If the real estate market has been through a rough few years, those navigating the rental market have even more stories -- from the Phoenix homes now renting for as much as similar properties in the Bay Area to the New Yorkers who, after getting a deal during the pandemic, saw their rent raised by as much as 65%.

Many of these stories come down to high demand and decades of underbuilding. Locations such as Phoenix, Miami, and certain parts of North and South Carolina were particularly popular destinations for those leaving urban centers during the pandemic. They were, as a result, subject to some of the most drastic increases.

The median rent for a one-bedroom apartment nationwide, meanwhile, was $1,454 in December 2022. This is a 4.2% increase from 2021 but also a 1.4% drop from a month ago -- a clear sign that real estate prices cannot rise indefinitely as cities with overinflated markets start to self-correct.

What's Going On With Rental Prices In Many Small Cities?

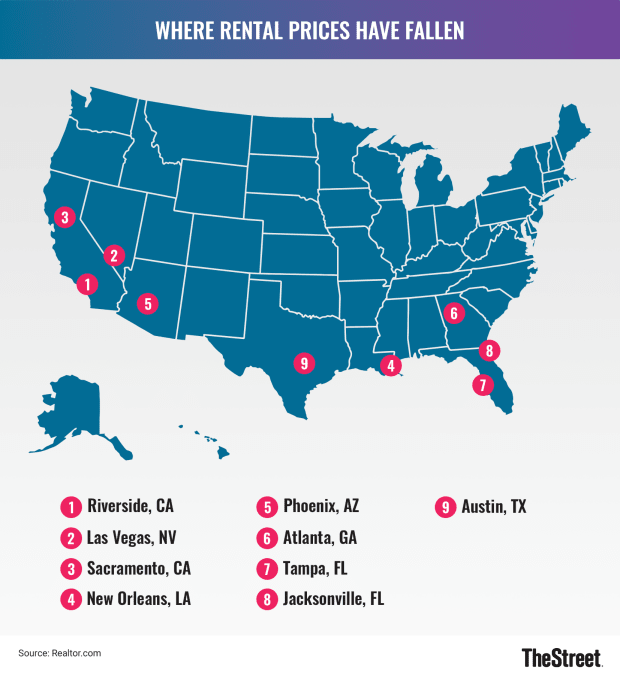

According to Realtor.com's monthly rental report, the city with the steepest drop in monthly rental prices was Riverside, California. In November 2022, the rent price for an average of apartments ranging from a studio to a two-bedroom was $2,071 -- a 5.5% drop from the year before.

The city of 320,000 is an hour's drive away from downtown Los Angeles and was particularly popular for those looking for a less dense alternative. This flurry of activity quickly spurred developer interest and a rush of new construction that, local agents report, was too ambitious for the city's long-term prospects.

"People started to move back to big cities," Jiayi Xu, an economist for Realtor.com, said in a statement. "During the [COVID-19] pandemic, people were moving to the Sun Belt areas like Florida. Now, when we look at data from Boston and Chicago, demand there is up."

The other two cities among Realtor's top three all have a population above 500,000 people -- the year-over-year drop in rent prices in Las Vegas, Nevada, and Sacramento, California was a respective 4.9% and 4.8%.

While neither of these places tells the same "urban exodus and then return" story, Las Vegas and Sacramento both saw high numbers of newcomers during the pandemic. Prices in both cities soared in the double-digits between 2020 and 2022 but, as the interest wanes, the market is now in the process of correcting itself from overly-inflated prices.

This Is Where You Should Be Investing

"Many newly remote workers left the pricey Bay Area and moved to Sacramento, where real estate prices and the cost of living were significantly lower," Realtor.com writes of the latter. "[..] But now that the influx of new residents is ebbing and locals are getting priced out, prices have begun coming back to earth."

In fact, Riverside was the only smaller city to make the list -- others in the top ten include Louisiana's New Orleans, Arizona's Phoenix, and Georgia's Atlanta.

This news is undeniably good for renters who have been hit hard by increases in the above-mentioned cities -- the shuffling pushed some long-time residents to look elsewhere amid an influx of higher earners from out of town.

For those looking to invest, the largest cities on this list are likely to continue to bring in steady returns -- demand is still very strong and the drop is largely a correction from the disproportionate increases seen in the last two years.

SEE THE FULL LIST OF CITIES WHERE RENT PRICES ARE FALLING THE MOST HERE.