- Kroger (KR), valued at $45.6 billion, is a leading grocery retailer with strong technical “buy” signals and consistent price appreciation.

- KR is trading above all daily moving averages with a Trend Seeker “buy” signal and a 100% technical “buy” rating.

- Analysts and investors are bullish, with multiple “Strong Buy” ratings.

Today’s Featured Stock:

Valued at $45.6 billion, with over 2,700 locations across the United States and a portfolio of over 20 different banners, no-moat Kroger (KR) is one of the nation’s leading grocery retailers. The company is a component of the broad-based S&P 500 Index ($SPX).

What I’m Watching:

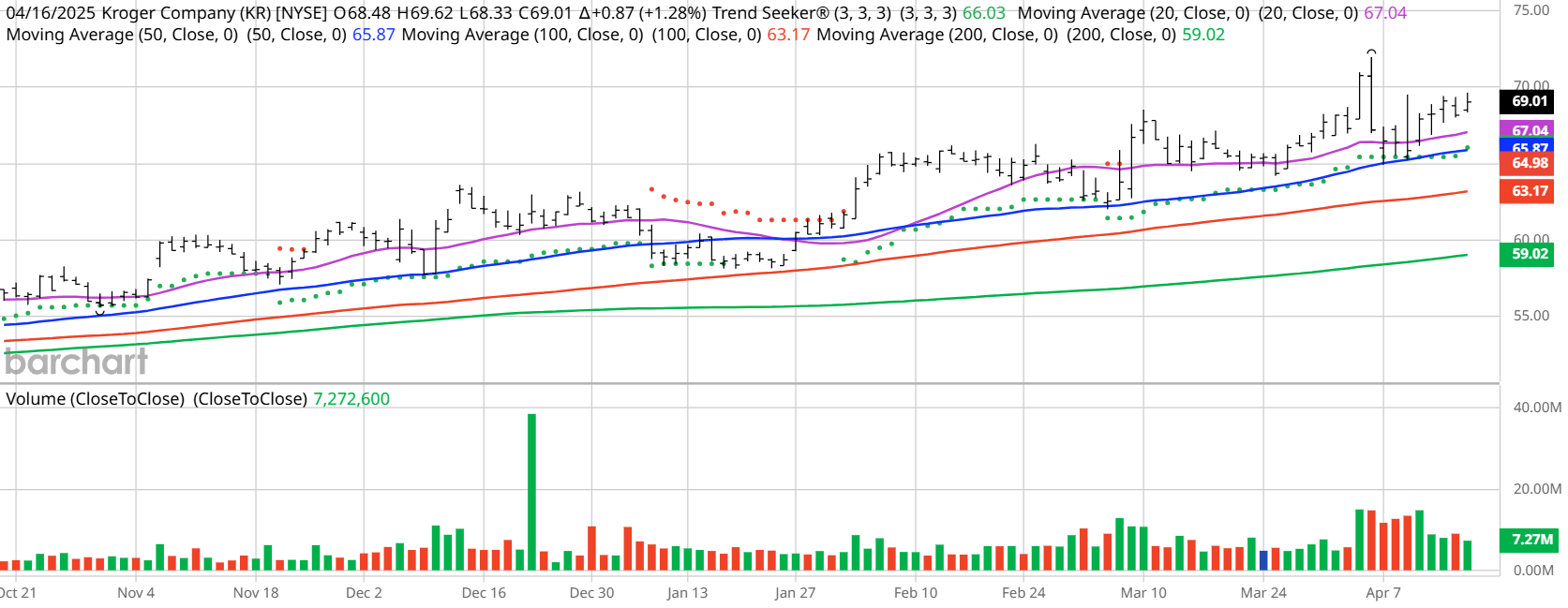

I found today’s Chart of the Day by using Barchart’s powerful screening functions. I sorted for stocks with the highest technical buy signals, superior current momentum in both strength and direction, and a Trend Seeker “buy” signal. I then used Barchart’s Flipchart feature to review the charts for consistent price appreciation. KR checks those boxes. Since the Trend Seeker signaled a “buy” on March 7, the stock has gained 3.46%.

