In today’s increasingly health-conscious world, weight loss is more than a trend – it’s a priority. To that end, GLP-1 drugs, renowned for their weight management efficacy, are expected to see demand surge, with the market projected to hit roughly $133 billion by 2030, expanding at a compound annual growth rate (CAGR) of 20%.

Big players like Novo Nordisk (NVO) and Eli Lilly and Company (LLY) are leading the charge on development, joined by retailers like Costco Wholesale Corporation (COST) and telehealth platforms like Hims & Hers Health, Inc. (HIMS) on distribution. The Kroger Co. (KR), a grocery chain, is also now stepping into the game, offering its journey to wellness through “The Little Clinic,” blending food and medicine to guide weight management. Embodying its “Food as Medicine” philosophy, this grocery giant is set to make GLP-1 drugs accessible to the masses.

Investors who watch Warren Buffett's Berkshire Hathaway (BRK.A) (BRK.B) portfolio for its market-beating picks and long-term value investments may already know that Kroger has been a part of the equity lineup since the fourth quarter of 2019, reflecting Buffett's confidence in the grocery giant. Let's have a closer look at this dividend-paying Warren Buffett stock.

About Kroger Stock

The Kroger Co. (KR), founded in 1883 and based in Cincinnati, is a retail giant operating 2,722 supermarkets across the U.S. From its combination food and drug stores brimming with organic produce and fresh seafood to its multi-department outlets offering everything from apparel to automotive products, Kroger caters to every need.

Marketplace stores enhance the customer experience with a full-service grocery, pharmacy, and general merchandise, while its price impact warehouses focus on essential groceries and fresh goods. Fuel centers and online food sales complete Kroger’s comprehensive retail ecosystem. Kroger weaves technology like artificial intelligence (AI) and digital twin simulations into its fabric, enhancing shopping experiences and streamlining operations.

Buffett’s Berkshire Hathaway has owned Kroger since the fourth quarter of 2019. A filing with the U.S. Securities and Exchange Commission (SEC) disclosed that as of the end of Q1 of 2024, Berkshire owns approximately 50 million shares of the Ohio-based company, valued at $2.5 billion.

Valued at $36.2 billion by market cap, shares of Kroger have rallied 10.5% over the past 52 weeks, and are up about 13% over the past six months.

Kroger boasts a 16-year streak of dividend growth. On June 1, the company paid its shareholders a quarterly dividend of $0.29 per share. With an annualized dividend of $1.16 per share and a 2.31% dividend yield, Kroger outshines the S&P Retail SPDR’s (XRT) yield of 1.26%, enhancing its appeal to income-focused investors. Additionally, a conservative 22.71% payout ratio ensures room for growth and potential dividend boosts.

In terms of valuation, Kroger stock trades at 11.59 times forward earnings and 0.25 times sales, lower than its retail industry peers Walmart Inc. (WMT) and Costco.

Kroger’s Strong Q4 and Optimistic Outlook

Shares of the grocery store chain surged 9.9% on March 7 after the company reported impressive Q4 earnings results and upbeat forward guidance. Kroger's Q4 sales matched estimates, reaching $37.1 billion, up 6.4% year over year, thanks to an extra week in the quarter. Profits soared to $1.34 per share - or $1.14 per share, excluding the $0.20 benefit from the extra week - smashing expectations by 18.6% and marking a 35.4% annual increase.

The grocery chain boosted digital sales by over 10% and increased loyal shoppers and customer visits. Kroger streamlined costs with better volume, process enhancements, and tech improvements for efficient picking.

Kroger is gearing up for an upbeat 2024, banking on higher grocery demand, tighter cost control, and the strength of its private-label brands. By offering lower prices and targeted promotions, it is set to drive demand and introduce over 800 new private-label products.

This year, Kroger plans to open new stores and complete 30 major store projects, including new locations, relocations, and expansions, focusing on high-growth areas with strong returns. The retailer aims to boost market share and solidify its place in the competitive landscape.

Kroger forecast fiscal 2024 identical sales, excluding fuel, to increase between 0.25% and 1.75%. Adjusted EPS is expected to range between $4.30 and $4.50.

The company is expected to report its Q1 earnings results on Thursday, June 20, before markets open, with the consensus looking for a profit of $1.33 per share in next week’s release.

Kroger – The Newest GLP 1 Weight-Loss Contender

With a fresh twist, Kroger is stepping into the weight-loss arena, emerging as a contender with its GLP-1 weight-loss offerings. In the same vein as Costco’s partnership with telehealth provider Sesame, and Hims & Hers’ approach, Kroger is transforming its Little Clinics into wellness hubs. Here, amid the aisles of fresh produce and pantry staples, customers can find a blend of medical guidance, weight loss education, and cutting-edge GLP-1 treatments.

Like Costco, Kroger will offer popular GLP-1 drugs like Novo Nordisk’s Wegovy, Eli Lilly’s Zepbound, and others as part of its revamped weight management program. Eligible patients can access these weight-loss drugs starting at $99 per visit, bringing a new dimension to their health journey.

Kroger Health's The Little Clinic unit, with about 226 clinics across nine states, will run the program through in-person and telehealth consultations, serving millions of patients. This bold move diversifies Kroger’s health portfolio and positions it as a forward-thinking player in a market blending retail and healthcare innovation.

What Do Analysts Expect for Kroger Stock?

Analysts tracking Kroger predict its profit per share to reach $4.43 in fiscal 2024 and then surge by another 4.7% to $4.64 in fiscal 2025.

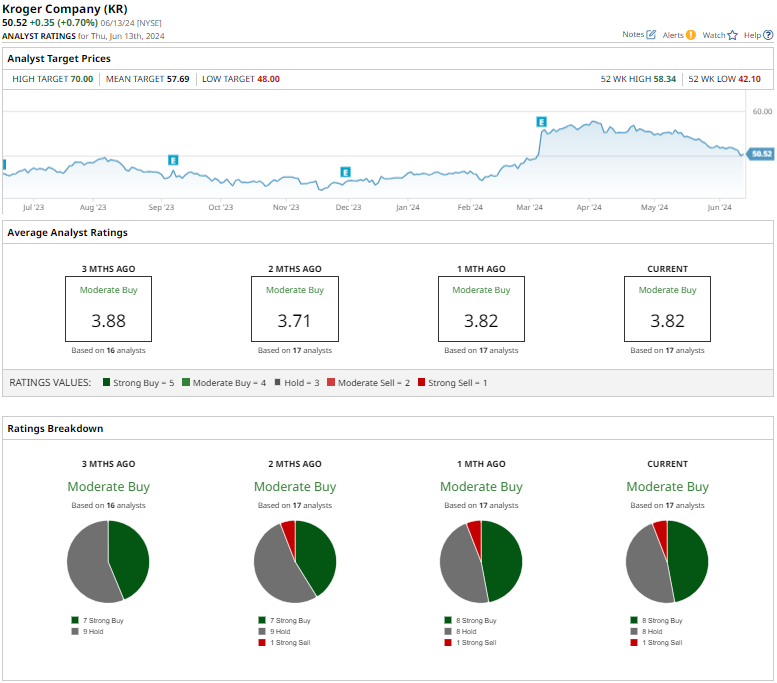

Kroger has a consensus “Moderate Buy” rating overall. Of the 17 analysts covering the stock, eight advise a “Strong Buy,” eight give a “Hold,” and the remaining one suggests a “Strong Sell.”

The average analyst price target of $57.69 indicates a potential upside of 14.2% from Thursday’s close. However, the Street-high price target of $70 suggests that the stock could rally as much as 38.6%.

On the date of publication, Sristi Suman Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.