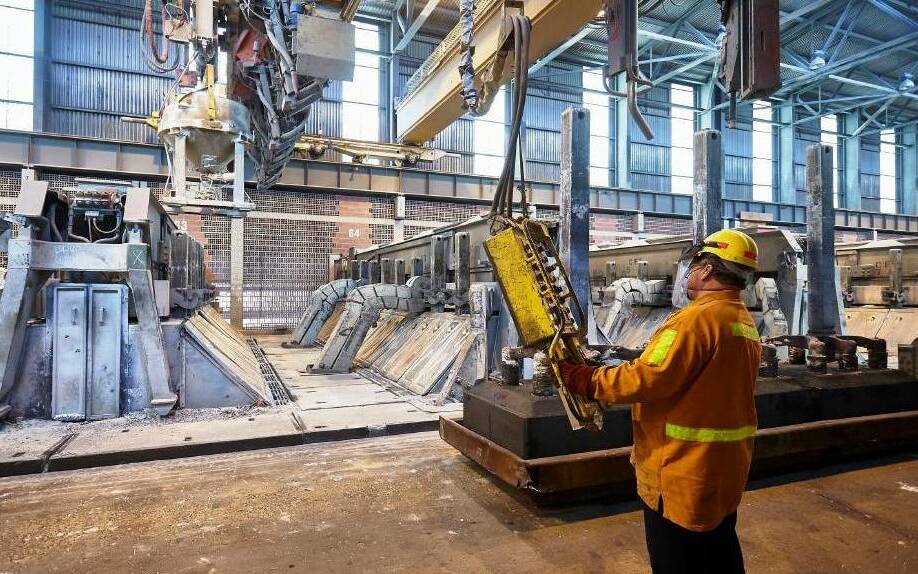

Tomago Aluminium, the state's largest power consumer, says it wants a better power supply deal as it considers options for its next long term contract.

The smelter, which uses about 10 per cent of the state's electricity supply, has committed to switching to renewable energy before 2030.

Its present contract with AGL expires in 2028.

It has called for expressions of interest to develop, invest in or procure long-term traceable renewable energy and dispatchable firm power generation projects or contracts to supply its production assets and underpin its decarbonisation strategy.

The company is jointly owned by Rio Tinto Alcan, CSR and Hydro Aluminium.

CSR chief executive Julie Coates recently said the outcome of the new power deal would be crucial for the company's future.

"That's an important milestone in terms of the future of the Tomago business," Ms Coates told the Australian Financial Review.

"We continue to develop our plans for a 500 megawatt / 2000 megawatt hour grid-scale battery at Tomago. Public consultation regarding the Environmental Impact Statement is the next phase in this process," AGL spokesman said.

The grid-scale battery is part of the company's goal to have 5 gigawatts of renewable generation and firming in place by the end of 2030.

It's location at the corner of Old Punt Road and the Pacific Highway is seen as critical to the AGL's ongoing commercial partnership with the smelter.

AGL is yet to make a final investment decision on the $400 million project.

As the state's largest energy consumer Tomago Aluminium is expecting to be asked to cut its power usage more frequently in coming years in an effort to prop-up an increasingly unstable energy grid.

The smelter requires a constant 950 megawatts of electricity to operate normally.

It is also one of Australia's largest interruptible loads and can take around 600 megawatts off the state grid within minutes.

The Australian Energy Market Operator's Summer Readiness report, released this week, forecast that a hot summer could see demand for electricity spike to a once-in-a-decade high.

AEMO chief operating officer Michael Gatt said it was preparing to pay big energy users - like smelters and refineries - to cut their usage to ease the pressure on the grid.

"This year's summer forecast is for hot and dry El Nio conditions, increasing the risk of bushfires and extreme heat, which could see electricity demand reach a 1-in-10-year high across the eastern states and in Western Australia," said AEMO's," she said.

"Tomago plays a role that is very valuable to network stability and we need to incorporate that role into our thinking. But, by the same token, we can't put smelter reliability at risk. We've shown that we can do it responsibly and safely but there is a limit," he said.

The longest that Tomago's three potlines can be without power is three hours before they "freeze". This would mean the write-off of the plant, which would cost about $5 billion to rebuild.

"These challenges used to be a summer phenomenon, whereas now it is becoming a summer and winter phenomenon, as we saw last year," Mr Fallu said.

IN THE NEWS:

Jets set to unleash Matildas star Emily van Egmond against City

Two strokes before his second birthday: how Lakyn inspired his mum

Four-year-old hit by electric scooter at Cardiff shopping centre