Uber (UBER) shares were up 7.7% at one point early in the Feb. 8 session after the ride-hailing company reported earnings. The stock then faded from the post-earnings rally.

At last check Uber shares were up 2%, while Lyft (LYFT), which reports Thursday, was 4% lower.

The fade in Uber's stock price shouldn’t be too surprising to investors, particularly after the rally we’ve seen in the stock. The shares have logged a weekly gain six weeks in a row. Coming into the report, Uber stock had also rallied six daily sessions in a row, accumulating a gain of almost 18%.

Even if the results were good — and they were — the bar was set quite high after the rally.

As for the earnings, Uber stock initially jumped after the company reported a near-50% gain in revenue to top expectations, while adjusted earnings also beat estimates. Further, the company’s first-quarter-revenue outlook soared past analysts’ expectations.

Lastly, CEO Dara Khosrowshahi was quite bullish, saying, “We ended 2022 with our strongest quarter ever, with robust demand and record margins."

Trading Uber Stock on Earnings

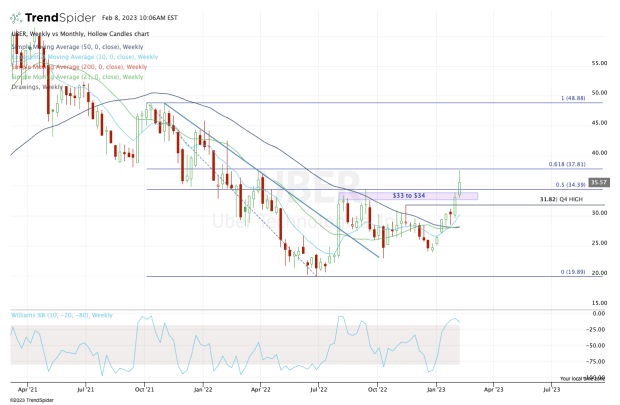

Chart courtesy of TrendSpider.com

Coming into the earnings report, Uber shares were still struggling with the 50% retracement and the $33 to $34 resistance zone. Both have been in effect for several months.

With today’s rally, Uber stock burst through these measures and raced up toward the 61.8% retracement.

Unfortunately for the longs, the current rally has simply gotten too long in the tooth. At today’s high, Uber’s six-week rally had taken it higher by more than 57%. That’s a big move, even if the travel industry is doing quite well.

From here, bulls would love to see a close above prior resistance (the $33 to $34 zone) and the 50% retracement. These measures have been a ceiling to the stock price and if shares can get above and stay above them, it will be a bullish development despite today’s fade.

Below $33 and the fourth-quarter high of $31.82 is back in play, followed by the 10-week moving average.

On the upside, a move over the 61.8% retracement would be monumental for the bulls, opening the door to $42.50, then potentially $48 to $50.

Make sense of the market. Get daily analysis of market conditions and economic trends from our portfolio managers.