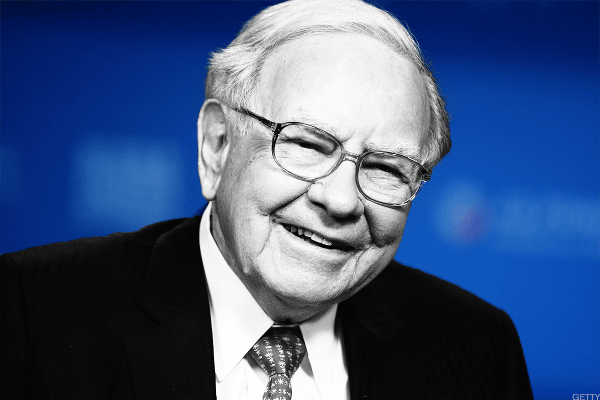

When it comes to learning the secrets of rockstar investors, no one's wisdom is quite as coveted as Warren Buffett's.

The 92-year-old Berkshire Hathaway CEO on Feb. 25 released his much-anticipated annual letter, which was chock full of wisdom for investors.

DON'T MISS: How to Invest Like Warren Buffett: Morningstar

But people naturally want to know what the Oracle of Omaha is buying -- and the letter showed that fully three-quarters (75%) of Berkshire Hathaway's investment portfolio was in just five stocks, with one weighing much more heavily than all the others.

Buffett bet biggest on Apple (AAPL): Berkshire Hathaway holds $119 billion of shares in the group.

Bank of America (BAC) came in at $32 billion of shares, while $30 billion was devoted to oil giant Chevron (CVX). Coca-Cola (KO) and American Express (AXP) rounded out the list with holdings of $25.4 billion and $22.4 billion respectively.

Berkshire Hathaway spent a record $68 billion on stocks in 2022 ($34 million on a net basis).

'Over time, it just takes a few winners to work wonders," Buffett said in the letter.