The most oversold stocks in the health care sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

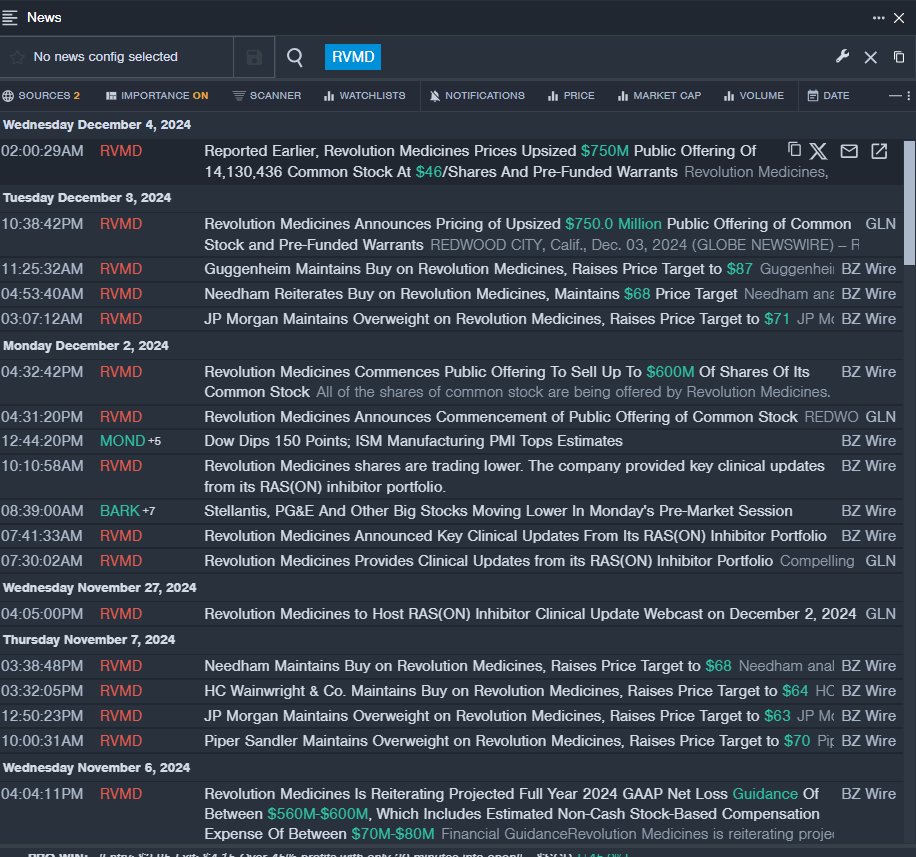

Revolution Medicines Inc (NASDAQ:RVMD)

- On Dec. 3, Revolution Medicines priced its upsized $750 million public offering of 14,130,436 common stock at $46/share and pre-funded warrants. The company's stock fell around 17% over the past five days and has a 52-week low of $23.38.

- RSI Value: 27.88

- RVMD Price Action: Shares of Inter fell 6.9% to close at $48.23 on Tuesday.

- Benzinga Pro's real-time newsfeed alerted to latest RVMD news.

Elanco Animal Health Inc (NYSE:ELAN)

- On Dec. 2, Leerink Partners analyst Daniel Clark initiated coverage on Elanco Animal Health with a Market Perform rating and announced a price target of $14. The company's stock fell around 7% over the past five days and has a 52-week low of $11.40.

- RSI Value: 27.85

- ELAN Price Action: Shares of Elanco Animal Health fell 7.4% to close at $12.48 on Tuesday.

- Benzinga Pro’s charting tool helped identify the trend in ELAN stock.

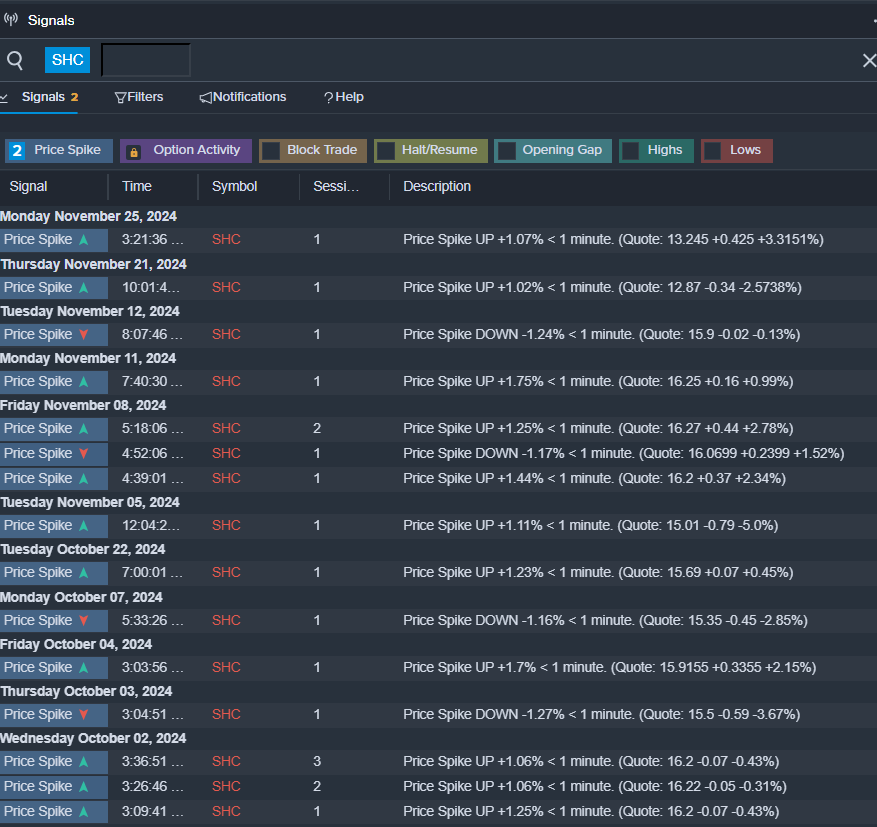

Sotera Health Co (NASDAQ:SHC)

- On Nov. 5, Sotera Health reported quarterly earnings of 17 cents per share which missed the analyst consensus estimate of 18 cents per share. The company reported quarterly sales of $285.468 million which beat the analyst consensus estimate of $278.585 million. “I am pleased we achieved both top- and bottom-line growth for the third-quarter,” said Chairman and Chief Executive Officer Michael B. Petras, Jr. “Our performance was largely in line with expectations, with an additional benefit at Nordion tied to the timing of cobalt-60 shipments. With most of the year behind us, we are reaffirming the 2024 revenue and EBITDA outlook ranges previously provided.” The company's stock fell around 19% over the past month and has a 52-week low of $10.71.

- RSI Value: 29.58

- SHC Price Action: Shares of Sotera Health fell 3.2% to close at $12.83 on Tuesday.

- Benzinga Pro’s signals feature notified of a potential breakout in SHC shares.

Read More: