with the same issue yet again: getting filled at a reasonable price as you attempt to close the trade.

- You’re faced with two options:

- Wait around, hoping your order executes before the stock leaves your profitability zone.

- Overpay to close your spread, sacrificing some or all of the profit you made.

- Well that’s frustrating. How can I avoid this problem?

Answer: Get familiar with open interest and volume. These are two important liquidity metrics for any option trader to understand — even if you aren’t trading spreads. Volume indicates the total number of option contracts bought and sold for that day. Open interest indicates the total number of active option contracts out there.

In short: It isn’t just about being right, it’s about picking the right tool for the job.

Translation: If the volume and open interest are low or next to nothing, your probability of getting a good fill is too. Remember, the Market Maker will need to match the highest bid with the lowest offer — that’s the mid price.

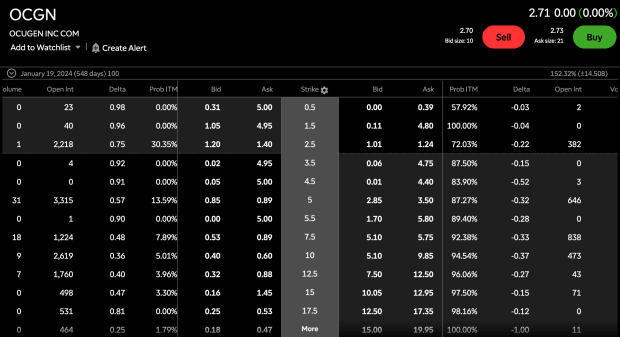

It’s important to search for tight bid/ask spreads whenever possible. If the spread is particularly wide, that’s a good sign you’ll have trouble reliably getting your order filled near the mid price.

There isn’t really a great “picture” of someone frustratedly trying to get filled on a low-volume option, so instead, here’s an example of what a low-liquidity option chain looks like.

So far, these have all been about avoiding low quality options. The next big “don’t” is about avoiding a low quality trading style.

2. YOLOing

Made famous by the option trading subreddit Wall Street Bets, YOLOing means allocating your entire portfolio to one trade — despite the potential reward, the high risk means the YOLO (You Only Live Once) trade is highly, highly, not advised.

- You’re sure that stock XYZ is going higher today.

- So sure in fact that you stake the entirety of your portfolio on that outcome.

- Surprise: It doesn’t. You’re wrong. And because you used the whole of your portfolio to make this bet, the damage is magnified.

- How can I make sure this never happens again?!

Answer: Start developing your risk management skills. Option leverage is an incredibly versatile tool that can help traders to risk less — allowing traders to risk just a portion of the value of 100 shares in exchange for up to 100 shares worth of leverage. But with great power comes great responsibility — and it’s your responsibility not to abuse option leverage with high-risk scenarios.

Translation: You might be a great trader, but no one is perfect. If you’re YOLOing your entire account trade after trade, it only takes one mistake to wipe out years of hard work.

