Deep-pocketed investors have adopted a bullish approach towards Constellation Energy (NASDAQ:CEG), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in CEG usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 22 extraordinary options activities for Constellation Energy. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 45% leaning bullish and 45% bearish. Among these notable options, 10 are puts, totaling $1,042,491, and 12 are calls, amounting to $500,580.

Projected Price Targets

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $120.0 to $270.0 for Constellation Energy during the past quarter.

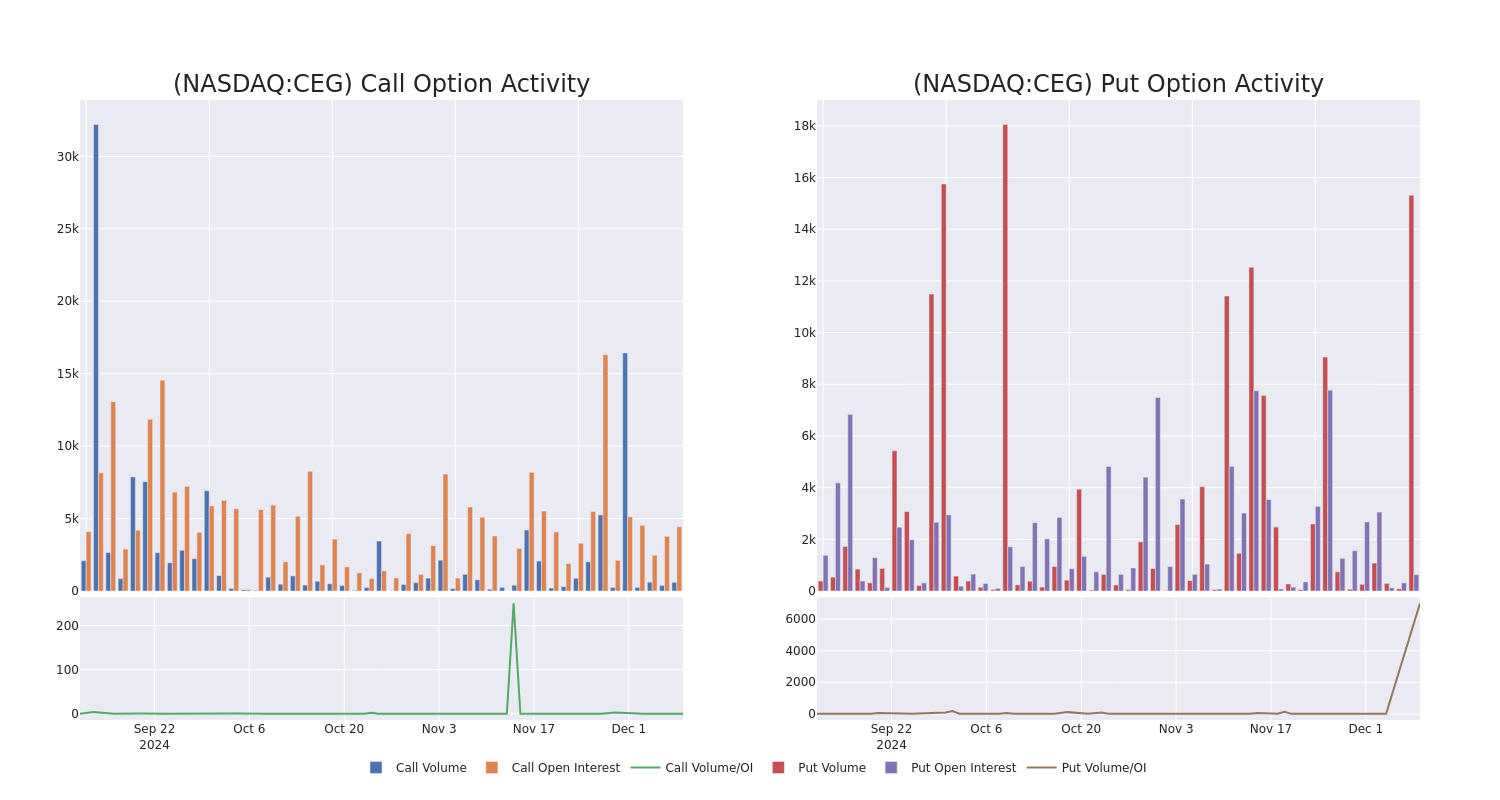

Insights into Volume & Open Interest

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Constellation Energy's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Constellation Energy's substantial trades, within a strike price spectrum from $120.0 to $270.0 over the preceding 30 days.

Constellation Energy 30-Day Option Volume & Interest Snapshot

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CEG | PUT | SWEEP | BULLISH | 01/24/25 | $3.4 | $1.85 | $2.4 | $210.00 | $634.4K | 2 | 2.6K |

| CEG | PUT | TRADE | BULLISH | 01/24/25 | $2.55 | $2.5 | $2.5 | $210.00 | $99.7K | 2 | 3.2K |

| CEG | CALL | SWEEP | BULLISH | 03/21/25 | $25.6 | $24.6 | $25.6 | $240.00 | $76.4K | 4 | 35 |

| CEG | CALL | TRADE | BULLISH | 12/27/24 | $7.5 | $6.3 | $7.1 | $245.00 | $71.0K | 11 | 100 |

| CEG | PUT | SWEEP | BEARISH | 01/24/25 | $2.5 | $2.15 | $2.5 | $210.00 | $50.0K | 2 | 2.8K |

About Constellation Energy

Constellation Energy Corp offers energy solutions. It provides clean energy and sustainable solutions to homes, businesses, the public sector, community aggregations, and a range of wholesale customers (such as municipalities, cooperatives, and other strategics). The company offers comprehensive energy solutions and a variety of pricing options for electric, natural gas, and renewable energy products for companies of any size.

Having examined the options trading patterns of Constellation Energy, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Current Position of Constellation Energy

- Trading volume stands at 1,925,839, with CEG's price down by -5.37%, positioned at $240.0.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 78 days.

Expert Opinions on Constellation Energy

Over the past month, 1 industry analysts have shared their insights on this stock, proposing an average target price of $322.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access. * Consistent in their evaluation, an analyst from Morgan Stanley keeps a Overweight rating on Constellation Energy with a target price of $322.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Constellation Energy, Benzinga Pro gives you real-time options trades alerts.