The stock market is highly unpredictable. In this volatile market, dividend stocks provide a sense of stability by offering regular income. Without a doubt, high-yield dividend stocks are appealing.

However, another important factor to consider when selecting dividend stocks is the consistency of dividend payments. This serves as an indicator of a company’s business stability and commitment to return cash flow to shareholders. Realty Income (O), also known as “The Monthly Dividend Company,” has been paying and increasing dividends for the past 30 years in a row.

Its impressive track record has earned it a coveted spot in the S&P 500 Dividend Aristocrats Index. Let’s see if this is a good dividend stock to buy now.

Realty Income: Fundamentals Are Strong

Realty Income (O) is a real estate investment trust (REIT) that acquires and leases retail and commercial properties to tenants from a variety of industries. In exchange, the company receives rental income, which serves as a consistent source of income. O stock has risen 6.3% in the year to date.

Realty Income’s growth strategy focuses on acquiring high-quality properties with reliable tenants in a variety of industries. The inclusion of clients from various industries, such as convenience stores, drugstores, gaming, health and fitness, and restaurants, among others, reduces the risks associated with generating revenue from a single tenant. Its tenants include FedEx (FDX), Tesco (TSCDY), Home Depot (HD), Walgreens (WBA), CVS Pharmacy (CVS), and Dollar Tree (DLTR), among others.

Notably, its diverse portfolio includes 15,621 properties in six countries (besides the U.S. and U.K.) with clients from 89 industries. This international diversification not only increases the company’s revenue base but also reduces the risks associated with market concentration. The company’s emphasis on long-term, net lease agreements lasting 9.3 years has positioned it favorably in the REIT industry. Furthermore, its strategy of securing leases that require tenants to pay for property-related expenses such as maintenance, taxes, and insurance ensures a consistent and stable income stream.

In 2024, Realty Income’s total revenue of $5.28 billion increased 29.5% from 2023. In the case of a REIT, adjusted funds from operations (AFFO) measure the amount of income payable as dividends, similar to net income in non-REITs. AFFO increased by 4.7% to $4.19 per share during the year, marking the company’s 14th consecutive year of annual AFFO per share growth.

A Reliable Dividend Payer

One of the fascinating things about Realty Income is its monthly dividend payments. During its 56-year history, the company has paid out 656 monthly dividend payments.

In February, the company announced a 1.5% increase in its monthly cash dividend to $0.268 per share. Additionally, the company announced a $2 billion share repurchase program for 2025, demonstrating its confidence in generating cash flow and financial stability. Furthermore, as a REIT, the company is legally required to distribute 90% of its taxable income as dividends.

Realty Income pays a 5.7% yield, which is higher than the real estate sector average of 4.5%. Its AFFO dividend payout ratio of 73.9% is slightly higher, but it is sustainable if the company continues to grow its AFFO. Analysts that cover O stock expect its funds from operations to increase by 8.8% in 2025, followed by another 2.9% increase in 2026.

Realty Income Corporation’s reputation as “The Monthly Dividend Company” is well-deserved, thanks to a diverse portfolio and a focus on shareholder returns, making it an appealing dividend stock for investors seeking passive income.

What Does Wall Street Say About Realty Income Stock?

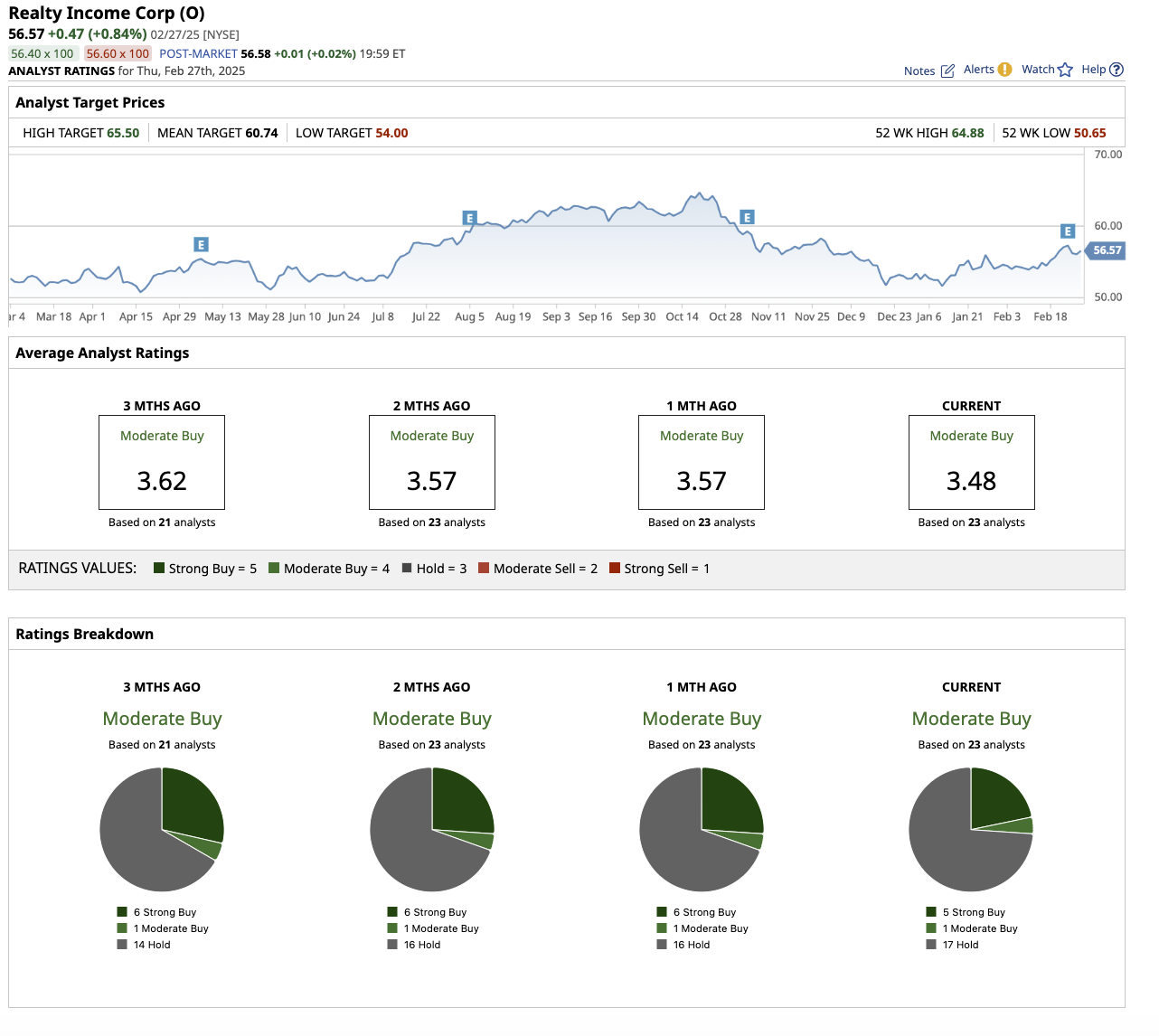

Overall, on Wall Street, Realty Income stock is a “Moderate Buy.” Out of the 23 analysts that cover the stock, five rate it a “Strong Buy,” one rates it a “Moderate Buy,” and 17 rate it a “Hold.”

The mean target price for the stock is $60.74, which is 7.4% above current levels. The Street-high estimate of $65.5 implies upside of 15.7% over the next 12 months.