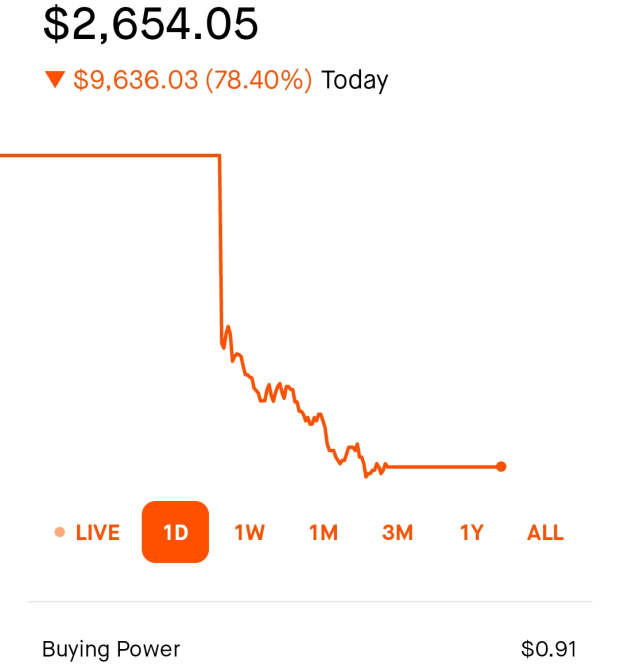

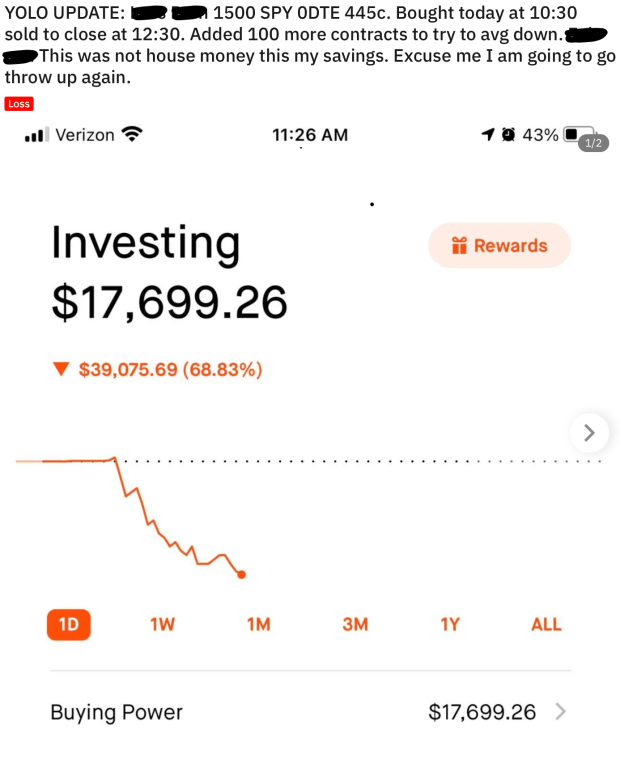

In short: Don’t end up like this guy:

YOLO: ✔️Short-Term: ✔️OTM: ✔️— That’s literally ¾ of the things we’ve covered so far!

Okay, up until now these traders have made some serious option trading mistakes. But they’ve all avoided the cardinal rule. They’ve all avoided the worst mistake on this list:

1. Betting Money You Don’t Have: Naked Options & Margin

Yes. These traders lost a lot of money. Yes, they’re all probably pretty sad about it. But at least they only lost down to zero. Here’s a scenario that’s even worse:

- Your brokerage allows you to deploy naked option strategies, withholding some collateral and covering the rest with margin.

- Because a stock can technically rise infinitely, strategies like short strangles, short straddles and short calls have infinite risk.

- You decide to ignore this glaring risk, and instead attempt to collect the premium from a short straddle ahead of stock XYZ’s earnings event.

- Earnings are associated with high-cost options — and high-volatility moves.

- In a short straddle, your goal is for a stock not to move.

- Unfortunately, the stock does move — a lot, creating a larger loss than the value of your portfolio overnight.

- The loss triggers a margin call, your brokerage liquidates your portfolio, and you’re left with a negative value — a debt you must now pay in exchange for your option trading hubris.

- All I wanted to do was collect a premium! Is there a way to sell options without incurring infinite risk?

Answer: Yes, there are plenty of strategies to sell options with defined risk. Market Rebellion has entire services dedicated to doing just that! Strategies like credit spreads, short iron condors, short iron butterflies and covered calls are just a few ways that you can sell options without the potential for the trade to go into the negative.

Translation: By selling an option against another option, you define your maximum risk.

In short: Like YOLOing, one wrong move can obliterate years of hard work. Unlike YOLOing, this strategy can send you into bankruptcy. Naked options: never, ever, ever, ever.