On the chart, you can note that the stock is trading above all of its daily moving averages and has rising prices on steady volume.

KR Price vs Daily Moving Averages:

Barchart Technical Indicators for Kroger:

Editor’s Note: The technical indicators below are updated live during the session every 20 minutes and can therefore change each day as the market fluctuates. The indicator numbers shown below therefore may not match what you see live on the Barchart.com website when you read this report. These technical indicators form the Barchart Opinion on a particular stock.

When a stock is trading above all of its daily moving averages and closed within 4% of its 52-week high, it won’t take much to hit another new high.

- Kroger has a 100% technical “buy” signal.

- The stock closed at $69.01 on April 16, within 4.06% of its 52-week high of $71.93.

- KR has a weighted alpha of +28.46.

- The stock has gained 24.9% over the past year.

- Trend Seeker “buy” signal intact.

- KR is trading above its 20-, 50- and 100-day moving averages.

- The stock has made 5 new highs and is up 4% in the last month.

- The 14-day Relative Strength Index is at 58.61%.

- The technical support level at $68.35.

Follow the Fundamentals:

Note the projected increases in both revenue and earnings.

- Trailing price/earnings (P/E) ratio of 15.42x.

- Forward dividend yield of 1.85%.

- Revenue is expected to grow 1.48% this year and another 2.67% next year.

- Earnings are estimated to increase 6.04% this year and increase again by 8.62% next year.

Analyst and Investor Sentiment on Kroger:

I don’t buy stocks because everyone else is buying, but I do realize that if major firms and investors are dumping a stock, it’s hard to make money swimming against the tide.

It looks like not only Wall Street analysts, but also many of the popular investing advisory services, are bullish on this stock.

- Wall Street analysts issued 11 “Strong Buy,” eight “Hold,” and 1 “Sell” opinion on the stock with price targets between $52 and $76.

- Value Line gives the stock its highest rating and comments: “These shares might appeal to investors with a near-term performance orientation. This low-beta stock, like many others in the consumer staples sector, has largely held its ground amid the downturn in the broader market since late February, and our ranking system pegs it as a timely selection for the year ahead.”

- CFRA’s MarketScope gives the stock a “Hold” rating and comments: “Our Hold rating reflects concerns about sustaining recent improvements given macroeconomic headwinds, partly offset by a relatively attractive valuation, a strong balance sheet, and plenty of share buyback capacity.”

- MorningStar thinks the stock is 11% overvalued mainly because its recent price has driven up the P/E and comments: “It built its vast footprint through expansion of its namesake banner along with numerous acquisitions of competing chains, giving it an ingrained presence in many US communities. Considering this, an immense top line (nearly $150 billion in fiscal 2024) that brings a strong standing with suppliers, and its loyalty membership program, Kroger’s competitive standing appears enviable.”

- Of the 2,395 investors following the stock on Motley Fool, 2,093 investors think the stock will beat the market while 302 think it won’t.

- 85,300 investors monitor the stock on Seeking Alpha, which rates the stock a “Hold.”

The Bottom Line:

Currently Kroger has market momentum but it will have a hard time taking market share from some much bigger rivals like Walmart, Costco and Amazon’s Whole Foods.

Additional disclosure: The Barchart Chart of the Day highlights stocks that are experiencing exceptional current price appreciation. They are not intended to be buy recommendations as these stocks are extremely volatile and speculative. Should you decide to add one of these stocks to your investment portfolio it is highly suggested you follow a predetermined diversification and moving stop loss discipline that is consistent with your personal investment risk tolerance and reevaluate your stop losses at least on a weekly basis.

On the date of publication, Jim Van Meerten did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.