Shares of Charles Schwab (SCHW) have not had it easy. The regional banking crisis that came to life in mid-March sent Charles Schwab stock tumbling lower.

The stock fell 12.8% on March 9, then sank 11.7% the next day. On Monday, shares fell as much as 23.3%, but recovered off the lows and closed lower on the day by “just” 11.6%.

In all, the stock lost about one-third of its value in three days and at the low, shares were down more than 40% in that stretch.

Don't Miss: Here's Where Microsoft Stock Needs to Hold Support on a Pullback

Given that shares were not trading all that well coming into earnings, it’s no wonder that investors were nervous when Charles Schwab reported on Monday. Initially, the stock fell 3.5%.

The big dip in State Street (STT) likely didn’t help sentiment.

However, Charles Schwab stock ended up closing higher by about 4% on the day and is continuing higher today. It’s got investors wondering if this name has the all-clear.

Trading Charles Schwab Stock After Earnings

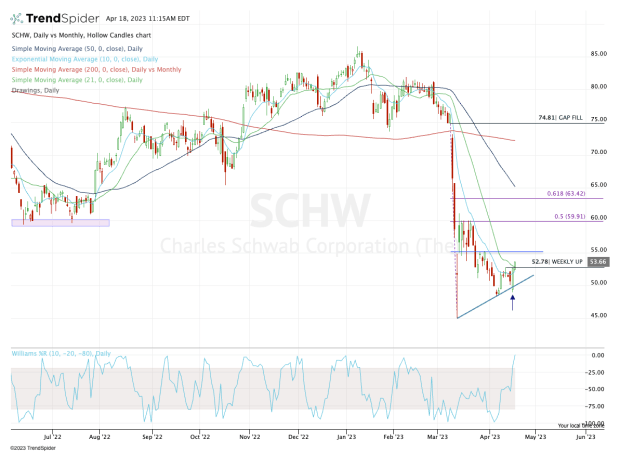

Chart courtesy of TrendSpider.com

I’m not a forensic accountant, nor do I specialize at looking at bank holdings and what these companies hold on their balance sheets. However, I do know my way around the charts.

As I look at Charles Schwab stock, shares recovered nicely off the $45 low, struggled with $60, then rolled back over and found support in the high-$40s.

Yesterday’s reversal gave traders a “bullish engulfing candle,” meaning that Monday’s trading range quite literally “engulfed” the prior day’s action, as the stock opened below Friday’s low and closed above Friday’s high.

With Tuesday’s upside continuation, Charles Schwab stock is now back above its 10-day and 21-day moving averages, while clearing last week’s high.

If this name can continue higher, $55 is one area of interest, but $60 is the main upside target. Not only is this level recent resistance, but it’s the 50% retracement of the March plunge. Those who look to the left of the chart can also see that this area was notable support in the summer of 2022.

Should Charles Schwab stock continue higher, the $63 to $64 zone could be in play, along with the declining 50-day moving average.

On the downside, bulls need to see shares hold up above the $50 level and specifically, stay above the post-earnings low of $49. Below that and the March low is in play at $45.