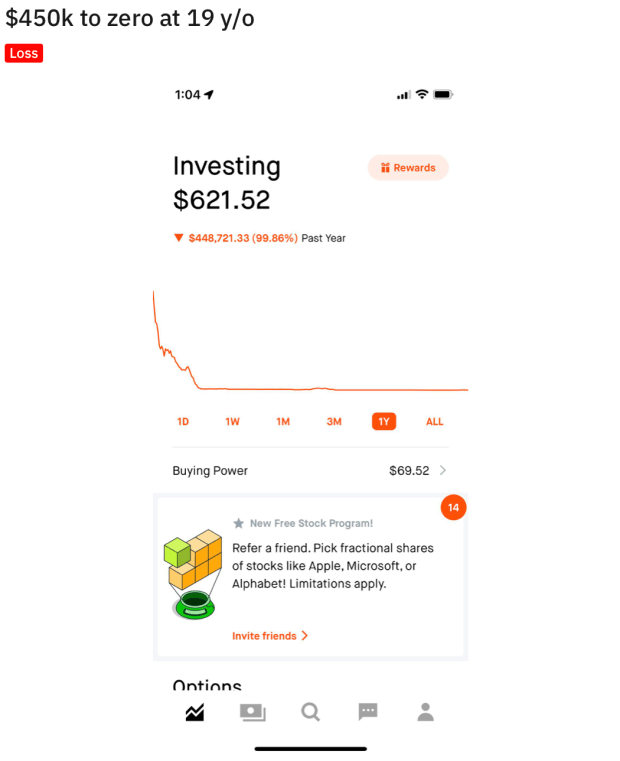

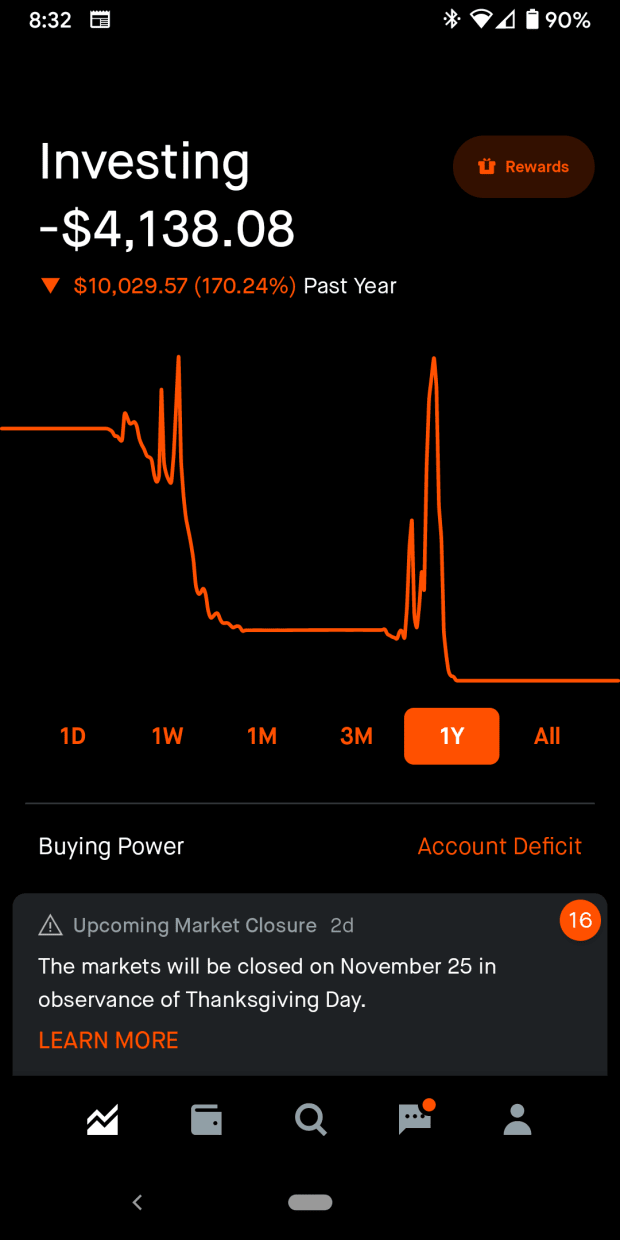

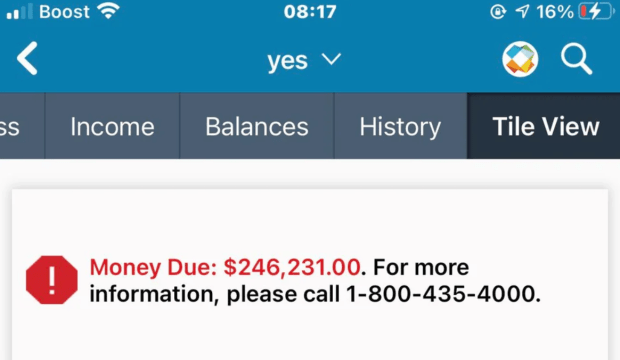

Unless you want to end up like these guys:

The Bottom Line: Looking at pictures of massive losses is all fun and games until it happens to you. By avoiding these five critical option trading mistakes, it’s possible to have a long, successful option trading career.