Anyone who is planning for retirement and preparing to claim Social Security benefits must do a lot of math to determine exactly what they will need every month to live comfortably.

Yet, according to the Employee Benefit Research Institute (EBRI), only around half of workers (48%) have tried to calculate how much money they will need to live comfortably in retirement. (That number is a slight increase from 42% in 2019 and 38% in 2018.)

💰💸Presidents Day Sale: Get Free access to TheStreet Pro for 31 days – Claim your offer today! 💰💸

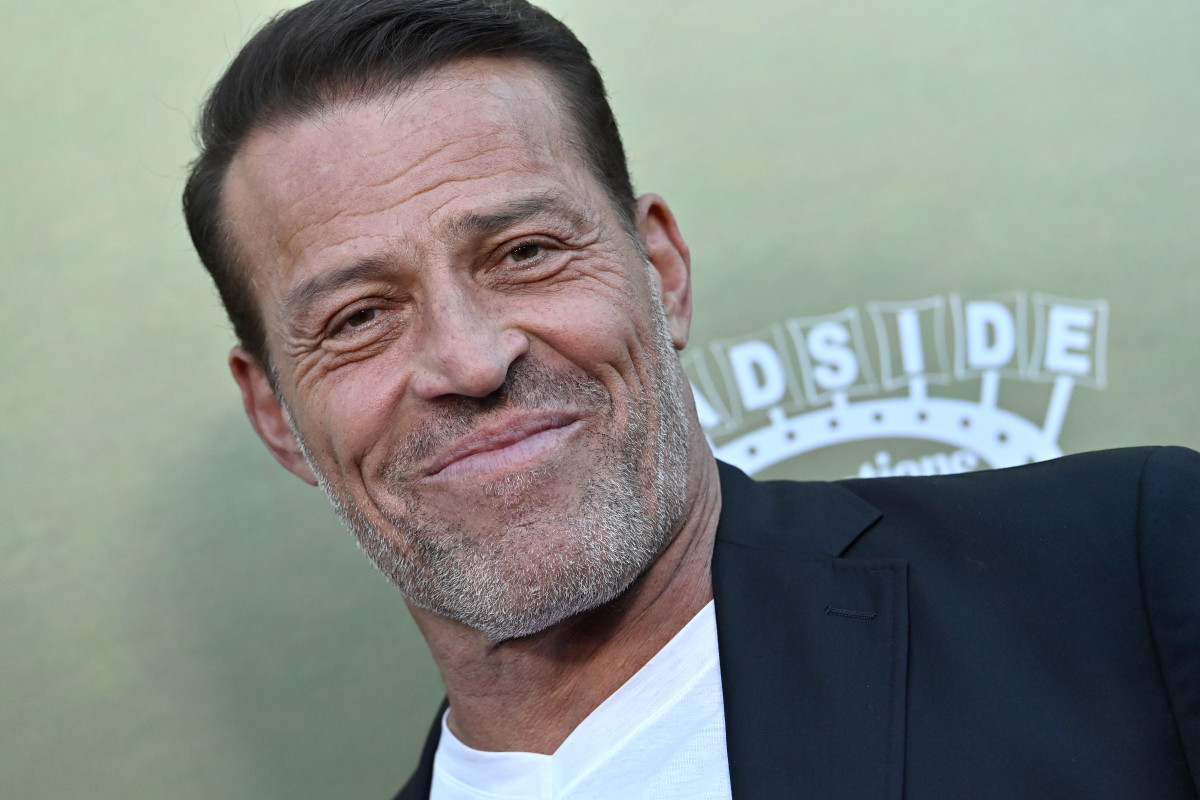

"That's an astounding number," writes Tony Robbins, the personal finance author and motivational speaker. "Almost half of us have yet to take one of the first steps toward planning for our financial future — and our time of reckoning is coming."

Most Americans will rely on Social Security for at least part of their retirement income, but the bottom line is that it will not be enough to cover all living expenses. Not even close, considering the life expectancy of the average American is 79.4 years.

Related: Dave Ramsey’s net worth: The personal finance pundit’s wealth in 2025

Tony Robbins recognizes the ramifications of people living longer

The Social Security Act, enacted in 1935, was meant to be a supplement, to cover basic needs of elderly retired workers. Today, however, more than 97% of Americans ages 60 to 89 either receive Social Security or will receive it. What's more, around 40% of Americans rely almost entirely on their Social Security benefit to pay for day-to-day living expenses.

In other words, it's the only retirement income they have. The benefits are fairly modest: in February 2024 the average average Social Security payment was around $1,862 a month, or $22,344 per year.

Related: Tony Robbins warns U.S. workers on Social Security, retirement

While not quite half of Americans rely entirely on Social Security, it's the largest source of retirement income for most Americans: According to the Social Security Administration, among people aged 65 and older, 39% of men and 44% of women receive 50% or more of their income from Social Security.

More on Tony Robbins:

- Tony Robbins warns Americans on Social Security mistake to avoid

- Philanthropist warns U.S. workers on retirement, Social Security

- Tony Robbins has blunt words on Social Security and retirement

Relying on Social Security income can be a risky proposition. It is simply not designed to cover the costs of living, especially given rising healthcare costs.

Tony Robbins warns that outliving retirement savings is a very real possibility

Given that today, there is a 50% chance that among married couples, one partner will lie to age 92 and a 25% percent one will live to 97, it makes sense that a recent survey from Mass Mutual showed the number one fear of many retired Americans was outliving their savings.

Further, according to an Ernst and Young Study, "75% of Americans can expect to see their assets disappear before they die," writes Robbins. And "the Social Security safety net — if it survives into the next generation — won't provide a reasonable standard of living on its own," says Robbins.

"If you don't have another source of income, you could end up the best-dressed greeter at Walmart," he says.

Related: Tony Robbins' best words on money, wealth, and power

50 years ago, Robbins writes, the average person could expect to live 12 years following retirement. Today, it's closer to 20.

So what can you do to protect yourself during your retirement years? Set up a plan that automates saving and investing, says Robbins.

You decide what percentage of your paycheck goes into retirement savings — maybe it's 10%, maybe 15% or 20%. "There is no right answer," he says, "what does your gut tell you?"

Robbins' basic concept is one of "paying yourself first," and he offers some basic steps for how to get started. First, if you get a regular paycheck, set up an automated plan through your human resources department to send a certain percentage of your paycheck directly to your retirement account.

If you already have automatic deductions going to a 401(k), you can even increase the amount to the percentage you've chosen.

"It is not realistic to finance a 30-year retirement with 30 years of work. You can't expect to put 10% of your income aside and then finance a retirement that's just as long." John Shoven, Stanford University professor of economics.

If you're self-employed or your employer doesn't offer a retirement savings plan, "jump online and open a savings or retirement account with your bank or financial institution," urges Robbins. "Congratulations, you've just made the most important financial decision of your life."

As Robbins says: "Your financial future will flow from the ability to save systematically." Even if you live to be 100.

Related: Veteran fund manager issues dire S&P 500 warning for 2025