The most oversold stocks in the real estate sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

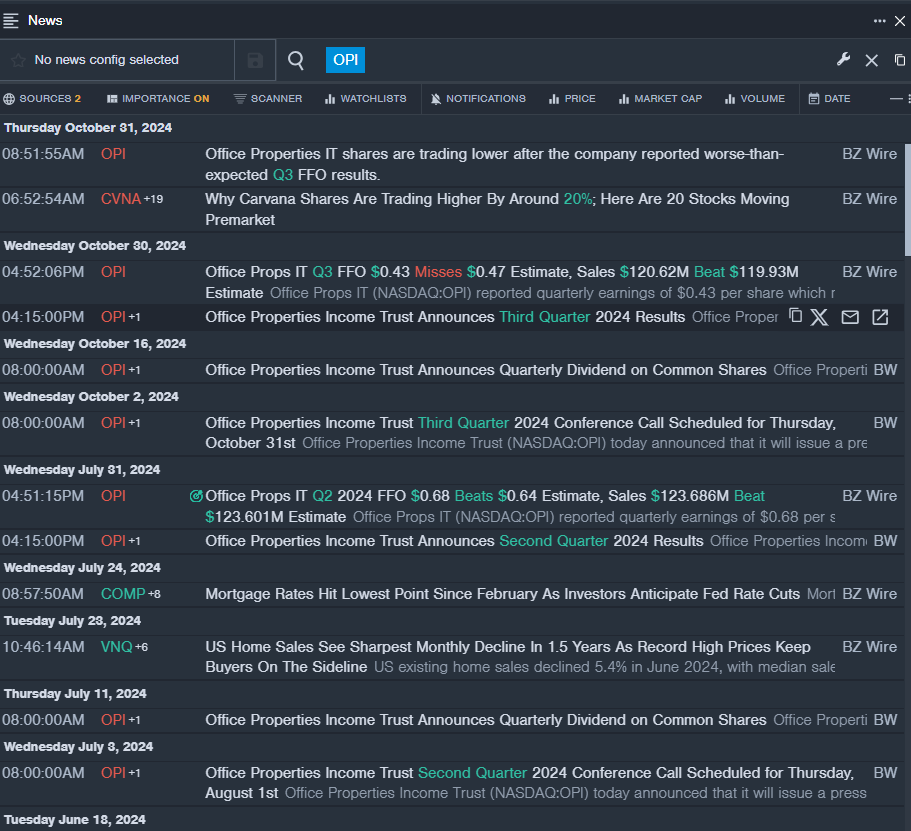

Office Properties Income Trust (NASDAQ:OPI)

- On Oct. 30, Office Properties IT reported worse-than-expected third-quarter FFO results. The company's stock fell around 40% over the past month and has a 52-week low of $1.06.

- RSI Value: 20.67

- OPI Price Action: Shares of Office Properties Income Trust closed at $1.14 on Friday.

- Benzinga Pro's real-time newsfeed alerted to latest OPI news.

Wheeler Real Estate Investment Trust Inc (NASDAQ:WHLR)

- On Nov. 15, Wheeler Real Estate Investment Trust announced a 1-for-2 reverse stock split effective Nov. 18. The company's stock fell around 32% over the past five days and has a 52-week low of $5.79.

- RSI Value: 26.03

- WHLR Price Action: Shares of Wheeler Real Estate Investment Trust fell 2.2% to close at $8.50 on Friday.

- Benzinga Pro’s charting tool helped identify the trend in WHLR stock.

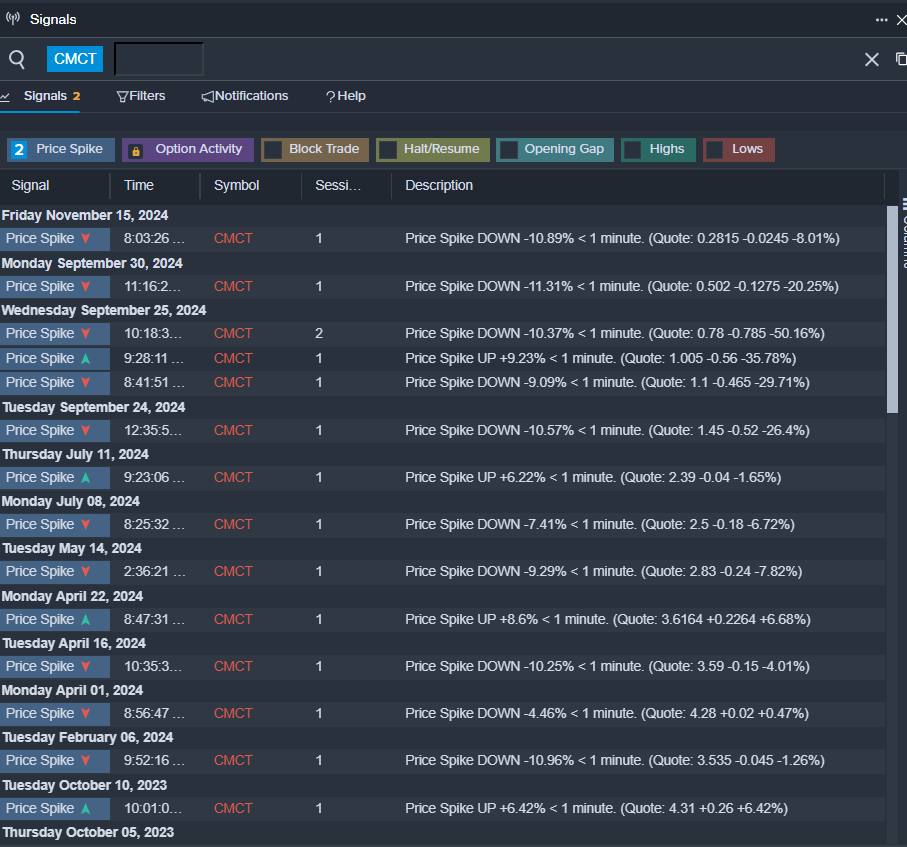

Creative Media & Community Trust Corp (NASDAQ:CMCT)

- On Nov. 8, Creative Media reported a quarterly loss of $1.22 per share which missed the analyst consensus estimate of a loss of 64 cents per share. “We continue to make progress on our previously announced actions to accelerate our focus towards premier multifamily assets, strengthen our balance sheet and improve our liquidity,” said David Thompson, Chief Executive Officer of Creative Media & Community Trust Corporation. The company's stock fell around 25% over the past five days and has a 52-week low of $0.21.

- RSI Value: 21.55

- CMCT Price Action: Shares of Creative Media & Community Trust fell 9.1% to close at $0.22 on Friday.

- Benzinga Pro’s signals feature notified of a potential breakout in CMCT shares.

Read This Next: