Although Elon Musk-led Tesla (TSLA) initially sourced to new record highs following the reelection of President Donald Trump, the last few months have been a nightmare for TSLA stock.

Trading almost at a more-than-50% discount to its 52-week high, Tesla shares are down 40% on a year-to-date basis. Concerns around tariffs, heightened competitive intensity from Chinese companies, dwindling sales, and Musk’s distractions with the Department of Government Efficiency are all contributing factors that have led to the freefall.

However, amid all the gloom, an analyst at TD Cowen believes that Tesla is poised for a substantial upside from current levels.

TD Cowen Upgrades Tesla to “Buy”

Upgrading the stock to a “Buy” from “Hold,” analyst Itay Michaeli sounded bullish about Tesla’s prospects. He stated “While we are valuation-/sentiment-minded when recommending stocks, we agree with the underlying notion that Tesla cannot be compared to other automaker stocks, not because it isn’t an ‘auto company’, but because it’s arguably best positioned to capture sizable opportunities that exist across auto/mobility and adjacent markets.” This references Tesla’s ambitions in self-driving vehicles and humanoid robots, among other initiatives.

Michaeli further commented, "Most of Tesla’s US fleet is concentrated in less dense counties where AVs (autonomous vehicles) could prove easier to deploy, and where both new business models and existing rideshare revenue (gross bookings) are available.”

The analyst hiked his target price from $180 $388, denoting upside potential of 61% from current levels.

Tesla Remains on a Growth Path

Despite falling short of revenue and earnings expectations in Q4, Tesla still delivered growth. Revenue increased by 2% year-over-year to $25.71 billion, while earnings per share rose 3% to $0.73, slightly below the consensus forecast of $0.75.

Although the drop in vehicle deliveries was a setback, certain operational metrics continued to show progress. Tesla reported a 17% annual increase in charging stations, reaching 6,975, while the number of charging connectors expanded by 19% to 65,495.

The company generated $4.8 billion in net cash from operating activities in Q4, exceeding the prior year’s $4.4 billion, though full-year free cash flow saw a slight decline to $2.03 billion. By the end of the year, Tesla maintained a robust cash position of $36.6 billion, far surpassing its short-term debt obligations of $14.9 billion.

What Will Drive This Growth

Tesla’s stock has faced pressure in recent times, but several of its strategic initiatives position it as one of the most transformative companies of the 21st century.

One such initiative is the Dojo supercomputer, which you can read more about in my previous article. According to analysts at Morgan Stanley, Dojo has the potential to add approximately $500 billion in enterprise value. Dojo utilizes an extensive dataset sourced from Tesla vehicles operating worldwide, enhancing Full Self-Driving (FSD) capabilities by improving safety and efficiency. The vast amounts of real-world driving data processed by Dojo also play a pivotal role in Tesla’s humanoid robotics program, spearheaded by the Optimus project.

Speaking of Optimus, Tesla expects to produce several thousand Optimus robots this year, with a sharp increase in production to follow. These robots will initially be deployed to streamline the company’s internal operations, increasing efficiency across various functions. While Musk’s forecasts have historically been met with skepticism, his projection of a long-term revenue opportunity exceeding $10 trillion for Optimus underscores its potential significance.

Meanwhile, Tesla’s energy division continues to experience strong momentum, with its stationary storage business anticipated to expand by 50% in 2025. As demand for grid storage surges, Tesla is ramping up production at its Shanghai Megafactory, where Megapacks and Powerwalls will be manufactured to support the global shift toward renewable energy solutions.

Additionally, Tesla has taken steps toward establishing its own ride-hailing service, submitting an application to the California Public Utilities Commission for a transportation charter-party carrier permit. This would allow Tesla to manage and operate its own fleet of vehicles. Musk has previously indicated that Tesla aims to launch a driverless ride-hailing service in Austin by mid-year, with plans to expand into California before the year’s end, though specifics remain undisclosed.

In response to evolving market dynamics, Tesla is also working toward making its vehicles more affordable. The company plans to introduce a lower-cost model in the first half of 2025, aiming to make Tesla ownership more accessible while addressing recent declines in sales.

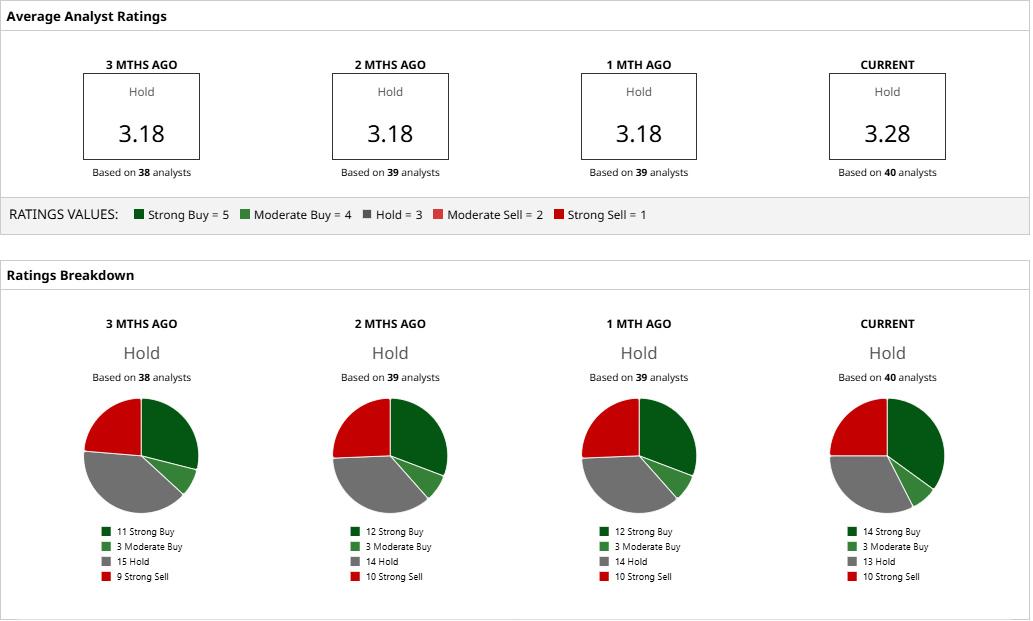

Analyst Opinions on TSLA Stock

Overall, the analyst community is still cautious about Tesla having deemed Tesla stock a “Hold” with a mean target price of $348.03. This denotes upside potential of about 45% from current levels. Out of 40 analysts covering the stock, 14 have a “Strong Buy” rating, three have a “Moderate Buy” rating, 13 have a “Hold” rating, and 10 have a “Strong Sell” rating.