Millions of people in the UK and across the world will come together for the Queen's Platinum Jubilee this week. Her Majesty the Queen will become the first British Monarch to celebrate a Platinum Jubilee after 70 years on the thrown.

Since Queen Elizabeth's began her reign in 1952, a lot has changed for those living in the UK. From the Great Recession and the Coronavirus pandemic to the current cost of living crisis, there have been many key events and challenges that have impacted house prices across the country.

During the last seven decades, the cost of a home has changed dramatically. The property market was very different back in 1952, with just 32% of households owning their own home, compared to 65% today, according to Nationwide.

READ MORE:

As well as the Queen's Jubilee, it has also been 70 years since the building society produced their first house price data.

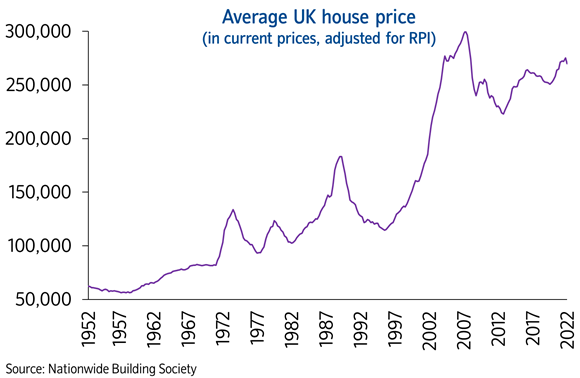

The average house price in the UK back in 1952 when the Queen was crowned was £1,891 - which is around £62,000 in today’s money.

According to Nationwide the standard cost of a home today is £269,914, meaning average house prices are currently more than four times higher than they were seven decades ago.

In 1952 the typical home cost four times what the average annual salary was back then, but today the average property costs almost seven times our earnings - which is an all-time record high.

However, Nationwide say borrowing costs were a lot higher back then, with the bank rate at 4.0% compared to 1.0% currently.

In the early 1950s, almost all mortgages were advanced by building societies, where the majority were small, locally-based lenders. In 1952, there were 800 societies operating in the UK, compared to 43 today.

In the 70 years following, house prices have fluctuated massively. Nationwide data shows that there was a steady increase in house prices up until the 1970s before the price of a home shot up towards £150,000 around 1972.

House prices since 1952

The Queen’s silver Jubilee in the 1970s saw mortgages become more widely available to more buyers, however high inflation had an negative impact on the repayments, making them unaffordable for many, says online lettings agent Mashroom.

By the 1980s, buying a home became an aspiration for many and saw the introduction of the ‘Right to Buy’ scheme, allowing people the opportunity to buy their rented council houses.

However, by the late 80s, a pending recession and house market crash made it less likely to obtain a mortgage and repayments suddenly became less affordable for the average household.

The average house price began to rise and fall again up until the 1990s, when prices climbed towards the region of £200,000. After a small decrease towards the end of the 90s, house prices then began to rise steadily year on year.

It was around the time of the recession in 2008 when house prices reached a new high of £300,000. In the last two decades the cost of a home has have shifted up and down, but remains high as of today.

According to Nationwide's latest data, house prices have seen their tenth successive monthly increase in May which has kept the annual price growth in double-digits.

The average house price which current stands at £269,914 slowed modestly in May, with an annual growth of 11.2 per cent in comparison to 12.1 per cent in April.

However prices have still gone up 0.9% month on month after taking into account seasonal effects of the market.

Commenting on the figures, Robert Gardner, Nationwide's Chief Economist, said: “Despite growing headwinds from the squeeze on household budgets due to high inflation and a steady increase in borrowing costs, the housing market has retained a surprising amount of momentum.

“We continue to expect the housing market to slow as the year progresses. Household finances are likely to remain under pressure with inflation set to reach double digits in the coming quarters if global energy prices remain high. Measures of consumer confidence have already fallen towards record lows.

"Moreover, the Bank of England is widely expected to raise interest rates further, which will also exert a cooling impact on the market if this feeds through to mortgage rates."

Sign up to our free weekly property newsletter by clicking here