Each day, Benzinga takes a look back at a notable market-related moment that occurred on this date.

What Happened? On March 3, 1933, the Dow Jones Industrial Average gained 2.4% on its last day of trading before the New York Stock Exchange shut down for 11 days.

Where The Market Was: The Dow closed the day at 53.84.

What Else Was Going On In The World? In 1933, Great Depression-era U.S. unemployment peaked at 25.2%. Adolph Hitler became the chancellor of Germany. A gallon of gasoline costs 10 cents.

FDR’s Banking Holiday: March 1933 was one of the darkest periods of the Great Depression. On Friday, March 3, the stock market experienced extreme volatility ahead of the Saturday inauguration of incoming President Franklin D. Roosevelt. The Dow traded down 1.9% in intraday trading before bouncing back aggressively to close the day up 2.5%.

That same day, the Federal Reserve Bank of New York adopted a resolution formally requesting the Federal Reserve Board urge the president to proclaim a national banking holiday due to the mounting number of bank closures and failures that had occurred in recent weeks.

On Monday, March 6, just 36 hours into his first term in office, FDR issued Proclamation 2039, suspending all U.S. banking activity for one week.

The NYSE would also shut down that entire week, and trading would not resume until Wednesday, March 15.

Ultimately, FDR’s Bank Holiday of 1933 was successful in preventing an accelerating run on national banks. Investors likely didn’t mind the stock market closure as well. By July 18, 1933, the Dow would hit 108.67, marking the fastest 100% gain in the index’s history up to that point.

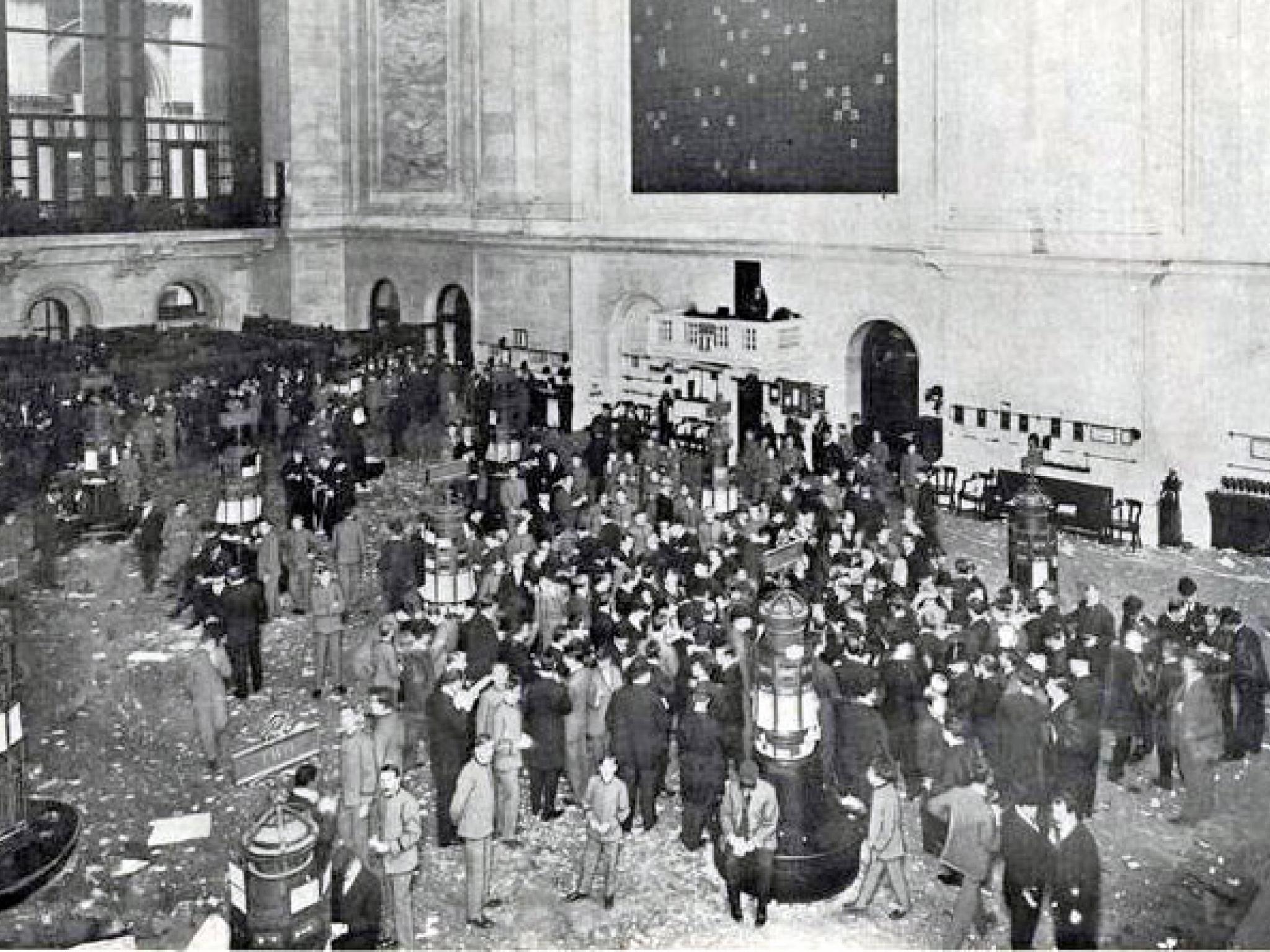

The floor of the New York Stock Exchange published in 1908. Public domain photo.