Deep-pocketed investors have adopted a bullish approach towards Home Depot (NYSE:HD), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in HD usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 16 extraordinary options activities for Home Depot. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 43% leaning bullish and 37% bearish. Among these notable options, 2 are puts, totaling $80,563, and 14 are calls, amounting to $889,056.

What's The Price Target?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $240.0 to $470.0 for Home Depot over the recent three months.

Analyzing Volume & Open Interest

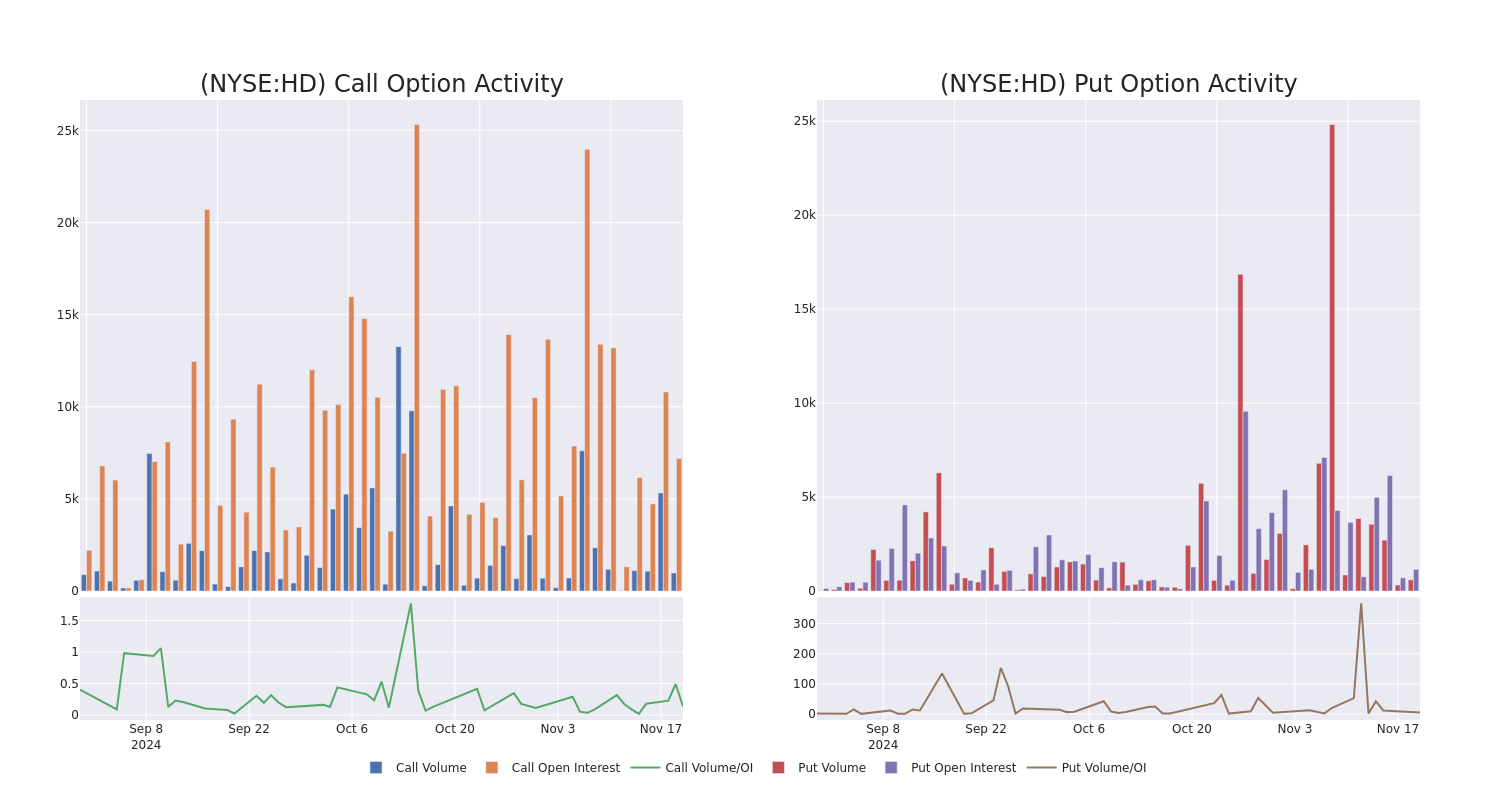

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Home Depot's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Home Depot's significant trades, within a strike price range of $240.0 to $470.0, over the past month.

Home Depot Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| HD | CALL | TRADE | BULLISH | 02/21/25 | $4.2 | $3.6 | $4.0 | $470.00 | $200.0K | 640 | 620 |

| HD | CALL | SWEEP | BULLISH | 12/20/24 | $32.0 | $29.8 | $32.0 | $400.00 | $128.0K | 1.4K | 0 |

| HD | CALL | TRADE | BEARISH | 12/20/24 | $179.85 | $178.75 | $178.75 | $250.00 | $107.2K | 0 | 6 |

| HD | CALL | TRADE | NEUTRAL | 12/20/24 | $55.1 | $53.1 | $54.1 | $375.00 | $64.9K | 280 | 38 |

| HD | CALL | TRADE | BULLISH | 01/17/25 | $192.75 | $189.8 | $192.75 | $240.00 | $57.8K | 6 | 6 |

About Home Depot

Home Depot is the world's largest home improvement specialty retailer, operating more than 2,300 warehouse-format stores offering more than 30,000 products in store and 1 million products online in the US, Canada, and Mexico. Its stores offer numerous building materials, home improvement products, lawn and garden products, and decor products and provide various services, including home improvement installation services and tool and equipment rentals. The acquisition of Interline Brands in 2015 allowed Home Depot to enter the MRO business, which has been expanded through the tie-up with HD Supply (2020). The additions of the Company Store brought textiles to the lineup, and the recent tie-up with SRS will help grow professional demand in roofing, pool and landscaping projects.

After a thorough review of the options trading surrounding Home Depot, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Present Market Standing of Home Depot

- Currently trading with a volume of 796,588, the HD's price is up by 0.33%, now at $428.66.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 83 days.

What Analysts Are Saying About Home Depot

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $442.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access. * Consistent in their evaluation, an analyst from Telsey Advisory Group keeps a Outperform rating on Home Depot with a target price of $455. * Consistent in their evaluation, an analyst from Truist Securities keeps a Buy rating on Home Depot with a target price of $465. * Maintaining their stance, an analyst from Wells Fargo continues to hold a Overweight rating for Home Depot, targeting a price of $430. * An analyst from Telsey Advisory Group has elevated its stance to Outperform, setting a new price target at $455. * An analyst from Stifel has decided to maintain their Hold rating on Home Depot, which currently sits at a price target of $405.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Home Depot options trades with real-time alerts from Benzinga Pro.